On battered ledgers and behind heavy vaults, Michael Saylor prophesies: “Your golden future, comrade, is a $10 million bitcoin. But the gatekeepers in woolen suits, clutching their endless paperwork, still mutter ‘nyet’.”

$10 Million for a Single Bitcoin? That’s the Magic Moment of ‘Aha!’—Just Wait a Few Decades 😏

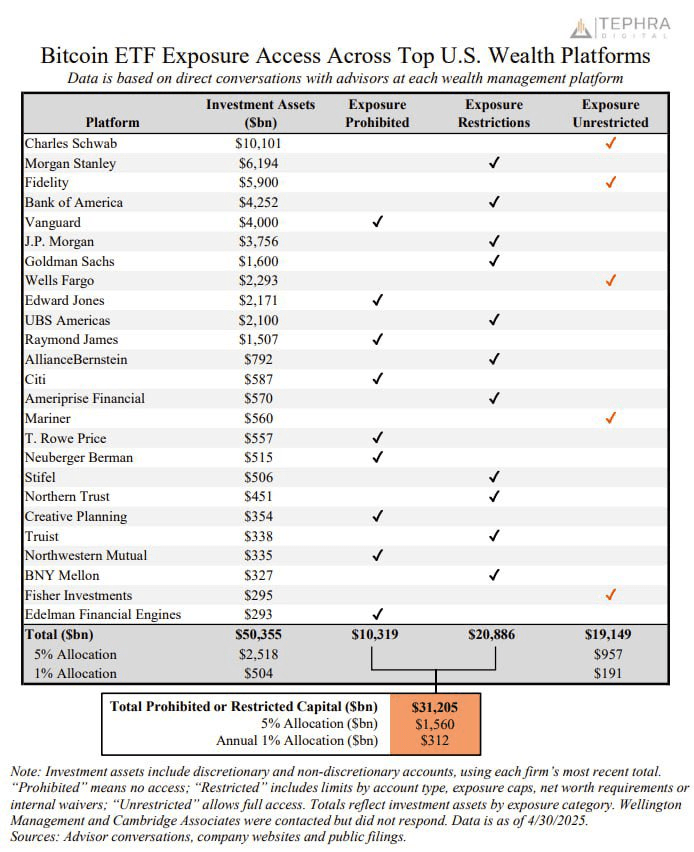

The giants of finance, those stoic titans tending over $50 trillion (a sum large enough to make even the czars blush), continue to lock the common folk—and even the not-so-common—out of the Bitcoin bazaar. Behold this chart, released by Tephra Digital on April 30, and paraded by Saylor like a revolutionary pamphlet:

“By the time your financial adviser says it’s OK to buy bitcoin, it’ll cost $1 million. When they say it’s a good idea, it’ll be $10 million.”

The bureaucracy has devised a glorious new classification system: ‘Prohibited,’ ‘Restricted,’ and ‘Unrestricted’. Try not to get lost among the tripwires, friend. Despite the regulatory applause, only 38% of this pile of loot sits in fabled houses where you can grab bitcoin ETFs without jumping through flaming hoops.

Some titans—call them the capitalistic Bolsheviks—stand ready: Charles Schwab, Fidelity, Wells Fargo. Together, they fling open their doors to $19.1 trillion of assets. Meanwhile, a stubborn $20.9 trillion lingers behind velvet ropes, subject to secret handshakes and eligibility criteria that would make a Russian bureaucrat proud. And $10.3 trillion? Locked away like the last loaf of bread in winter, housed with platforms like Vanguard, Edward Jones, and Citi, where even the word ‘bitcoin’ is spoken only in whispers and only after hours.

Tephra Digital, ever the mathematician at the village tavern, raises a mug and counts: what if just 5% of this forbidden cache were greenlit for bitcoin ETFs? $1.56 trillion, comrade! Even 1%, and you’d still have $312 billion, enough to fund a few revolutions—or at least buy bread for everyone on the block. Critics murmur about volatility, regulators clutch their pearls, but the dream marches on. Tear down the velvet curtain, they cry, and let the institutional floodgates open—one trembling financial advisor at a time.

This, dear reader, is not just a chart of access. It is a map to riches languishing in bureaucratic exile, while the world waits for the last gray-haired gatekeeper to say, “Maybe bitcoin is a good idea after all.” 😂

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-05-02 05:57