Hold onto your monocles and button up your waistcoats! Crypto traders, with the calm serenity of a cat in a bath, are about to witness the expiry of nearly $3 billion in Bitcoin (BTC) and Ethereum (ETH) options today. Spiffing, what? 🕰️💸

Options expiry day is rather like the village fête: guaranteed to cause a commotion, the odd pratfall, and, if one is not careful, one’s portfolio may do a spectacular impersonation of the Titanic. Market participants are advised—if anyone ever listens to advice in this field—to keep a weather eye on the goings-on at around 8:00 UTC. Gimlets out, chaps! 🍸

$2.95 Billion of Crypto Options Waltzing Off

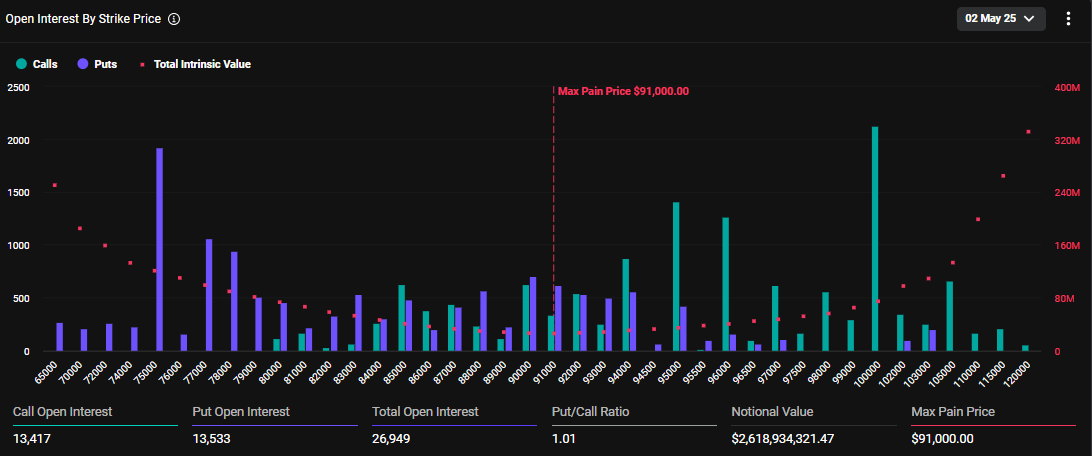

Apparently, the nice people at Deribit (one assumes comfortably ensconced in leather-backed chairs) inform us that 26,949 Bitcoin contracts are due to expire at the stroke of the bell. That’s a notional value of roughly $2.6 billion—enough to make Bertie’s bookie break into a light sweat.

The “maximum pain point” (which sounds like Jeeves describing my attempts at the Charleston), sits at $91,000. Reach this, and most contracts shrivel up like last week’s cucumber sandwiches—utterly useless to all involved.

Bitcoin’s put-to-call ratio, so the brainy ones inform us, is 1.01—a trifle bearish, suggesting more hearty sales (puts) than hopeful punts (calls). The market, in brief, is looking more nervous than a debutante at her first dance. 🕺

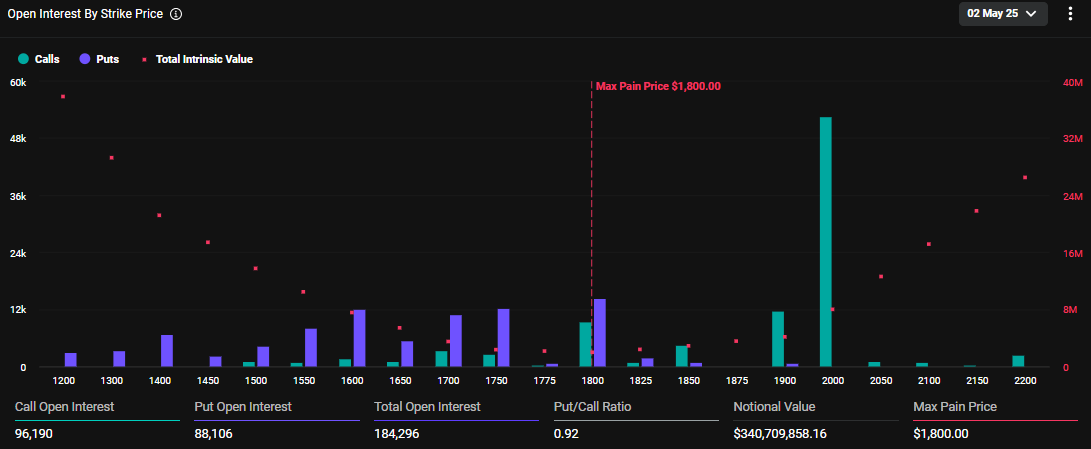

Meanwhile, Ethereum is keeping up appearances with a put-to-call ratio of 0.92—positively chipper! There are 184,296 ETH contracts, worth some $340.7 million, also sailing off today, with a maximum pain point of $1,800. Slight uptick of 2.27% since Friday, which, in ETH terms, is almost as good as a firm handshake and a promising wink.

Despite the unseemly surplus of Bitcoin puts, the oracles at Greeks.live insist the air is “predominantly bullish.” Apparently, even when all signs point to impending disaster, hope springs eternal in the cryptoverse. Traders are eyeing $100,000 like Bertie eyes Aunt Agatha’s sherry. 🍷 Low volatility and market structure—whatever that is—add to the jollity.

“Key levels being watched include the $96,000 NPOC that was just hit and the $94,400 rolling VWAP, though some express concerns about ‘sell in May and go away’ seasonality,” wrote Greeks.live, perhaps while twirling their mustaches.

Low volatility: a soporific state in which traders sniff opportunities for taking long positions. Greeks.live note that market makers are flogging calls at a 30% implied volatility (presumably in spats), collecting gamma in the process—as one does in polite society. This translates to selling options for a bit of premium and jolly good fun, with leverage tremulously low, a bit like my uncle’s gin supply at Christmas.

Gamma collecting: for those blessedly innocent of the term, it means scooping up the odd shilling from option premiums as the market ambles along, blissfully unaware.

Ether has been snoozing compared to BTC, so some mischievous types are shorting ETH, while others ponder July volatility positions for vega gains—no, not a botanical garden, but a method to profit should the market suddenly remember how to panic. It’s a regular tug-of-war, if you ask me.

Vega gains—there’s a word for your next Scrabble duel—occur when volatility picks up, like lord Emsworth’s prize pig startled by a fox, sending option prices leaping skywards.

Elsewhere, the Deribit soothsayers agree: the real fun might be above $95,000 in BTC, where call options are piling up like sandwiches at a Drones Club picnic.

“Market shows strong BTC call stacking above $95K, what impact will the expiry do?,” Deribit analysts pondered, perhaps over a cheeky game of bridge.

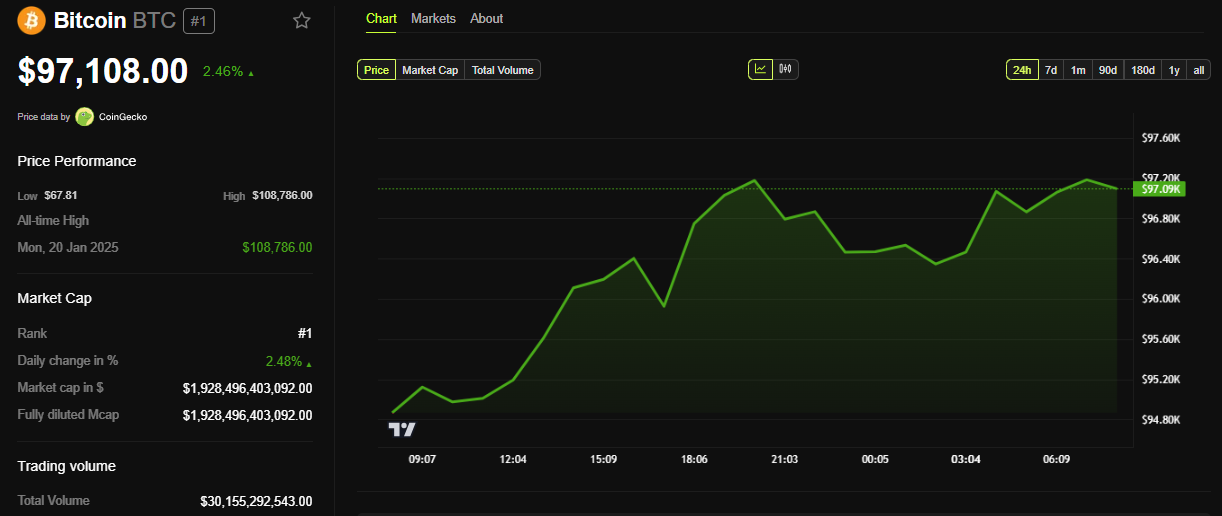

And as we sip tea and watch the spectacle, Bitcoin was seen lounging around $97,108, boasting almost a 3% rise in 24 hours. Splendid!

To sum up, Bitcoin bulls are clearly inhaling optimism like it’s the scent of fresh-cut roses. Yet, let’s not forget: options expiry has a nasty habit of introducing volatility, as shown by last week’s $8.05 billion expiry brouhaha, which produced short-term price squiggles. Thankfully, all this ruckus tends to calm down again once the contracts are settled around 8:00 UTC. At which point, as always, it’s time for lunch. 🥪🤵

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Reminder: Look Out for PS5 Logos in Today’s Xbox Showcase

2025-05-02 08:31