Amid the US Senate’s labyrinthine debate over the Clarity Act, a tempest has stirred in the crypto cosmos, where XRP and its kin now find themselves under the microscope of regulatory gaze, as if summoned by a magician’s wand.

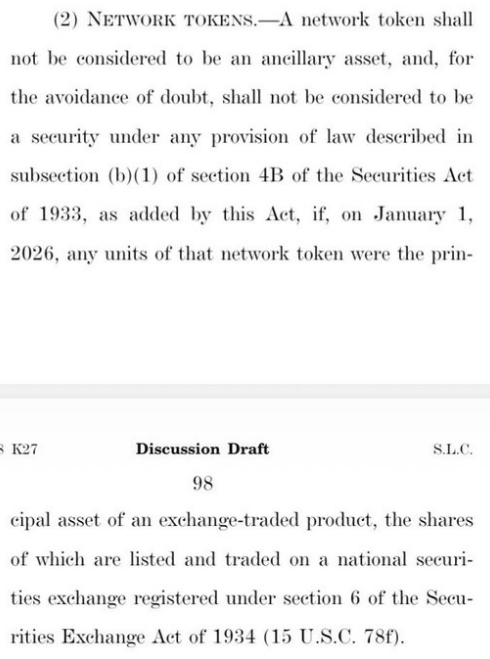

Reports whisper of a bill poised to bestow clarity upon tokens backing ETFs, casting them in the role of commodities, a transformation as subtle as a chameleon’s shift.

XRP’s spot ETFs, those glittering beacons of capital, have drawn a tidal wave of $1.37 billion since their November 2025 debut-a figure so grand it might make a philosopher weep, or at least raise an eyebrow.

How It Works

The mechanism of creation and redemption, a process as intricate as a spider’s web, allows funds to accept actual assets rather than mere cash. Yet, for the common investor, this is a realm reserved for the initiated-authorized participants, those titans of finance, who trade tokens for shares with the precision of a surgeon.

Ordinary investors, meanwhile, dabble in the exchange, their transactions a dance of paper and pixels, leaving the true alchemy of ETFs to the elite.

“The XRP ETFs are in-kind funds, a portal through which one may deposit XRP and emerge with shares of equal value. A regulated sanctuary, if you will.”

– Chad Steingraber (@ChadSteingraber) January 13, 2026

What Community Voices Are Saying

Within the XRP community, a chorus of visionaries envisions ETFs as sanctuaries for token holders, a regulated parking spot where value is safeguarded until the whims of the market demand its return.

Chad Steingraber, that erudite oracle of the crypto cosmos, has championed the in-kind mechanics, painting a future where ETFs function as a bank’s vault, albeit with a bureaucratic flourish.

This notion, though tantalizing, is met with the skepticism of a seasoned gambler-after all, who trusts a casino with their life savings?

What Taxes Might Look Like

Reports and investor guides reveal a tax landscape as convoluted as a Russian novel, where ETFs, with their in-kind structures, evade capital gains distributions like a ghost in the night. Yet, for token holders, the path is fraught with pitfalls, each transaction a potential minefield of taxable events.

Under current US rules, the mere act of converting one asset to another can trigger a tax audit more grueling than a medieval trial. Chad Steingraber, ever the optimist, posits that the Clarity Act will grant XRP holders a regulated haven-a gilded cage, if you will, where safety and oversight reign supreme.

For him, the allure lies not in the technicalities but in the reassurance of a structured, organized product-a siren song for the risk-averse.

Read More

- Darkwood Trunk Location in Hytale

- Best Controller Settings for ARC Raiders

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- Ashes of Creation Rogue Guide for Beginners

- Daredevil Is Entering a New Era With a Chilling New Villain (And We Have A First Look) (Exclusive)

- We’ll Never Get Another Star Wars Show Like Andor, But Not Because of Dave Filoni

- Katy Perry Shares Holiday Pics With Justin Trudeau & Ex Orlando Bloom

- RHOBH’s Jennifer Tilly Reacts to Sutton Stracke “Snapping” at Her

- So Long, Anthem: EA’s Biggest Flop Says Goodbye

- 7 Announcements We’re Dying to See at Dragon Ball’s Genki Dama Festival This Month

2026-01-17 16:47