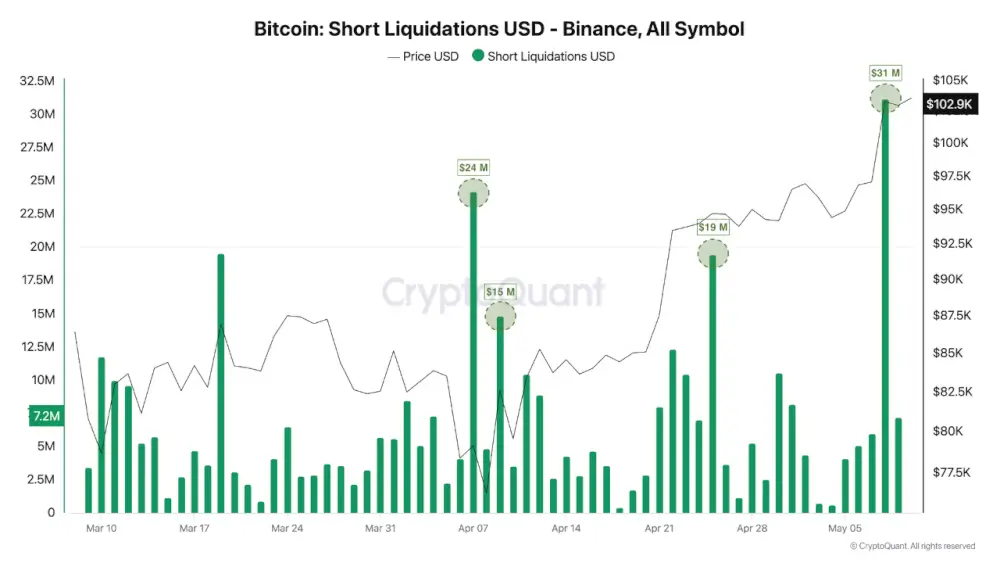

On the 8th of May, Bitcoin, that merry little troublemaker, decided to send over $31 million in short positions to the great digital graveyard, all in a single day, as it soared past $103,000—currently lounging around the plush $103.4K mark. 🍾

Darkfost’s Brilliant Post on Derivatives and Their Whimsical Ways

In a masterstroke of analysis, the ever-diligent Darkfost took to his keyboard to explain how Bitcoin’s heart-wrenching descent from $109,000 to $78,000 earlier this year led to an avalanche of short positions—especially over at Binance, that rascally exchange. These bearish moves put quite the strain on the market, amplifying volatility like an amateur juggler with too many flaming torches. 🔥

But lo and behold, come early April, Bitcoin, in a mood for redemption, started reversing its fortunes. And as those short positions unwound like a bad sweater, a delightful buying pressure emerged, sending Bitcoin on its merry upward march.

But lo and behold, come early April, Bitcoin, in a mood for redemption, started reversing its fortunes. And as those short positions unwound like a bad sweater, a delightful buying pressure emerged, sending Bitcoin on its merry upward march.

“The most significant liquidation event since April kicked off took place on May 8, with over $31 million in shorts getting wiped out in a single day,” Darkfost proudly declared. 🤑

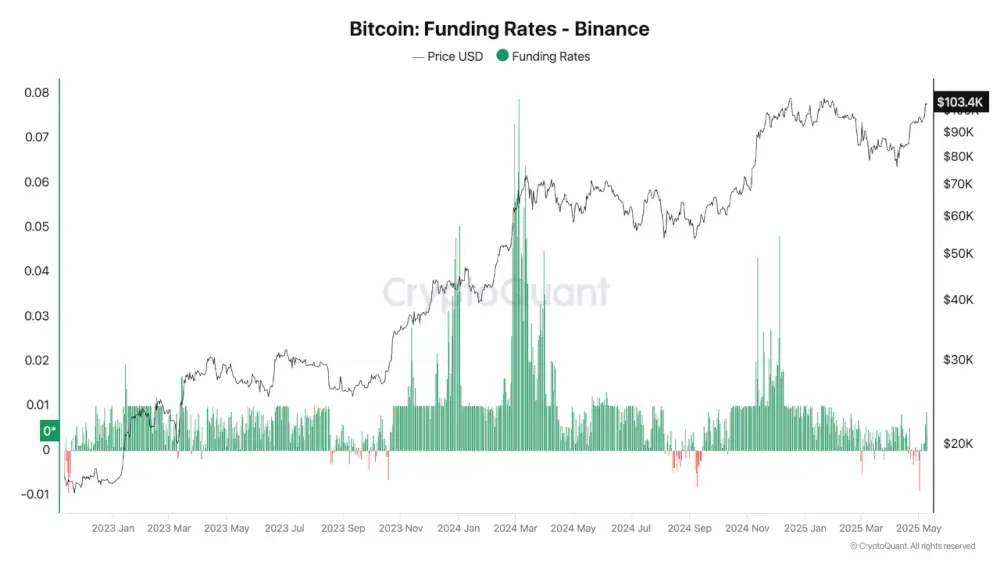

Funding Rates Low, Bulls Not Yet on Their Last Legs

And here’s the kicker: despite this rally that could make even the most stoic of bears shed a tear, the funding rates on Binance remain as low as a cat on a lazy Sunday afternoon—around 0.004. This rather suggests:

-

Shorts are still lurking about like uninvited guests at a wedding.

-

Traders are holding back from going all-in, which means this rally could have legs yet—it’s not ready to trip over its own shoelaces just yet.

CryptoQuant, always the observant detective, backs this up with data, revealing no wild spikes in the funding rate. This is like seeing a calm sea when you were expecting a storm—proof that the derivatives market isn’t about to do its best impression of a rollercoaster.

Momentum Growing, Shorts Getting Squeezed Like a Wet Sponge

The second chart, which can only be described as a thing of beauty, shows a sequence of major short liquidation spikes in the past few weeks, including:

-

$24M on April 6, the day the shorts went running for cover.

-

$19M on April 21, because why not do it again?

-

$31M on May 8, just to make sure everyone knows Bitcoin means business.

Each of these spikes coincides with a bullish surge, and let’s face it, short squeezes are practically the secret sauce to Bitcoin’s current strength. If you didn’t know better, you’d almost think Bitcoin was playing some kind of high-stakes game of Monopoly. 😏

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Solo Leveling Arise Amamiya Mirei Guide

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Bitcoin: The Dashing Drama of Saylor’s 21 Rules! 💰✨

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2025-05-10 19:44