The fields of cryptocurrency are wild and brambled, and out here under the digital sun, neither Solana nor SUI travel alone. The talk of the townsfolk is that they’re on a collision course. But as any veteran will tell you: rumor runs faster than fact, and these two blockchains aren’t neck and neck yet—we’re still hitching the horses for that race. 🐎💸

Both SUI and Solana roll out new tech faster than rabbits spawn in a Californian spring, but Solana’s already got a seat at the big table—while SUI’s still bringing biscuits to the barn dance.

Solana’s Dance With the Suits

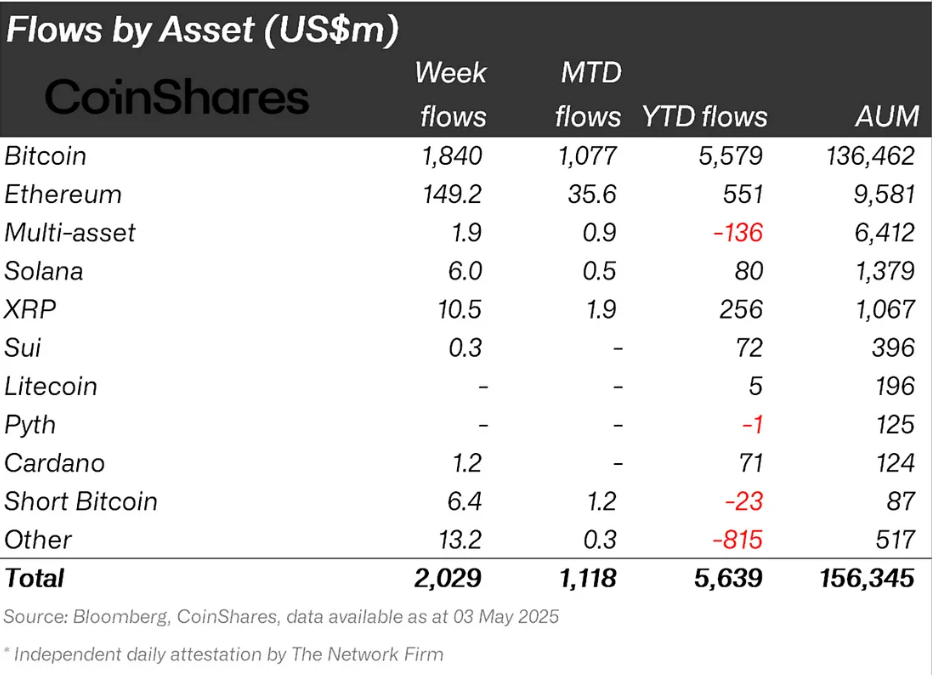

Where there’s money, there’s always a crowd. Institutions, those old men in dusty suits, eyed Solana in April with the hesitation of a farmer before an unfamiliar storm, but come May, they sprang from the hayloft with cash in hand. Solana netted $6 million in that week ending May 3rd, while SUI barely found loose change in the sofa cushions at $0.3 million. And year-to-date, Solana’s already hoarded $80 million versus SUI’s $72 million—so much for neck and neck; more like greyhound versus garden snail. 🐕🐌

So the big money pours into Solana like moonshine in a gambler’s glass. But don’t think SUI’s just laying in the grass. Alvin Kan, COO at Bitget Wallet, explains SUI’s got a few tricks—devs speaking the Move language, use cases popping up like gophers, and institutional heavyweights peering over the fence. Maybe it’s not just a flash in the pan—maybe it’s one of those long, slow boils.

“The recent uptick in institutional inflows to SUI appears to reflect growing interest in scalable and technically differentiated blockchains. With high throughput capacity, a novel programming language like Move, and expanding use cases such as Bitcoin restaking via SatLayer, SUI offers infrastructure that aligns with long-term investment theses. Backing from players like Franklin Templeton and Grayscale suggests this may be more than a short-term trend.”

SUI, though young and spry, does know how to hustle—its DeFi assets, or TVL (Total Value Locked, for the greenhorns), jumped 76% in just a month and now sits at a solid $2 billion.

Solana increased its own pile by 40%. Only thing is, its pile was so much larger to start: $9.38 billion in TVL, having shuffled $35 billion worth of transactions through DEXs since May began. Like asking who watered their garden best when one owns a river and the other a leaky hose. 💧🚜

Solana’s lodged firmly in DeFi. Ben Nadraski of Solstice Labs pointed out Solana handles 300 million daily transactions, has millions of active addresses, and leads capital flows like a shepherd with a particularly stubborn flock. As for SUI, it’s still in the part of the story where “the little engine that could” is busy huffing up that first hill.

“Solana is currently dominating net new capital flows from an L1 perspective, including a breakthrough 300 million daily transactions, 4 million+ active addresses… SUI, as mentioned above, is attracting institutional interest, but they are in the early stages of their institutional growth and have several steps of validation still to be seen in the market,” Nadraski told BeInCrypto.

Then there’s the whole business with ETFs, which are basically Wall Street’s way of saying “Hey, we’d like in on this nonsense.” Solana’s ETF might show up before SUI’s ever gets an invite. Shaun Lee of CoinGecko wagers the SEC will bless Solana first since applications from GrayScale, VanEck, and others are already stacked up on the regulator’s desk, probably somewhere between the spilled coffee and the government-issued stress ball. 📈☕

“It is likely that a SOL ETF will be approved before a SUI ETF, as the SEC is already reviewing multiple applications for spot SOL ETFs from the likes of GrayScale, VanEck, Franklin Templeton, and more. A decision for these applications is expected for early October. On top of that, Solana futures ETFs are already available for trading in the US, a sign that regulators are comfortable with SOL-based products. “

Both Slogging Up the Price Hill

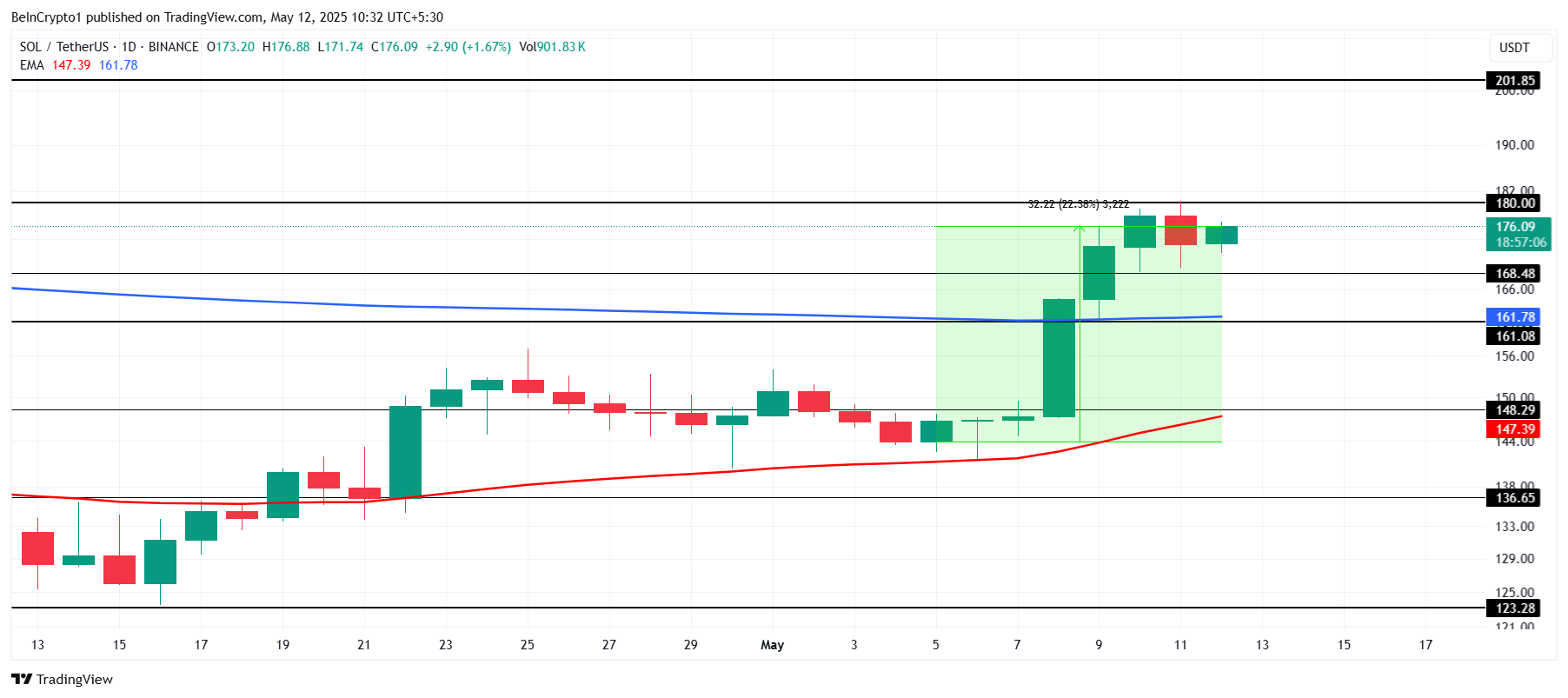

SUI and Solana both had a healthy breakfast, apparently; SOL went up 22% over the week, SUI did 26%. Still, $4.13 for SUI fighting to not trip below $4.05 is like watching a chicken defend every inch of coop. Let it slip, and the foxes will circle.

Solana’s perched at $176, stuck just below the $180 fence. Until it jumps that, $200 is just a mirage shimmering out in the fields. Death Cross? Sounds like something you catch if you try to buy crypto without reading a whitepaper. 🪦🐔

SUI’s got its spark, no doubt, and in the long story of blockchain maybe it’ll be the upstart who comes from nothing. For now, though, Solana’s holding the biggest stick, with a posse of suits and DeFi diehards at its back. Reckon SUI won’t be sending Solana running off the farm any time soon.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

2025-05-12 12:48