Ethereum‘s Secret Growth Spurt: Over 1 Million ETH Vanishes! 💸✨

Ethereum rebounded more than 50% in May, proving that your favorite digital darling is not dead yet. On-chain gossip suggests the sentiment shift is real, likely thanks to the Pectra upgrade, and analysts are now dreaming of Even bigger heights. Yes, higher than your usual hope and prayer. 🙄

This juicy on-chain intel includes ETH withdrawals from exchanges, exchange reserves, and whale hoarding—because nothing says ‘I’m serious’ like throwing ETH into cold storage. Over the past month, these metrics have hit some pretty impressive milestones. Who knew that crypto could be so dramatic?

Over 1 Million ETH Swiped from Exchanges – Poof! Gone! 😱

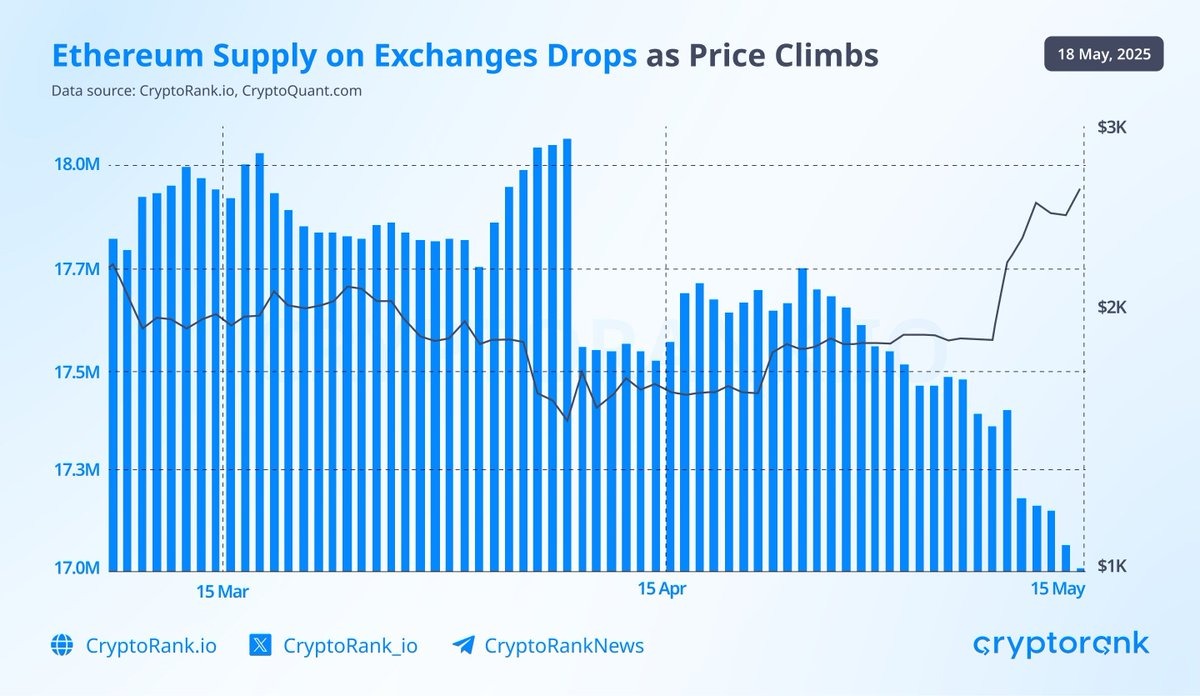

According to Cryptorank, the ETH sitting on centralized exchanges has dipped from a staggering 18 million to nearly 17 million in just four weeks. Someone’s getting serious about their crypto hobbies. 📉

“In the last month, more than 1 million ETH have been snatched away from centralized exchanges – about 5.5% of what was there before. Looks like folks are less about trading and more about hoarding. Thanks to the Pectra upgrade, which launched on May 7, this trend might push ETH’s price higher, like your cousin’s questionable investment decisions,” cryptorank.org said. 😎

CryptoQuant reports that Binance alone saw over 300,000 ETH disappear in the last month. Since January, a staggering 800,000 ETH have made a magic trick and vanished from Binance. Abracadabra! ✨

This exit stage left behavior didn’t just happen when ETH dipped below $1,400 in April; it actually sped up when ETH bounced back above $2,400 in May. Coincidence? Maybe. Or maybe just crypto being unpredictable as ever.

CryptoRank’s charts show ETH prices soared as reserves plummeted—a perfect recipe for price rallying with a side of supply scarcity. More whales, more fun. 🐋

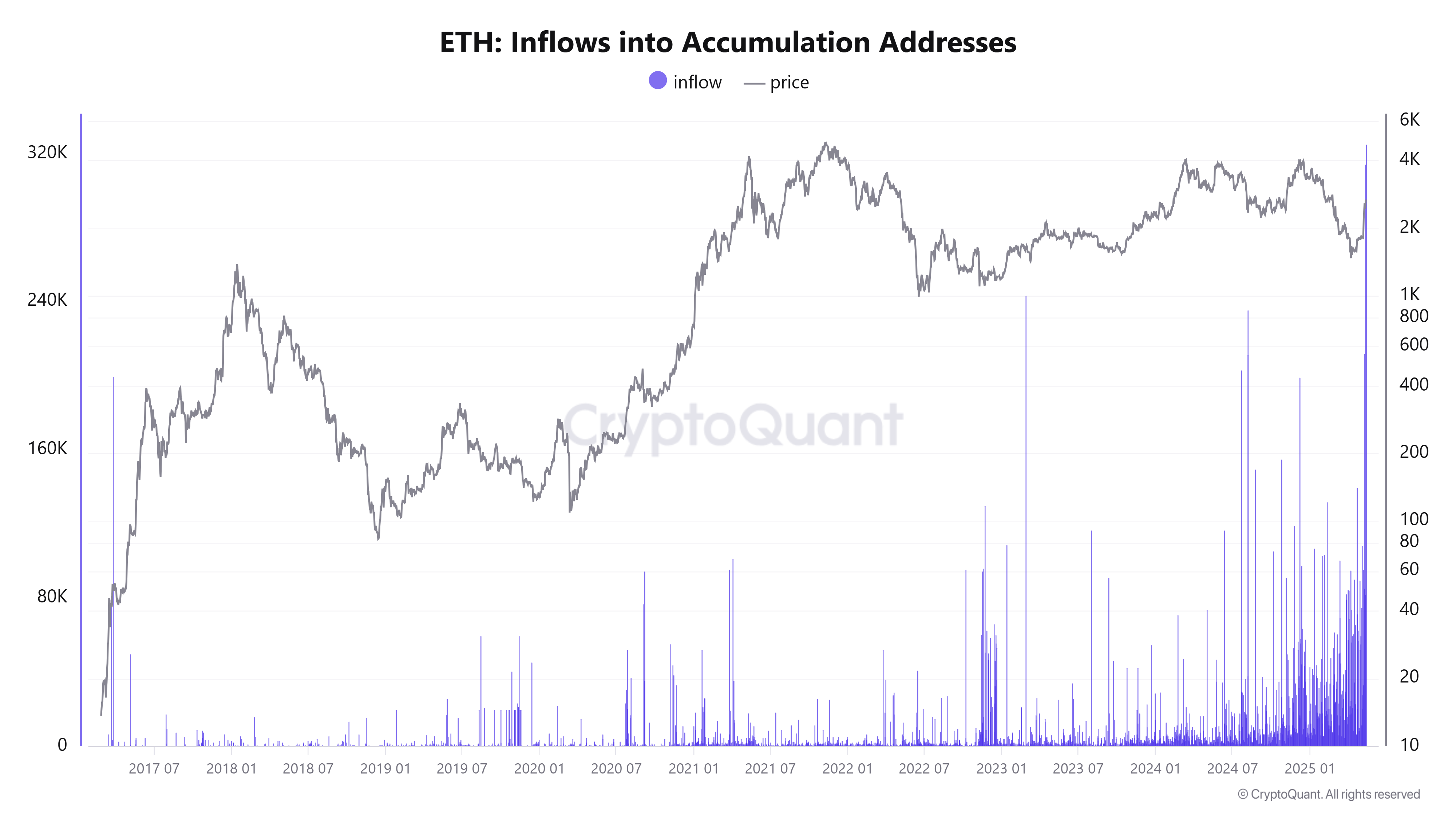

In related news, whale wallets packed their bags with a record 325,000 ETH on May 12. Because what says ‘I’m serious about this’ more than a whale hoarding a small country’s GDP? 🚢

When whales collect, they often withdraw ETH from exchanges to secure it in their fortress of solitude (cold wallets). Less circulating supply = more upward price pressure. It’s basic crypto economics, really. 🧊💰

Meanwhile, amid all this activity, a rare bullish pattern emerged in May. Analyst TedPillows—yes, really—predicts ETH is set to hit $3,000, that shiny psychological checkpoint we’ve all been pretending isn’t just a number. 🤑

“The ETH Golden Cross is confirmed. $3,000 Ethereum is making its way to us,” Ted confidently claimed, probably while sipping a fancy latte. ☕️

Arthur Hayes Thinks ETH Will Outshine Solana—Eventually. 😉

Even with all these on-chain fireworks, ETH still needs another 70% jump to beat its 2024 peak, and a doubler to reach new all-time highs—basically the crypto equivalent of climbing Everest without oxygen. 🏔️

While some analysts like PlanB call Ethereum “centralized” and “pre-mined,” and others say it’s lacking in a coherent economic story, hero of our story Arthur Hayes sees things differently. According to him, ETH, despite being the proverbial black sheep, is the most secure blockchain with the highest Total Value Locked (TVL). He even suggests it could outshine Solana in the next bull run—because who doesn’t love a good underdog story? 🐶

“Ethereum gets a bad rap—everyone says it’s been doing nothing. But it has the most TVL, the best developers, and remains the safest proof-of-stake blockchain. Sure, Solana had a hot streak from $7 to $172, but if I had to put my money on one, it’s ETH for the next 18–24 months,” Hayes reasoned, probably while dream-shopping for yachts. 🚤

And the industry experts? They’re even more bullish, imagining a future where ETH not only outperforms Solana but might even topple Bitcoin. Because what’s a little decentralization and a splash of DeFi compared to national dominance? 😉

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-05-19 16:16