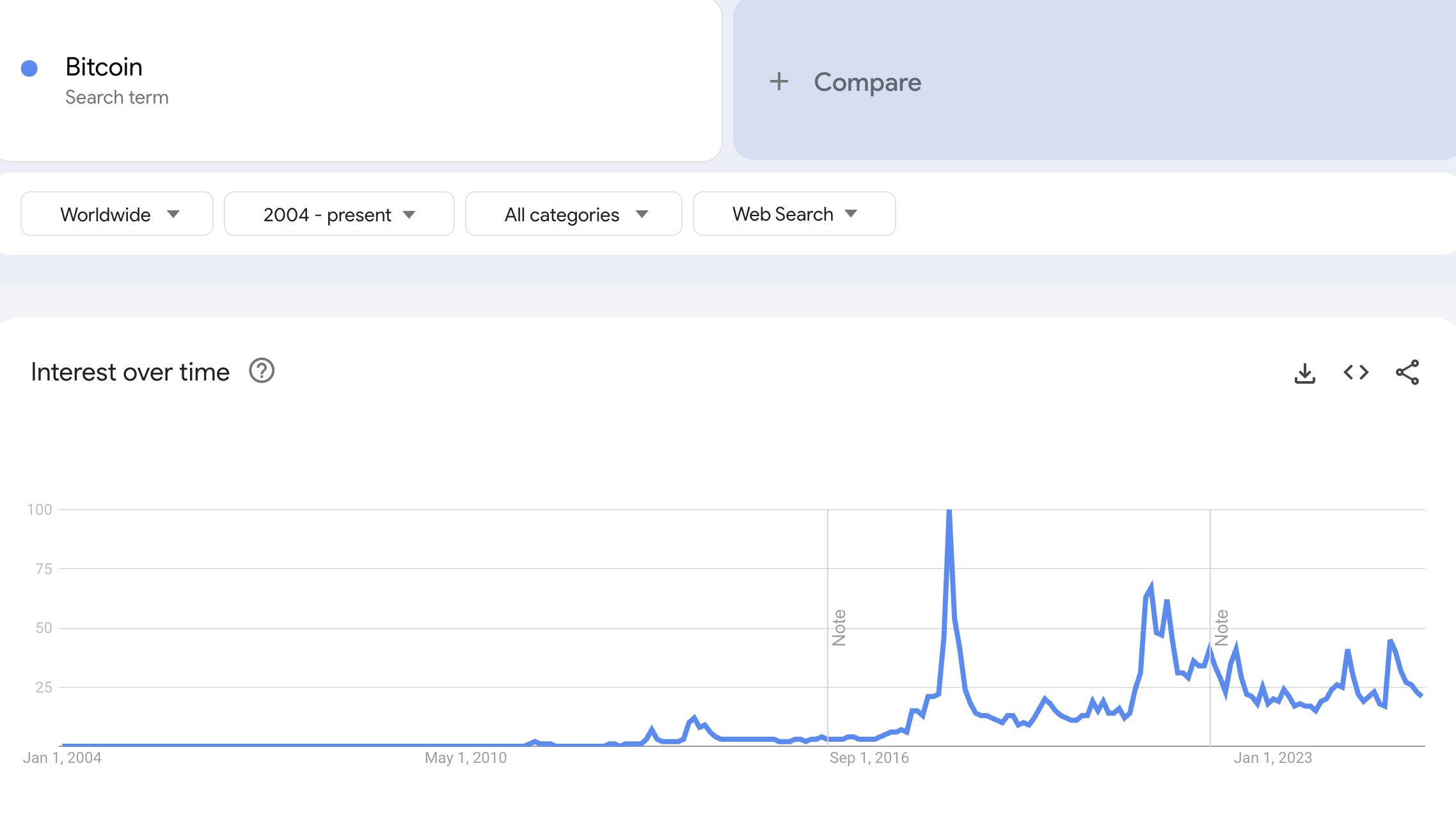

While Bitcoin (BTC) is practically tap-dancing on the doorstep of its all-time high (ATH), darling, it’s simply ghastly that search interest on Google Trends remains at a level usually reserved for dust bunnies and forgotten umbrellas. 🙄

Comparable, if you can imagine, to the bear market of ’22, when BTC was languishing around $16,000. The sheer audacity of Bitcoin’s price surge juxtaposed with the public’s utter indifference is causing quite the stir amongst the crypto cognoscenti. One might even say, a mild case of the vapors. 💨

Bitcoin Nears ATH But Search Volume at Record Lows

Bitcoin, bless its little cotton socks, was trading around $106,000 at the time of writing. However, Google Trends, that unflappable barometer of public whim, shows searches for “Bitcoin” haven’t exactly been setting the Thames on fire. 🔥

Indeed, the search volume is reminiscent of that dreary 2022 bear market, when BTC was priced like a slightly used handbag at a charity shop – around $16,000. 👜

This suggests that public interest in Bitcoin is currently lower than a snake’s belly, despite its value having increased more than sixfold since 2022. A most peculiar state of affairs, as normally, when Bitcoin reaches such dizzying heights, the retail investors, bless their naive hearts, surge forth in a frenzy of FOMO. 💸

Explaining this phenomenon, an X user (one assumes they’re terribly important) suggested that retail investors are simply too jaded to be bothered by Bitcoin’s price surge. Apparently, Bitcoin’s solo performance isn’t enough to spark the FOMO. Only when the altcoin market explodes in a shower of glitter and confetti will the “new blood” – the retail investors – deign to enter the fray. A rather convenient opportunity, one might add, for large institutions to offload their holdings and transfer the risk to these eager newcomers. How very sporting! 🥂

This perspective aligns rather neatly with insights from Matrixport, who emphasized that medium- and long-term investors are the primary Bitcoin custodians. Meanwhile, retail investor participation remains as subdued as a vicar at a rave. 😇

The absence of these retail darlings could explain why Google Trends search volume hasn’t exactly gone bananas, even as Bitcoin teeters on the edge of its all-time high. 🍌

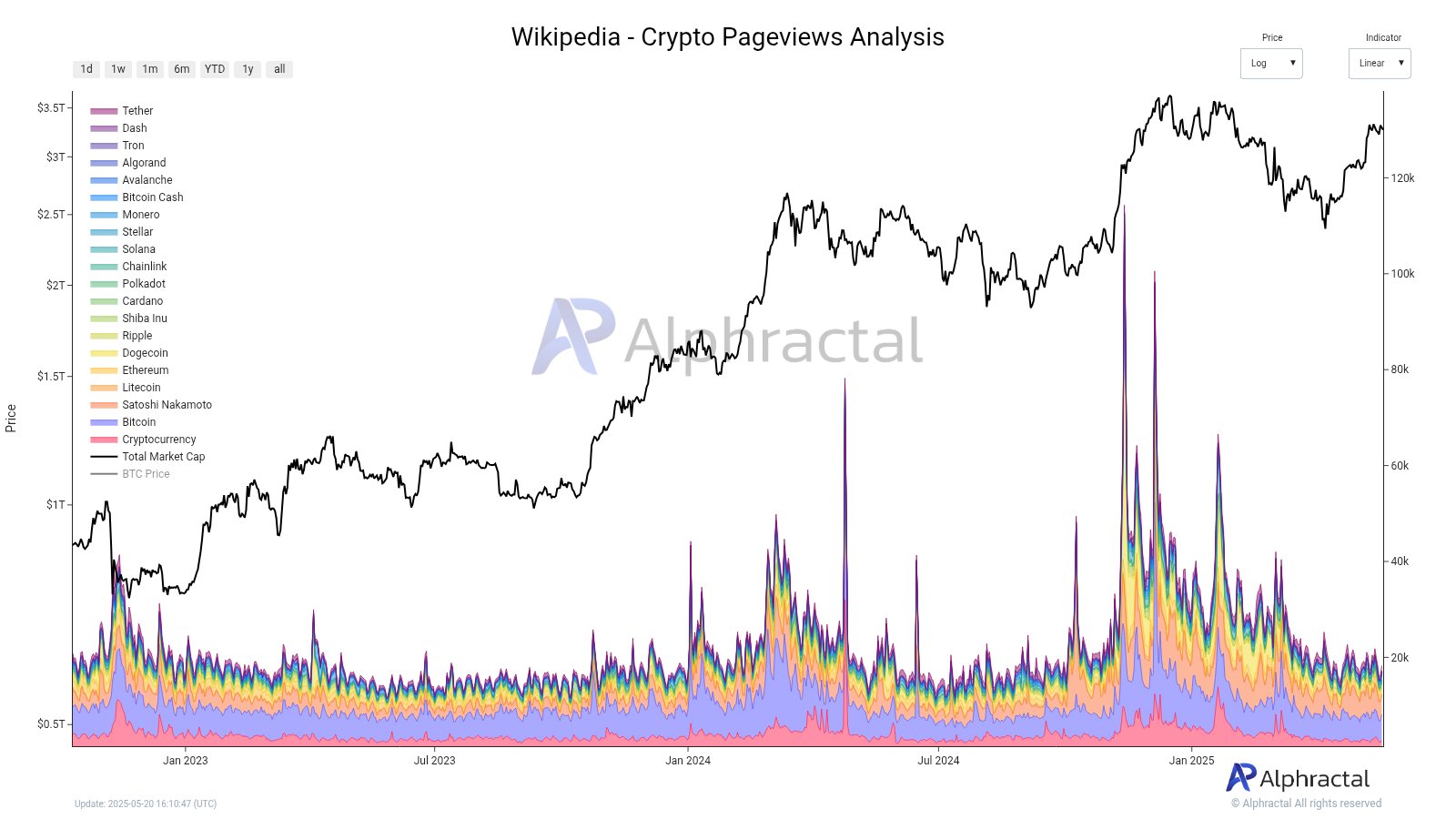

Besides, retail interest remains as flat as a pancake on Wikipedia as well. This indicates a distinct lack of confidence and suggests that the market is not, shall we say, euphoric. Historically, whenever interest rates spike sharply, the market enters a state of euphoria, coinciding with price peaks. A rather inconvenient truth, wouldn’t you say? 😈

Calm Before the Storm or a Lack of Market Momentum?

Some voices in the crypto community, ever the optimists, view this phenomenon rather positively. X user The_Prophet_ (one hopes they have a decent tailor) argues that the current Google Trends chart represents the “silence before the detonation.” They suggest that the public’s indifference could be a sign of a larger price surge lurking just around the corner. 💣

This view is seconded by X user SerSigma, who points out that Bitcoin’s volatility is currently at its lowest but won’t stay that way for long. According to this user, Bitcoin will continue its ascent as the market finally recognizes its inherent brilliance. One can only hope they’re not wearing rose-tinted spectacles. 🌹

The lack of public interest, as reflected by Google Trends, could present both opportunities and risks for the Bitcoin market in 2025. On the positive side, the absence of retail investor participation means the market hasn’t been inflated by FOMO, helping Bitcoin avoid a price bubble like the one seen in 2021. A most commendable achievement, if I may say so myself. 👏

On the other hand, the lack of retail investors raises questions about the sustainability of the current rally. If Bitcoin continues to rise without widespread public participation, the market may lack the liquidity needed to maintain long-term growth. A rather precarious situation, wouldn’t you agree? 🤔

This is particularly significant given that large institutions currently hold the majority of Bitcoin. Without “new blood” entering the market, institutions may struggle to sell at high prices, potentially leading to a rather unpleasant price correction in the future. A fate worse than a lukewarm martini, I assure you. 🍸

In the long term, Bitcoin is still expected to create significant market momentum. Many financial firms and major banks have issued optimistic forecasts for Bitcoin. Recently, HashKey Group predicted that BTC could surpass $300,000 in 2025. One can only hope they’re right, darling. Otherwise, we’re all in for a rather ghastly surprise. 😨

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Quick Guide: Finding Garlic in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2025-05-21 12:19