So, here we are, folks! Crypto US stocks are the talk of the town today. We’ve got Galaxy Digital (GLXY), MARA Holdings (MARA), and Riot Platforms (RIOT) strutting their stuff with some key developments and price movements. Who knew crypto could be this exciting? Or infuriating? 🤔

GLXY is like that friend who shows up to the party and immediately spills their drink. Volatile after its Nasdaq debut, it’s a real rollercoaster. Meanwhile, MARA is flexing with a 27.88% gain over the last 30 days. And RIOT? They just doubled their credit line with Coinbase to $200 million. I mean, who needs a budget, right? Analysts are all smiles, bullish on these three like they just found a $20 bill in their winter coat. 💸

Galaxy Digital (GLXY)

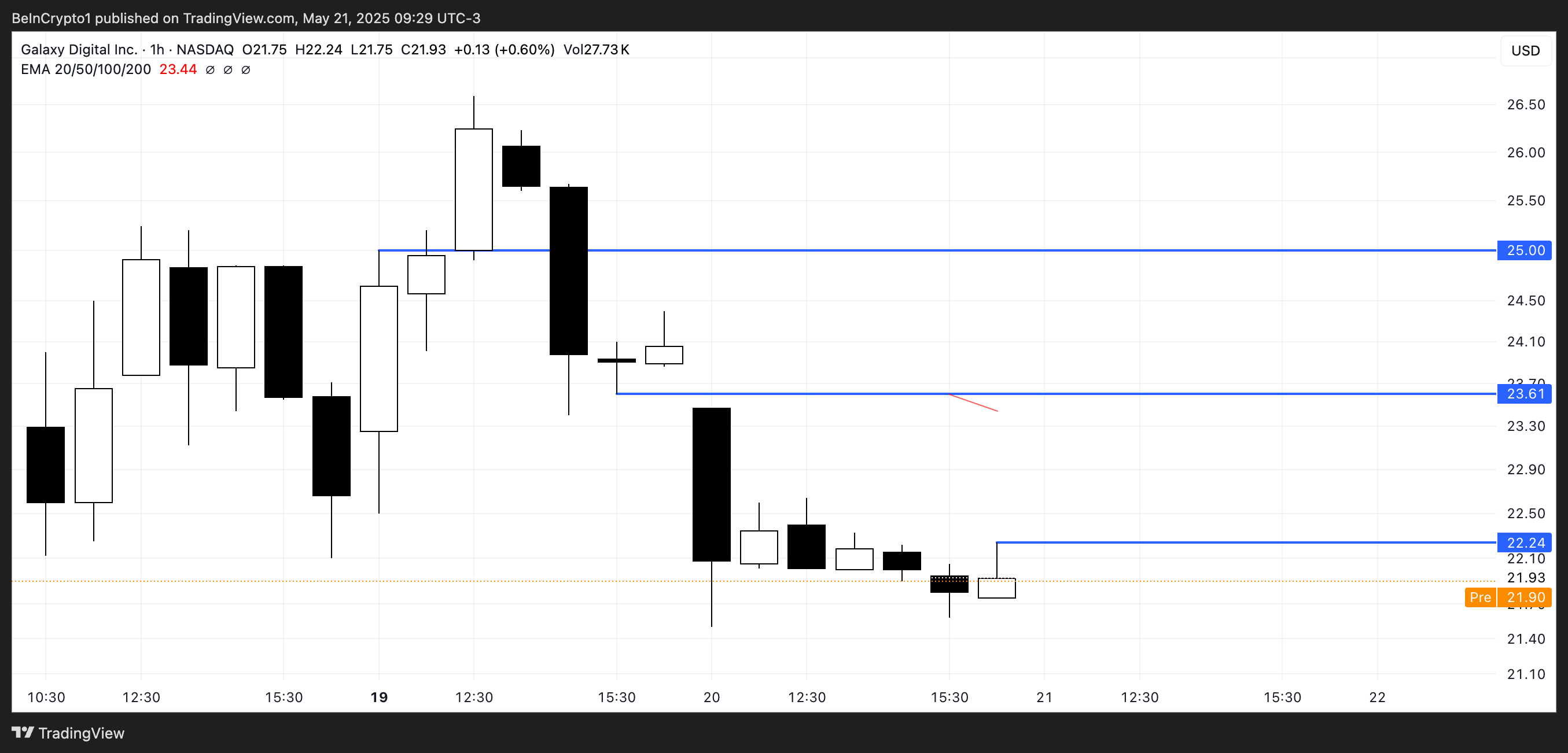

So, GLXY closed yesterday down 7.36%. Ouch! But wait, it’s showing a modest recovery in pre-market trading—up 1.5%. It’s like watching a bad sitcom that somehow gets a second season. They made their big Nasdaq debut on May 16, opening at $23.50 per share.

CEO Mike Novogratz called the listing process “unfair and infuriating.” Sounds about right! It’s like trying to get a reservation at a trendy restaurant—good luck with that! 🍽️

And guess what? They’re working with the SEC on tokenizing their shares. Because why not add more complexity to an already confusing situation? They also disclosed a $295 million Q1 loss. Talk about a mood killer! 😬

Technically, GLXY is down 6.77% since its debut and is hanging around key support levels like a lost puppy. If it keeps this up, it could slide below $22. New all-time lows? Just what we need! But if it finds some strength, it might just retest resistance at $22.24. Fingers crossed! 🤞

MARA Holdings (MARA)

MARA is up 27.88% over the past 30 days. It’s like the overachiever in class who still manages to get a B. It’s held above $15 since May 9, showing some resilience despite a little dip yesterday. Closed down 0.80% and down another 0.68% in pre-market. Classic!

Analysts are cautiously bullish—seven out of 17 say “Strong Buy,” nine say hold, and one brave soul says “Strong Sell.” The average 12-month price target is $20.27. So, there’s that! 📈

MARA reported Q1 2025 revenue of $213.9 million. That’s up from $165.2 million last year, thanks to a 77% jump in Bitcoin prices. But wait, they posted a net loss of $533.4 million. It’s like winning the lottery and then losing the ticket! 🎟️

They expanded their BTC holdings to 47,531. That’s a 174% year-over-year increase. But if momentum fades, watch out! They could test support at $15.25. It’s a wild ride! 🎢

Riot Platforms (RIOT)

Riot closed down 0.45% yesterday and is down another 1.23% in pre-market. They just doubled their credit line with Coinbase to $200 million. Because who doesn’t love a little financial flexibility? 💰

CEO Jason Les says this will enhance Riot’s financial flexibility. Sounds fancy! They’re operating mining facilities in Texas and Kentucky. It’s like they’re trying to be the Amazon of Bitcoin. 📦

Market sentiment around RIOT is strongly bullish. Of 17 analysts, 15 say “Strong Buy.” The one-year price target averages $15.54. That’s a potential upside of 74%. Not too shabby! 😎

But from a technical perspective, RIOT faces resistance at $9.09. Break above that, and we might see gains toward $9.47. If it breaks the $8.82 support level, though, it could fall to $8.40 or even $8.05. It’s like a game of Jenga—one wrong move and it all comes crashing down! 🏗️

Read More

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2025-05-21 17:12