Ah, dear reader! Gather ’round as we delve into the curious case of RAY, a price that seems to be preparing for a magnificent leap of 30% to the illustrious $4.20, all thanks to the benevolent buybacks of Raydium! Who knew tokens could be so generous? 💸

In the past 24 hours, our dear Raydium (RAY) has gallantly surged by 10%, currently trading at a modest $3.30. This comes after a recent escapade where it galloped from $2.40 to $3.86, a staggering 60% rally! The price structure is as bullish as a bull in a china shop, having printed five consecutive higher highs and higher lows. It continues to dance above both the 20 EMA and 50 SMA, which have been in a delightful bullish crossover since mid-April. What a waltz! 💃

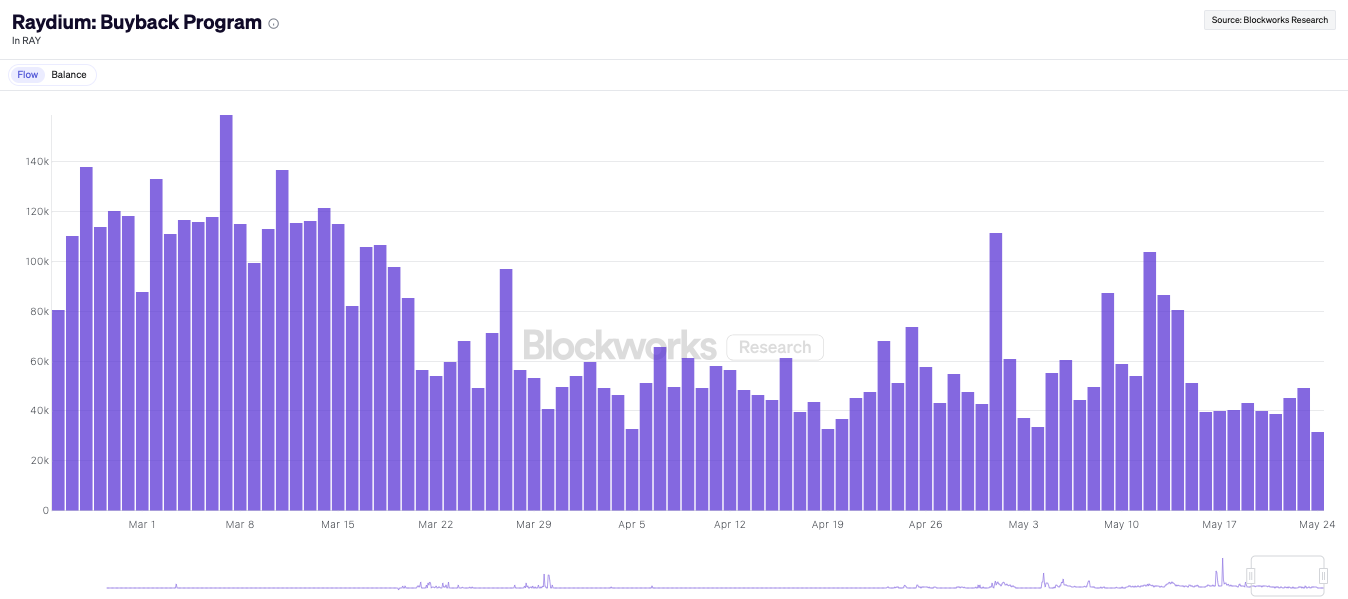

This delightful uptrend seems to be fueled by Raydium’s ongoing token buyback program, which, in a fit of generosity, allocates 12% of trading fees to repurchase RAY tokens. While the buybacks have slowed since mid-March, they have been as steady as a tortoise in a race, with occasional spikes that could make even the most stoic investor raise an eyebrow.

Now, let us not forget the local resistance, which lies at the noble price of $3.50. A confirmed breakout above this level would open the door to the next key resistance at $4.20 — a level that once acted as a sturdy support before the dramatic sell-off in late February. A rally to $4.20 would mark an almost 30% increase from the current levels. If that hurdle is cleared, the next major resistance is around $5.70, where the price was repeatedly rejected like a bad date before and after the January rally that peaked at $8.60. The RSI sits at a comfortable 58, meaning there’s plenty of room to run once the price breaks free from its current consolidation. 🏃♂️

However, dear reader, beware! The bullish outlook would be invalidated if RAY were to drop below the $2.20 support. A break below that could send RAY tumbling down toward the $1.50 level, like a cat that has lost its nine lives. Yet, given the sustained bullish crossover between the 20 and 50 EMAs and the consistent series of higher highs and lows for nearly two months, the trend appears to be as strong as a bear after a long hibernation. 🐻

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- ANKR PREDICTION. ANKR cryptocurrency

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Meghan’s Sweet Kids Tribute in Latest Vid!

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- New PS5 Console Bundle Leaks Prior to Reveal

2025-05-26 16:00