Ah, the elusive Tron (TRX), pirouetting in a tight embrace around the $0.27 mark, as if caught in a waltz of indecision. The technical indicators, those fickle friends, whisper tales of consolidation, while the momentum, once a vibrant dancer, now languishes, as evidenced by a waning ADX and a neutral RSI, hovering like a lost soul near the fateful 50.

Our dear token finds itself at the crossroads of resistance at $0.274 and support at $0.256, where a breakout or a breakdown could very well dictate the next act in this financial drama. Meanwhile, the SunPump’s CEX Alliance, a grandiose scheme to invigorate TRON’s meme coin ecosystem, flounders in the shallow waters of on-chain activity and revenue, which remain as subdued as a cat at a dog show. 🐱🐶

SunPump Launches CEX Alliance, But Platform Activity Remains Low

In a flourish of digital confetti, SunPump has unveiled its CEX Alliance, a strategic endeavor to cradle high-quality meme projects within the TRON ecosystem.

This alliance, a veritable gathering of centralized exchanges—BitMart, Poloniex, LBank, and their merry band—aims to streamline listing procedures and amplify marketing efforts for projects boasting stable on-chain performance and market caps over $500,000.

Through coordinated campaigns, social exposure, and access to trading events, this initiative seeks to elevate meme coin visibility and nurture growth within the TRON network, like a gardener tending to a particularly stubborn plant. 🌱

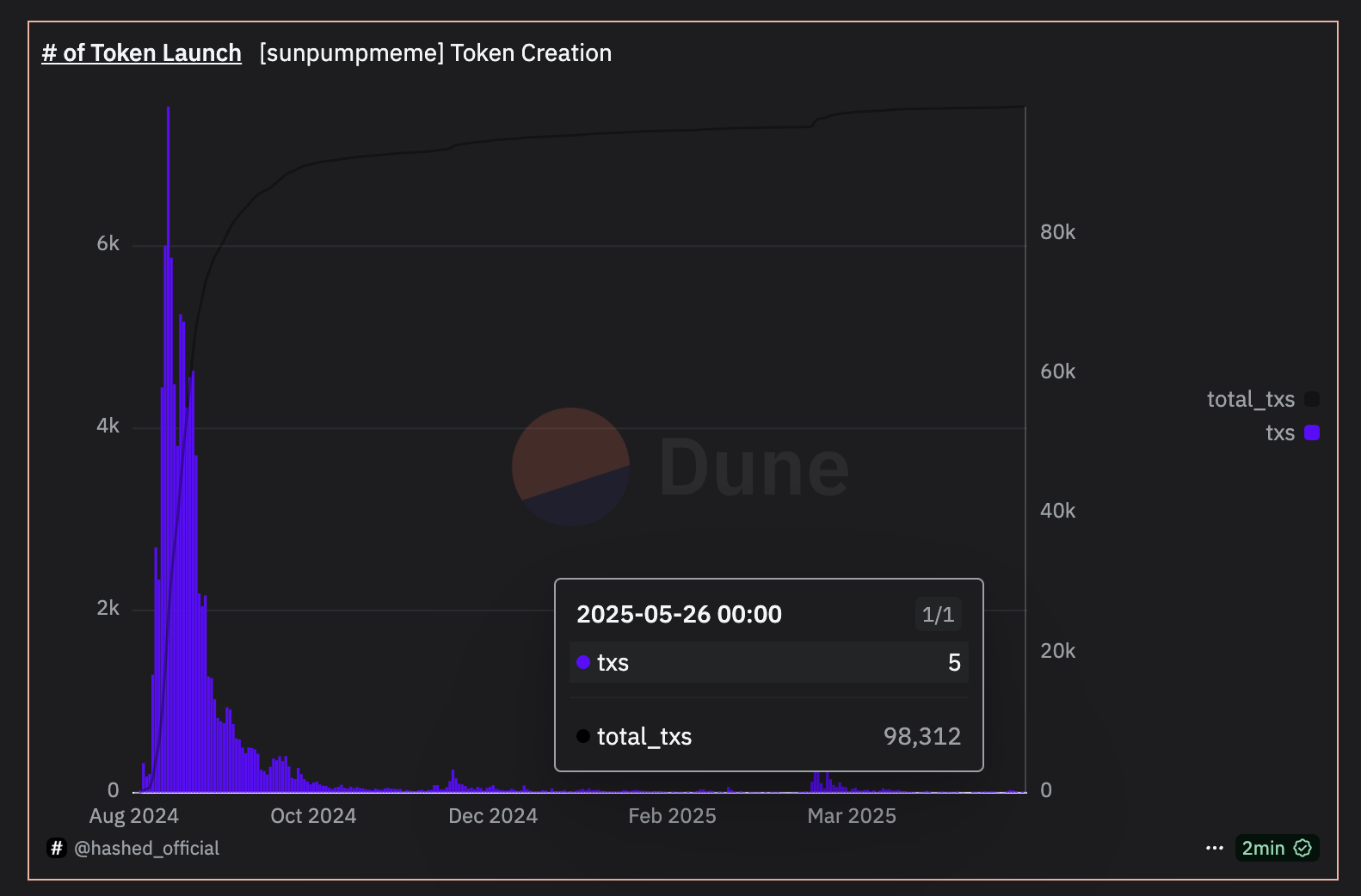

Yet, alas! SunPump’s on-chain metrics tell a tale of muted enthusiasm. Despite the fanfare, the platform has witnessed a mere 98,300 token launches over the past nine months—a figure that Pump.fun often eclipses in less than a week, leaving us to ponder the meaning of life and market dynamics.

Activity on the platform remains as lively as a sloth on a Sunday, and revenue generation has been underwhelming, with daily earnings often dipping below $1,000 in recent weeks.

While the CEX Alliance may sprinkle some fairy dust of exposure and credibility, SunPump’s quest to scale user participation and on-chain performance remains a Herculean challenge, akin to pushing a boulder uphill.

TRX Enters Sideways Phase as Trend Strength Weakens

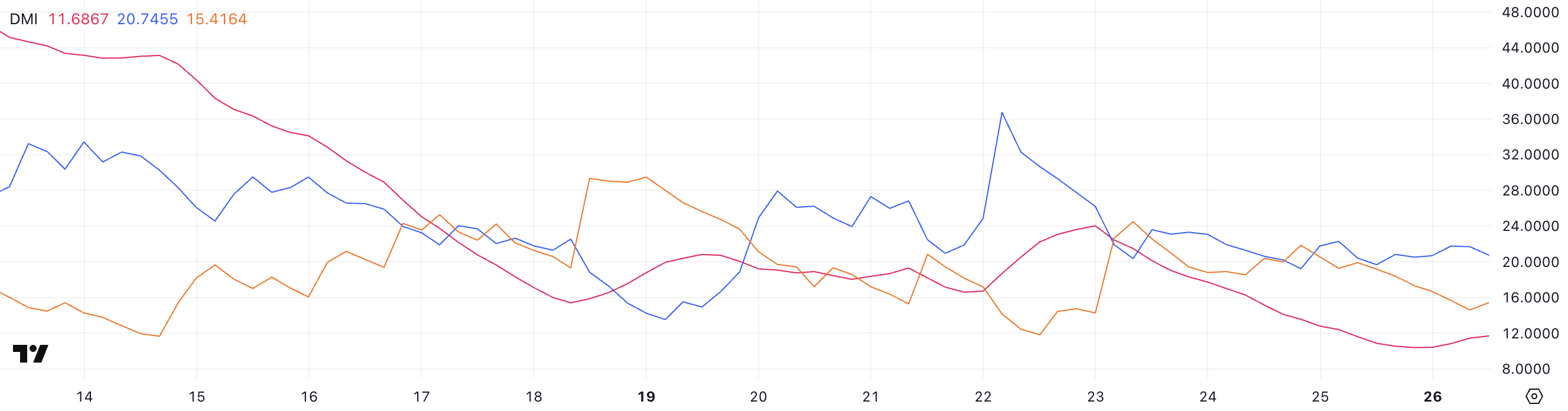

Tron’s Directional Movement Index (DMI) currently reveals a trend as weak as a cup of decaf, with the Average Directional Index (ADX) plummeting to 11.68 from a robust 24 just three days prior.

The ADX, that whimsical measure of trend strength, dances on a scale from 0 to 100, where readings above 25 suggest a strong trend—either up or down—while values below 20 indicate a market that’s about as exciting as watching paint dry. Alongside this decline, the positive directional indicator (+DI) has slipped to 20.74, while the negative directional indicator (-DI) languishes at 15.41, both down significantly from their earlier heights.

This alignment suggests that both bullish and bearish pressures are fading, leading us into a period of indecision and consolidation, where clarity is as elusive as a mirage in the desert.

The Relative Strength Index (RSI) for TRX currently hovers at 49.87, a neutral 50 level that has become its cozy home for the past three days.

RSI, that charming momentum oscillator, ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 signaling oversold conditions. An RSI near 50 typically reflects a balance between buying and selling pressure—suggesting that the market is in a state of equilibrium, like a tightrope walker on a windy day.

With both DMI and RSI pointing to a lack of strong conviction from either bulls or bears, TRX is likely to remain range-bound in the short term, unless a clear catalyst swoops in like a superhero to shift sentiment.

Tron Price Consolidates: Will $0.274 Breakout or $0.256 Breakdown Come First?

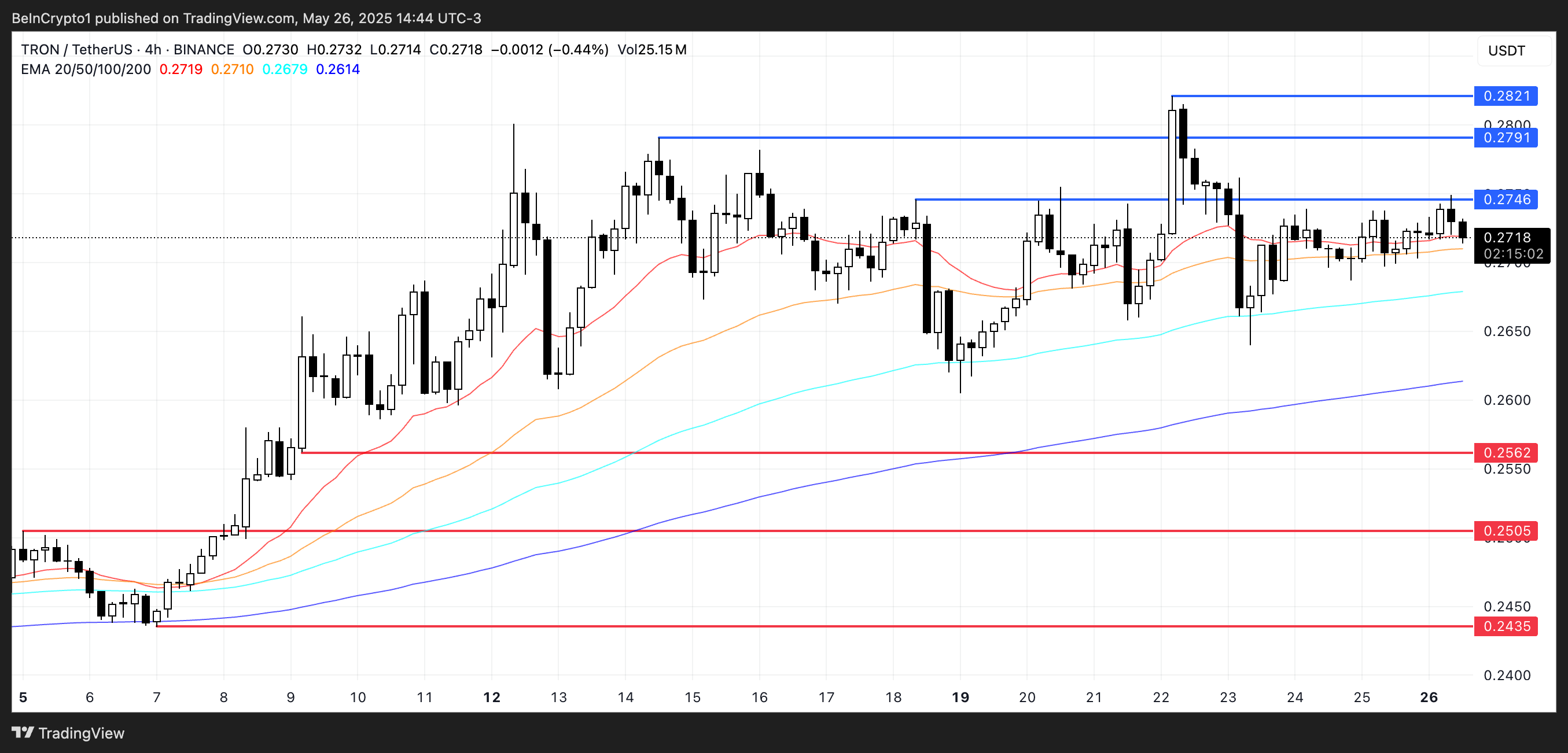

Tron has been trading steadily around the $0.27 level over the past week, with its EMA lines indicating ongoing consolidation, as if the market is taking a leisurely stroll through the park.

The token recently stumbled at the $0.274 resistance, a key short-term hurdle that remains as daunting as a mountain to a weary traveler.

A successful breakout above that level could open the door for a move toward $0.279 and $0.282, potentially setting up a larger rally to reclaim the $0.30 mark for the first time since December 2024, like a phoenix rising from the ashes. 🔥

However, such a move would likely require renewed momentum and a shift in market sentiment, akin to waiting for a bus that may never arrive.

On the downside, TRX faces important support at $0.256. If bearish pressure increases and that level is breached, the price could slip further to $0.250, and in a more extended pullback, even test $0.243, leaving traders to ponder their life choices.

The current setup suggests a market in wait-and-see mode, with traders closely watching for a decisive move in either direction, like spectators at a thrilling tennis match. 🎾

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-05-26 23:36