Bitcoin‘s Mood Swings: Are We in for a Delightful Rollercoaster? 🎢💰

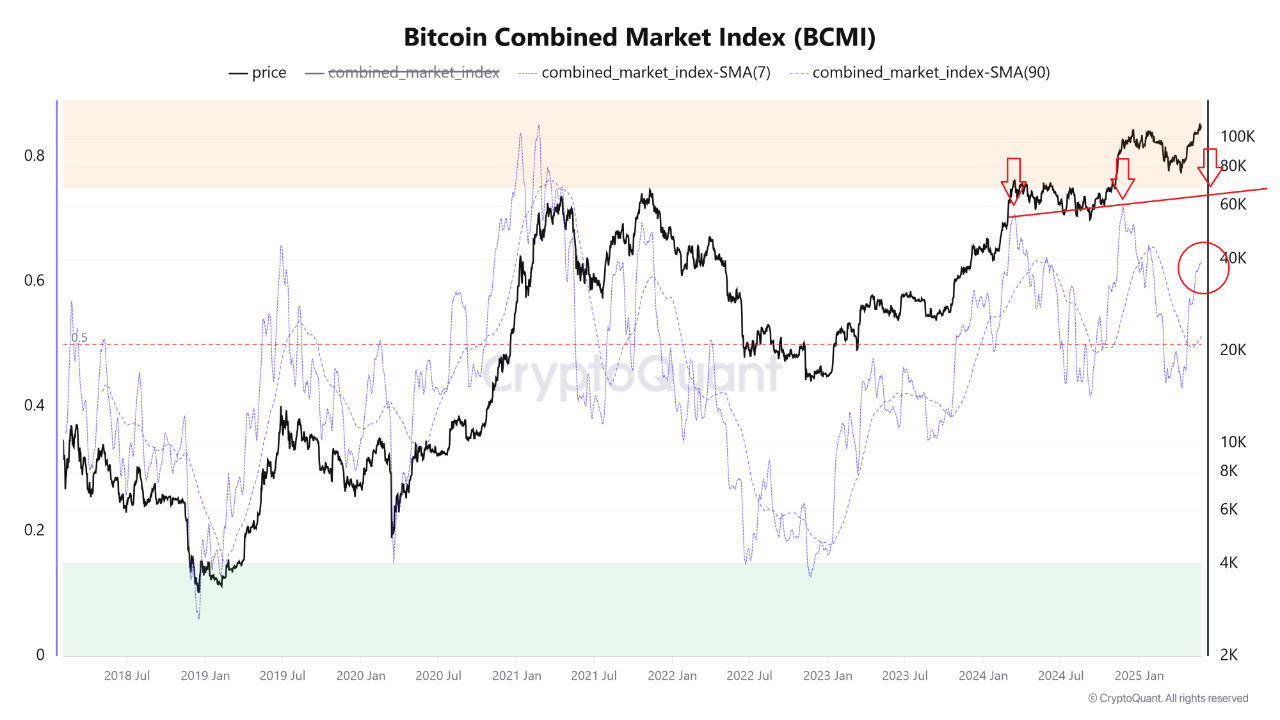

Ah, the analysis—a delightful romp through the whimsical world of the Bitcoin Composite Market Indicator (BCMI), that charming little concoction of various on-chain indicators, all blended together like a rather questionable cocktail at a soirée.

Now, let’s dissect this delightful brew: we have the Market Value to Realized Value (MVRV) strutting in at a dashing 30%, the Net Unrealized Profit/Loss (NUPL) at a modest 25%, the Spent Output Profit Ratio (SOPR) also at 25%, and the ever-so-dramatic Fear & Greed Index, contributing a cheeky 20%. Quite the ensemble, wouldn’t you say?

Our BCMI has its own set of rules, darling. When it dips below 0.15, it’s a signal of extreme fear—think of it as the market’s version of a bad hair day. On the flip side, a reading above 0.75? Well, that’s just market euphoria, a warning that we might be heading for a rather uncomfortable cycle top. Oh, the drama!

At present, the 7-day simple moving average (SMA) of the BCMI is rising like a soufflé, hovering around 0.6—an early upside signal, if you will. Meanwhile, the 90-day SMA is as flat as a pancake at 0.45, suggesting we haven’t quite reached the euphoric heights of a market meltdown. How quaint!

With on-chain sentiment improving and profit-taking slowing down, the report concludes that early signals of recovery are flashing like neon lights—though the broader market participants seem to be enjoying their time on the sidelines, sipping cocktails and watching the show. According to our dear Woominkyu, this could very well be the opening act of a grand accumulation trend. Bravo!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-05-29 20:09