So, Andre Dragosch, the Head of Research at Bitwise in Europe (yes, that’s a real job, and no, I don’t know how he got it either), has dropped a bombshell: Bitcoin’s 60-day correlation with US 10-Year Treasury Futures has plummeted to its lowest level ever. Like, lower than my self-esteem after a bad haircut. 💇♀️

This historical decoupling could mean that investors are starting to think, “Hey, maybe I’d rather gamble on Bitcoin than put my money in those boring old bonds.” Who knew? 🤷♀️

Curious? Dive in! Or, you know, just scroll through TikTok. Your choice! 📱

Bitcoin’s Correlation with US 10-Year Treasury Futures Explained

Correlation is like that friend who always shows up to parties with snacks. A higher correlation means they move together, while a low or negative correlation is like that friend who ghosted you after you lent them money. Ouch! 😬

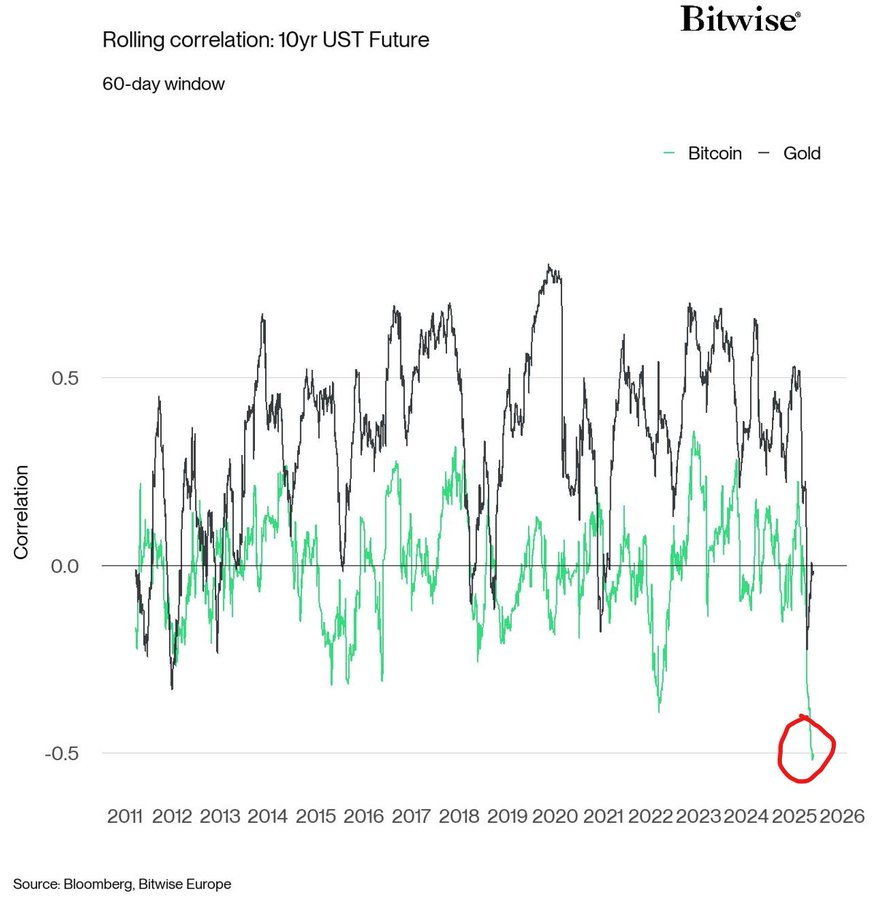

ATTENTION: This is probably the most important macro chart for #bitcoin right now.

Bitcoin’s 60-day correlation to US 10yr Treasury Futures has declined to the lowest level ON RECORD.

Are traditional investors selling US Treasuries to buy bitcoin?

— André Dragosch, PhD (@Andre_Dragosch) May 29, 2025

Dragosch has revealed that the 60-day correlation between Bitcoin and the US 10-Year Treasury Futures has taken a nosedive. It’s like watching your favorite TV show get canceled—devastating! 📉

This revelation has sparked a serious debate: are traditional investors really selling US Treasuries to buy Bitcoin? I mean, who wouldn’t want to trade a boring old bond for a digital currency that sounds like a character from a sci-fi movie? 🤖

US 10-Year Treasury Yield: A Simple Analysis

At the start of April, the US 10-Year Bond Yield was 4.213%. But then, like my diet on a Friday night, it slipped as low as 3.859%. Between April 7 and 11, it climbed steeply by 15.44%. On April 11, it hit the month’s peak of 4.590%. After that, it was like a rollercoaster ride with two minor corrections. 🎢

In the early half of this month, the US 10-Year Bond Yield saw a steady rise. Between May 1 and 21, it surged by 9.99%. At one point on May 22, it reached a peak of 4.629%. Currently, the yield sits at 4.420%—which is like being just shy of a perfect score on a test. 📚

Bitcoin Price Action: An Overview

At the beginning of April, the Bitcoin price was $82,497.20. But between April 1 and 8, it dropped by 10.27%. Then, between April 9 and 30, it grew by 23.34%. It’s like watching a dramatic movie where the hero keeps getting knocked down but always gets back up! 🎬

In the early half of this month, the Bitcoin market also witnessed a steep increase. Between May 1 and 22 alone, the market jumped by 18.63%, from $94,123.24 to a peak of $11,653.95. But since May 23, it’s dropped by over 5.16%. Talk about a rollercoaster! 🎢

A Final Note

During May, both US 10-Year Treasury Yield and Bitcoin price saw significant increases, indicating a risk-on environment where both traditional safe assets and riskier assets were bought. It’s like a buffet where everyone is trying to get a taste of everything! 🍽️

However, Bitcoin’s initial April drop while yields also fluctuated, then its subsequent strong recovery hints at some capital rotation into Bitcoin as bond attractiveness waned. The minor corrections in both assets at the end of April and May suggest some profit-taking or shifting market sentiment. It’s like watching a game of musical chairs, but with money! 💸

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Because who doesn’t want to be the smartest person in the room? 🧠

FAQs

What does Bitcoin’s low correlation with US 10-Year Treasuries mean?

It signals Bitcoin is moving independently, hinting investors may prefer crypto over traditional bonds. It’s like choosing a trendy coffee shop over a boring diner! ☕

Why is Bitcoin’s correlation with Treasuries declining?

Factors include increased institutional adoption, economic uncertainty, and Bitcoin’s emerging role as a hedge against traditional assets. Basically, it’s the cool kid on the block now! 😎

Is Bitcoin becoming a safe-haven asset?

Analysts suggest that Bitcoin is increasingly viewed as a store of value, especially during periods of economic instability. It’s like the friend who always has your back when things get tough! 🤝

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-05-30 10:23