Well, folks, it seems Bitcoin ETFs are having a bit of a meltdown, shedding a whopping $616 million in just two days! Blackrock’s IBIT is leading the charge out the door like it just saw a spider. Meanwhile, ether ETFs are riding a 10-day inflow wave like they’re on a beach vacation, thanks to Blackrock’s ETHA. 🌊

Bitcoin ETFs Slide for Second Day As Blackrock’s IBIT Leads Withdrawals

After a solid 10 days of feeling like the king of the world, bitcoin ETFs are now facing a short-term correction. It’s like they went to a party and realized they were the only ones not invited to the after-party. Total outflows? A staggering $616.22 million. Ouch! 😱

Leading the exodus is Blackrock’s IBIT, which decided to take a massive $430.82 million withdrawal. It’s like that friend who always orders the most expensive thing on the menu and then suddenly remembers they left the oven on. Ark 21shares’ ARKB followed suit with a more modest $120.14 million in outflows.

And let’s not forget the other stragglers: Bitwise’s BITB ($35.33 million), Grayscale’s Bitcoin Mini Trust ($16.22 million), and Fidelity’s FBTC ($13.71 million). It’s like a sad little parade of ETFs leaving the party early. No inflows were reported across the remaining seven ETFs. Trading volume? Still high at $3.39 billion, but total net assets dipped to $126.15 billion. Talk about a buzzkill! 🍹

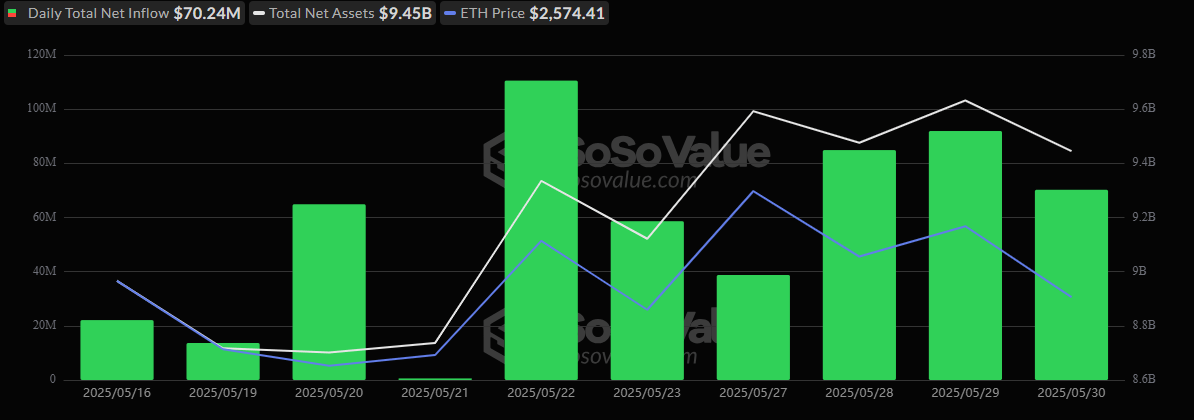

On the flip side, ether ETFs are living their best life, posting a tenth consecutive day of inflows. All $70.24 million of it came from Blackrock’s ETHA, proving that sometimes, it’s good to be the favorite child. No other ETF even bothered to show up. The total value traded? A cool $485.80 million, with net assets holding steady at $9.45 billion. 🎈

So while bitcoin ETFs are feeling the heat, ether’s momentum—especially with its one-hit-wonder fund—signals that investors are still feeling confident. Let’s just hope they don’t get too cocky before the next regulatory rollercoaster! 🎢

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2025-05-31 19:57