Bitcoin on the Move: Over 172K BTC Jump Chains & Make Mischief Everywhere! 🚀

Well now, reckon it’s over seven billion bucks worth of Bitcoin that’s busy bit-hooding its way across Ethereum, Base, and Solana — no longer sittin’ around like a lazy hound, but workin’ like a bunch of eager beavers, all courtesy of these fancy token-wrapped models like WBTC and cbBTC, says somethin’ the Coin Metrics folks just published.

Tokenized bitcoin (BTC), mainly wrapped up as WBTC and Coinbase’s cbBTC, now number more than 172,130 BTC. That’s stretchin’ Bitcoin’s legs beyond its own backyard, as the smart folks at Coin Metrics told us in their latest “State of the Network” report from June 3. Tanay Ved, a clever analyst at Coin Metrics, found these wrapped chaps makin’ Bitcoin more accessible and easier to mix around different chains like Ethereum, Base, and Solana — almost like teachin’ a wily coyote new tricks.

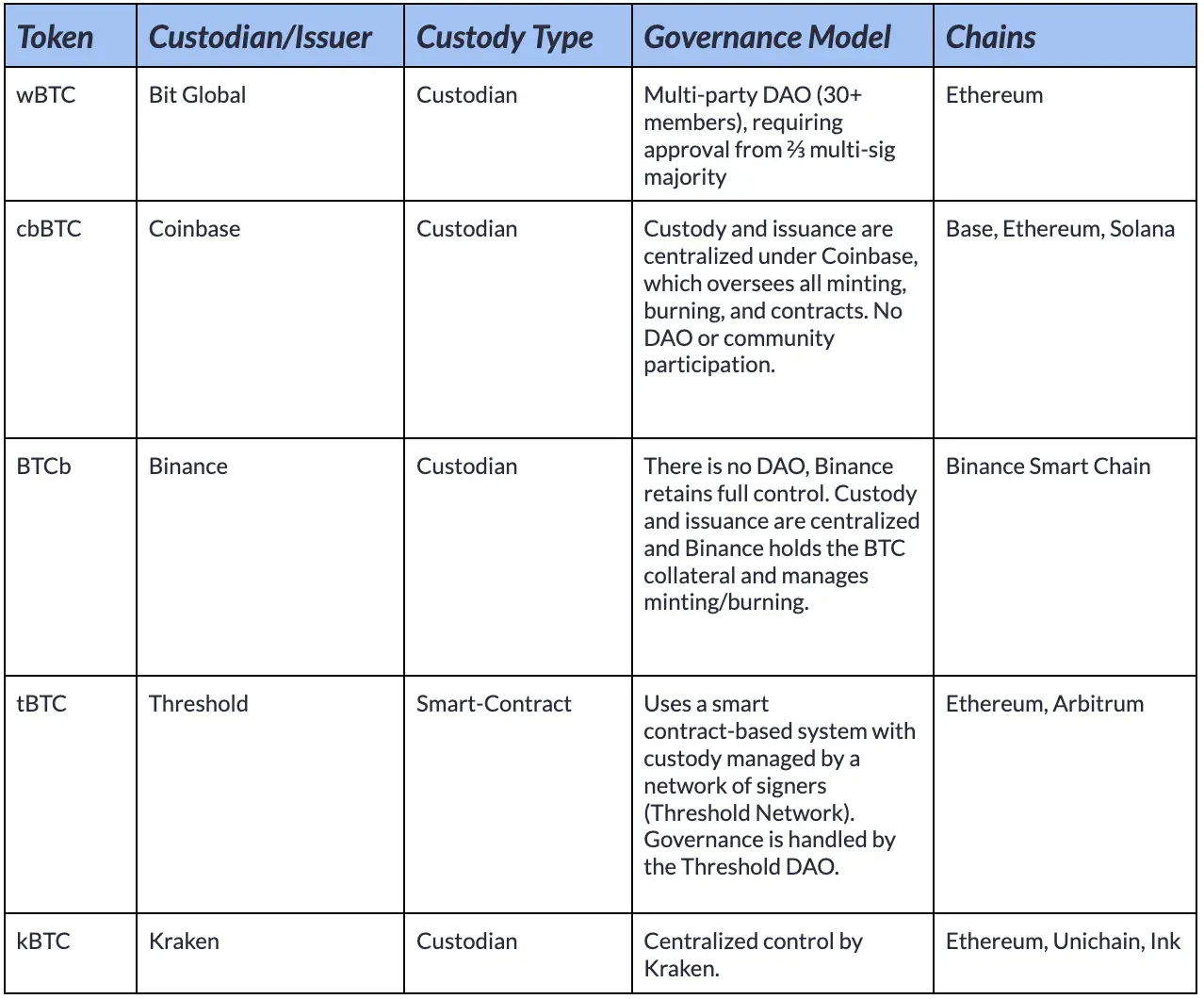

Them tokens sure do run on all sorts of fancy setups; some use multi-party councils and others are managed straight from Coinbase itself. There’s even a decentralized one called tBTC — smart contracts that don’t need no middlemen, mind you. No matter how you slice it, folks are willingly handing over their native BTC for these other versions that can play on many fields.

Since January of this year, the total amount of WBTC has grow’d five times over, no less! WBTC still paws the lead with 128,800 BTC, which makes up an impressive 81% — mostly kickin’ around on Ethereum. Coinbase’s cbBTC, born on Base and stolen away to Ethereum and Solana, counts for 43,100 BTC, gathering steam to leave WBTC in the dust as the early moon rises, especially after some faint-heartedness on WBTC’s part, as Coin Metrics notes.

Looking at the onchain business, it’s clear folks use these tokens differently. On Base, cbBTC is the belle of the ball — with roughly 7,000 daily address folks and weekly transfer volumes slingin’ around 40 billion dollars, a number so big it makes your head spin. That’s way more than WBTC on Ethereum, thanks in part to Base’s low costs and Coinbase’s wide reach. Solana’s not sittin’ still, either, with lots of hustle and bustle. All in all, these wrapped-up Bitcoin bits get chucked around faster than a squirrel in a peanut factory.

Most of this hustle? Well, it’s driven by DeFi — decentralized finance, that is. Over $7 billion worth of these wrapped Bitcoin tokens ($5B in WBTC and $2B in cbBTC) are locked up tight in lendin’ protocols like Aave and Morpho, kinda like a digital piggy bank. WBTC is king on Ethereum’s decentralized exchanges, especially Uniswap v3, while cbBTC makes a good showing on Base’s DEXs like Aerodrome. This here just proves that folks are eager to turn Bitcoin into a tool for all sorts of financial jiggery-pokery.

However, the wise folks at Coin Metrics warn a-twain — these custodial setups, while mighty useful, do put a little shackles on the risk. Centralized models might just be for makin’ the most loot and cross-chain gambles, but at the price of a bit of safety. Still, this tokenized Bitcoin is seen as a vital bridge, sort of like a digital rope, stretchin’ between Bitcoin’s old-soul store-of-value and the shiny, programmable economies sproutin’ on other chains.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2025-06-04 00:27