Bitcoin ETFs Take a Breather as $105K Fence Sits Firm and Traders Hold Their Breath

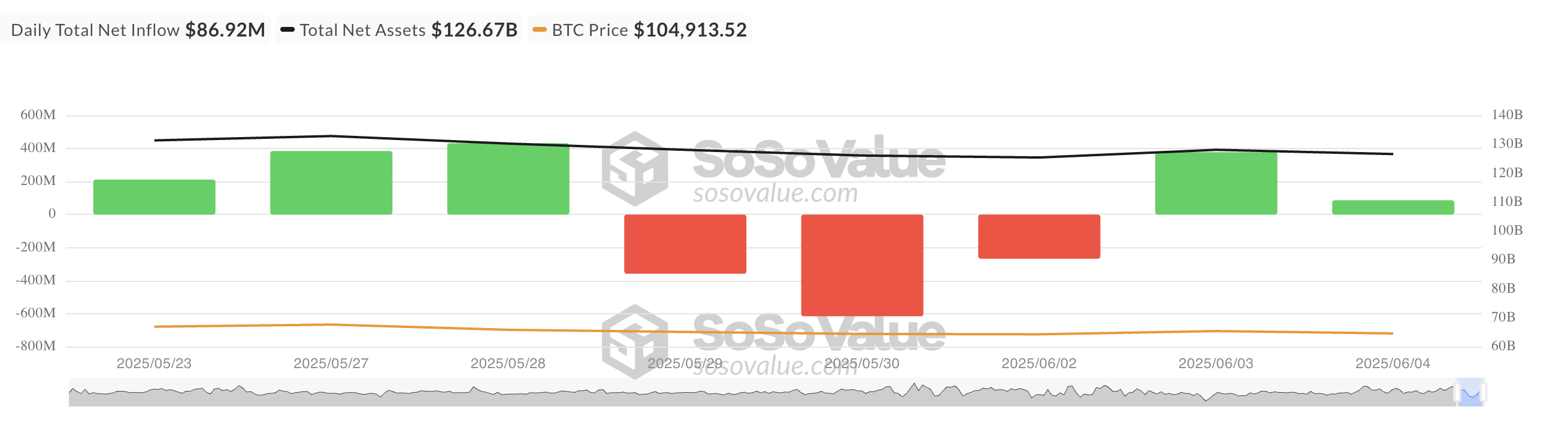

In a surprising turn of events that no one saw coming (except everyone who’s been paying attention), Bitcoin exchange-traded funds (ETFs) modestly raked in over $85 million on Wednesday. Yes, really, just about enough to buy a modest yacht, not that anyone would actually want one. This suggests that institutional interest in the world’s favorite digital gold still exists, though it’s starting to look a little tired after its marathon run.

However, the upland plains of investor enthusiasm have flattened out considerably from the lush $378 million influx seen back in early June, a reminder that even the most promising rollercoaster rides have their dips (and their nausea).

Bitcoin Traders Take a Chill Pill as ETF Inflows Slow to a Snail’s Pace

On Wednesday, US-listed spot Bitcoin ETFs managed to gather a cool $86.92 million—an admirable amount in the grand scheme, but a staggering 77% less than their June glory days when they pulled in $378 million. It’s as if everyone suddenly remembered that $105,000 is, allegedly, a “resistance level,” and decided, “Eh, maybe tomorrow.”

Experts (or perhaps just bored journalists) blame the slowdown on Bitcoin’s stubborn price hovering just below the $105,000 mark since the end of May. Apparently, this tiptoeing around the resistance line has sapped a little bit of investor’s urgency and caused a hasty retreat from new cash—like kids who get off the rollercoaster just before the big drop.

Meanwhile, BlackRock’s IBIT continues to flex its muscles, raking in a hefty $283.96 million in a single day, bringing its total to an eye-watering $48.78 billion (no typo). Just goes to show, giant asset managers aren’t exactly shy about throwing their weight around.

Fidelity’s FBTC, on the other hand, had a bit of a bad day—shuffling out a merited $197.04 million in what can only be described as investor “flight of fancy,” leaving the fund a little lighter in the wallet.

Bitcoin Remains Stuck—Futures Dip, but Options Are Hopeful

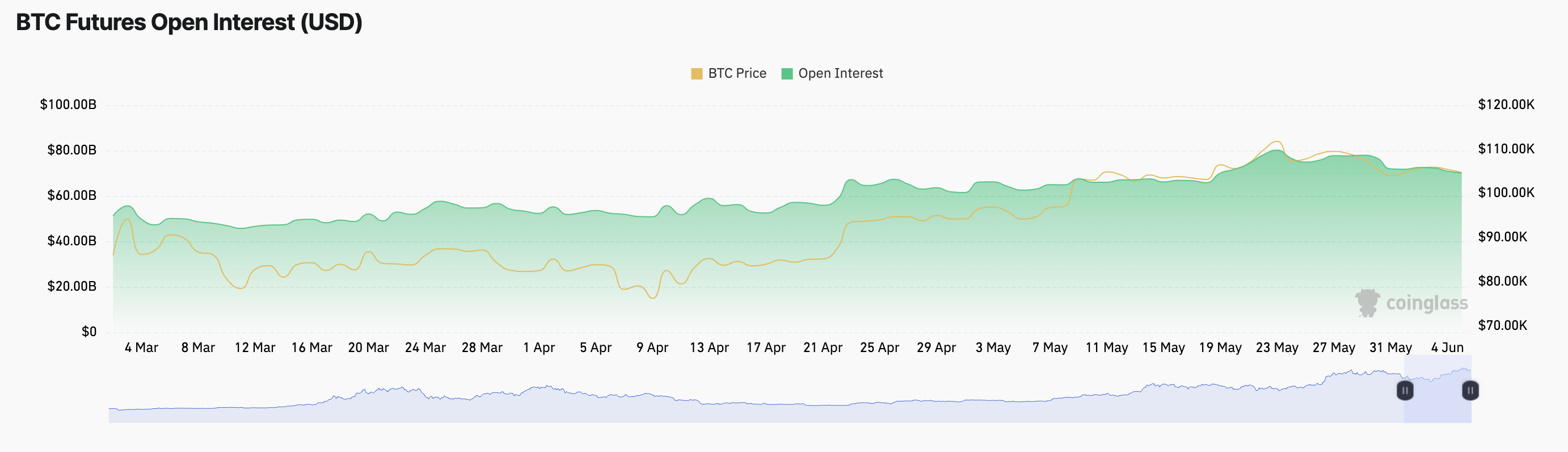

At the moment, Bitcoin is hanging out at an unimpressive $104,913—down a whole 1% in the past 24 hours. It’s doing its best impression of a sleepy sloth, trading sideways as traders sit on their hands and wait for some drama (or at least a move). Futures open interest has dipped slightly, to $70.09 billion, indicating that some traders are reducing their bets—probably to avoid catching (another) falling knife.

The general vibe? “Let’s wait and see,” as market participants debate whether this is a temporary lull or the beginning of a longer nap. The cautious stance has some traders holding tight, unwilling to throw big bets at a market that’s just sort of treading water.

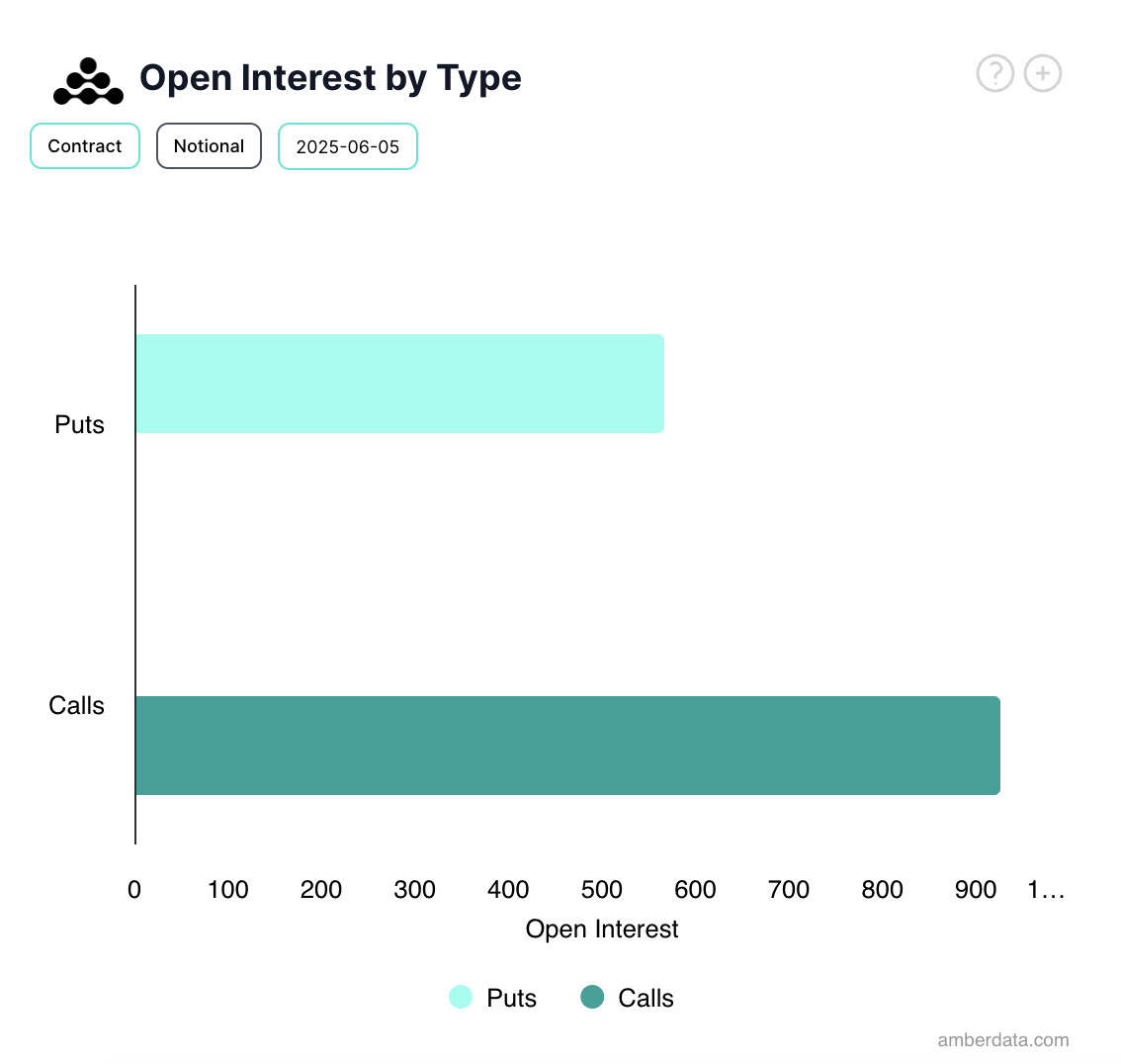

But, oh, the plot thickens! Despite Bitcoin’s sluggish day, options traders are showing signs of optimism, with a surge in demand for call options—which basically means, “Hey, we think this thing’s going to go up!” according to Deribit. So, maybe, just maybe, everyone’s secretly hoping for a breakout or, at the very least, some fireworks sometime soon.

In summary, the ETF inflow slowdown is a clear sign that investors are jumping into their metaphorical waiting room, eyes flicking nervously between the resistance level and their coffee. They’re primed for a rally if Bitcoin can burst through or a further dip if it plays chicken with the resistance—either way, it’s all very dramatic, and we’re all just here for the show. 🍿🔥

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2025-06-05 10:41