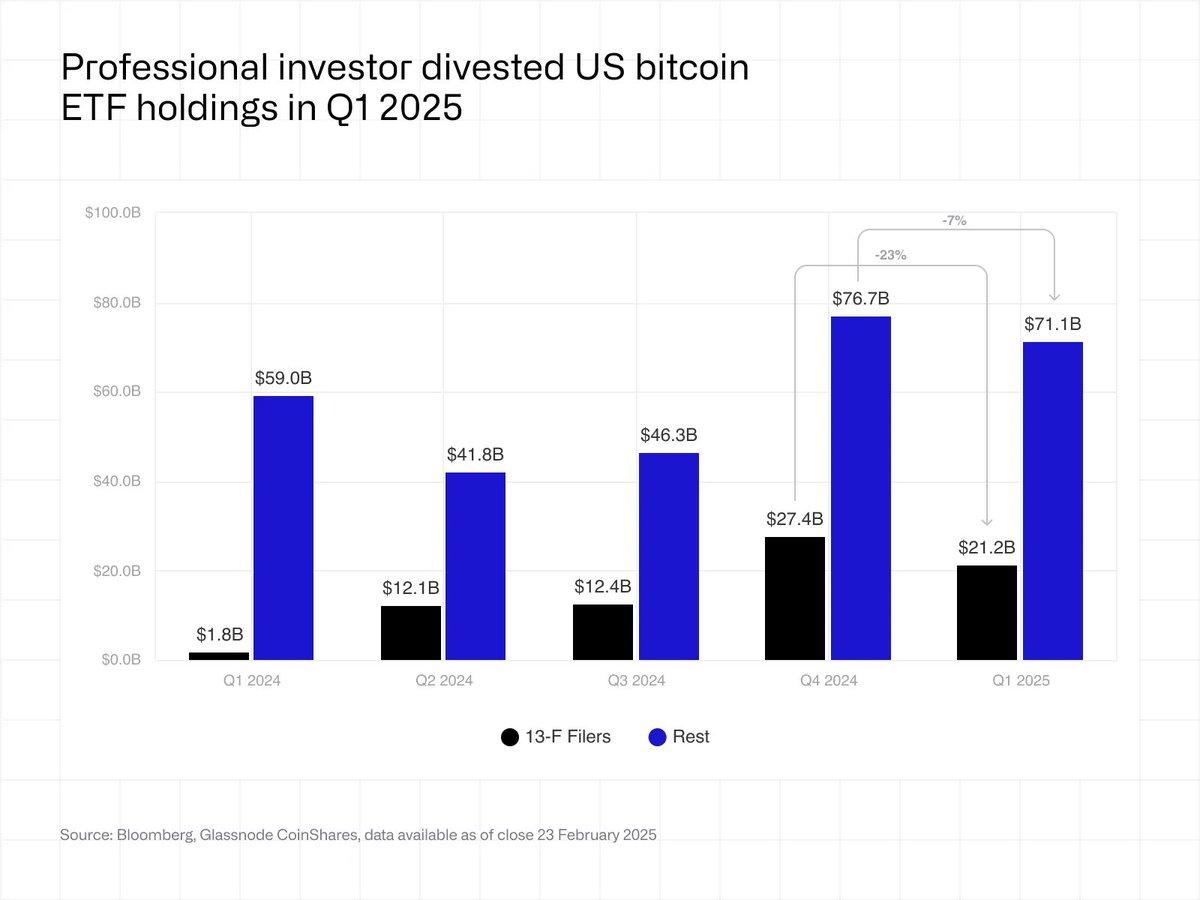

Ah, the grand world of finance—where even the mighty Bitcoin ETF cannot escape the clutches of decline. This quarter, 13F filers—a fancy term for hedge funds, pensions, and asset managers—decided to huh… cut back their digital treasure by a hefty 23%. From a staggering $27.4 billion in late 2024, it shrank to a modest $21.2 billion in early 2025. A real heartbreaker for the bulls! 😅

And lo and behold, this marks the first such quarterly dip since those brave regulators at the SEC blessed us with spot BTC ETFs in the beginning of 2024. Who knew that moonshots could sometimes come down with a thud?

Interestingly, while institutional players took a tumble, the overall ETF scene fared better—down just 7%, sliding from $76.7 billion to $71.1 billion. Such resilience—perhaps the market’s way of saying, “Hold on, don’t panic just yet!”

All signs point to the fact that, despite the enduring interest in Bitcoin ETFs—like a dog tied to a post—those professional folks are getting jittery. Could be the sneaky macroeconomic monsters, the regulatory boogeymen, or simply the thrill of shifting risk appetites. Anyway, they’re cautious now, probably at their coffee tables, debating whether the crypto train has finally hit a bump—or just a small pothole.

After four quarters of growth, it seems the institutional hype is cooling—perhaps just a brief summer flair, or maybe the beginning of a more serious retreat. Only time shall tell! Or maybe some crypto fortune-teller with a crystal ball.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-06-06 18:06