In the grand theatrical play of finance, it seems our dear crypto has finally stepped out from the shadows of obscurity, bravely striding onto the stage where the real money dances. Binance Research, ever so eager, announced that digital assets are no longer mere curiosities but burgeoning players in the grand game of Wall Street and beyond. Alas, even in this glorious ascent, turbulence persists — political storms have battered the market like an unruly sea captain steering his vessel through rocky waters.

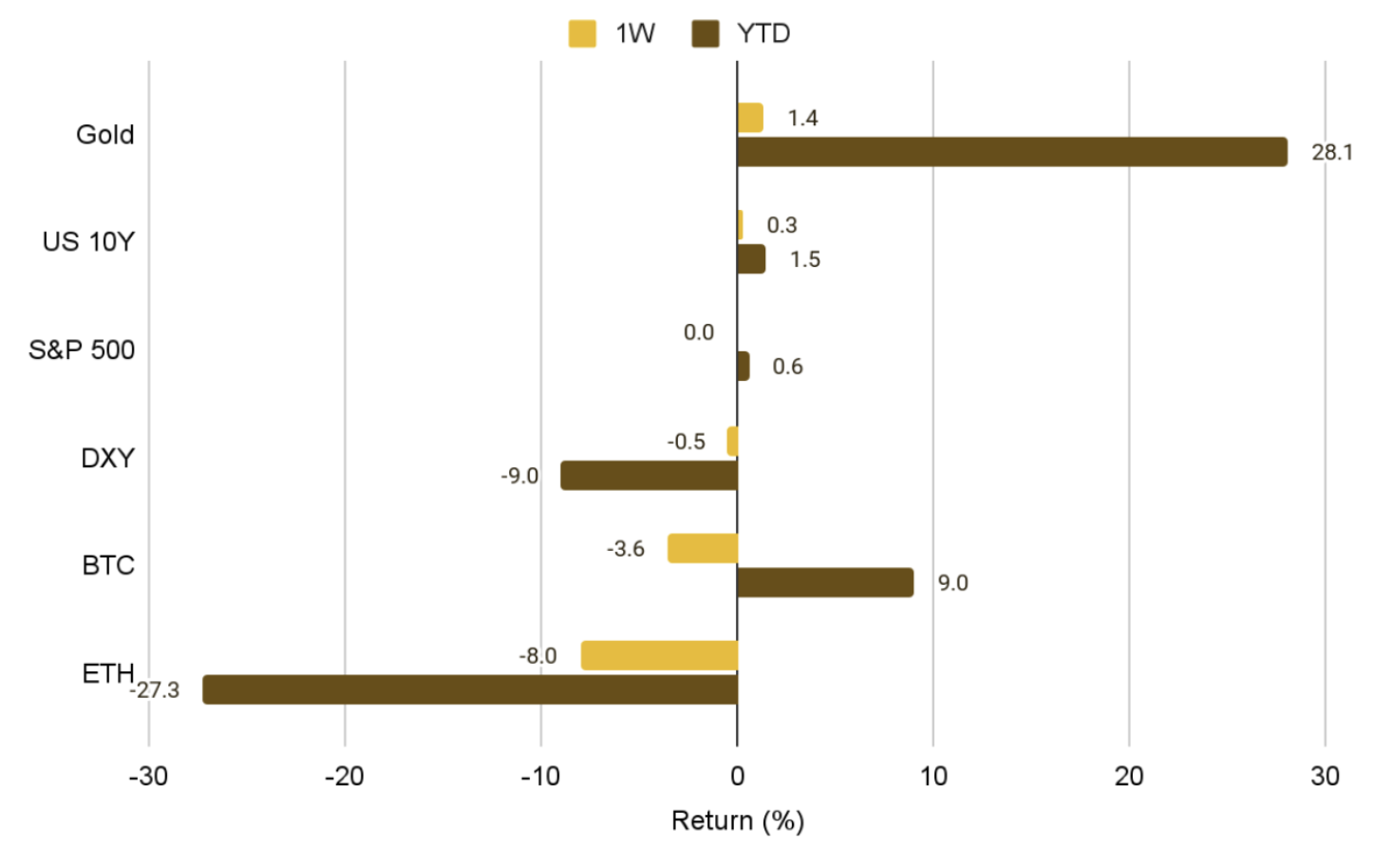

Last week proved to be a rollercoaster, with Bitcoin and Ethereum sliding into the negatives, weighed down by the fiery feud between none other than Donald Trump and Elon Musk. One’s a political titan, the other’s a technology maverick — together, they create quite a spectacle that leaves crypto investors clutching their virtual pearls. Musk, the industry’s darling, has become somewhat of a scapegoat amidst this chaos.

Bitcoin plummeted to a weekly nadir of $101,500, and Ethereum followed suit at $2,388. But fear not, dear reader, for seasoned investors understand that market tempests are but fleeting shadows; the long-term outlook remains as bright as a summer’s day. Interestingly, during this tumult, traders seem to have taken a long breath—moving their precious crypto into cold storage, perhaps for a rainy day or just to irk the day-traders further.

The exodus from exchanges hints at a simple truth: folks are accumulating their assets like squirrels preparing for winter. It’s an act of faith, or perhaps just an elaborate game of hide and seek with their crypto treasures.

Institutional Bets and Big Fish in the Crypto Pond 🐟

Meanwhile, the old wolves of finance, led by JP Morgan, are warming up to our shimmering digital gold. They announced with gusto that crypto ETFs could serve as collateral for loans — because nothing says trust like trusting a bird in the hand (or a coin in a vault). These funds are now being considered when assessing the worth of a client. Truly, the centuries-old banking giants are finally embracing their shiny new cousins.

In regulatory land, the SEC, that cautious old watchdog, has rolled out new instructions on proof-of-stake networks. Under the Trump era, staking was deemed a security — now, it’s as harmless as a puppy. This shift opens the door for Solana, Ethereum staking ETFs, and perhaps a few more breakthroughs, much to the delight of the crypto enthusiasts.

And let us not forget the splashy debut of Circle’s IPO on June 5, which saw its shares leap an astonishing 120% on opening day. Apparently, Wall Street’s fascination with crypto firms remains as intense as a summer romance — fleeting yet fiercely passionate. Truly, the age of digital riches is upon us, whether we like it or not.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-06-06 20:45