Well, well, well, look who waltzed into Wall Street like they owned the place. Circle, the fine folks behind the USDC stablecoin, decided to make their debut on the New York Stock Exchange on Thursday, June 5, 2025, under the charming ticker symbol CRCL. The stock kicked things off at a humble $31 per share, and what happened next was the stuff of Wall Street legends. I mean, if you didn’t blink, you missed it.

Now, I’ve seen stocks go up before, but nothing like this. As the market bell rang and the floodgates opened, Circle’s stock more than tripled in a matter of minutes. It was so crazy that the NYSE had to hit the pause button more than once just to catch its breath. Talk about a rollercoaster!

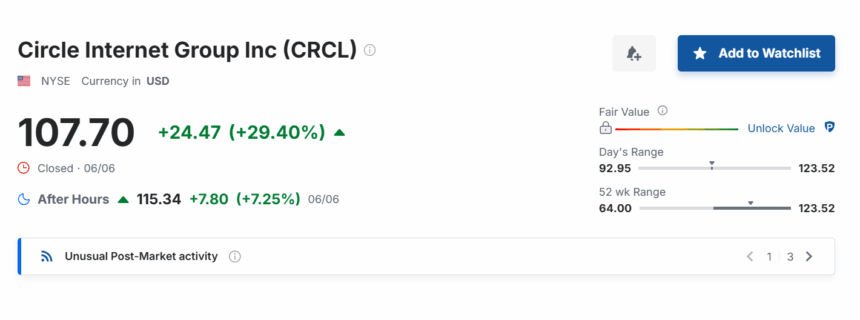

By the time the day was done, Circle closed at a jaw-dropping $82.84—a solid 167% gain from the IPO price. But hold your horses! It wasn’t over. Friday came along, and CRCL shot up to $123.51, a mere 49 cents shy of quadrupling its opening price. And just when you thought it couldn’t get any better, the price settled at $107.70, marking a 29% jump in just 24 hours. That’s like waking up to find you’ve been gifted a winning lottery ticket.

Now, if you think this kind of surge happens every day, well, let me tell you, it doesn’t. Not by a long shot. Take Meta—formerly known as Facebook. Back in 2012, Meta went public at $38 per share. The stock didn’t budge. I mean, it closed its first day at $38.23, and even with a sky-high valuation of $104 billion, it just sort of… stood there. Nothing to write home about, right?

Then there’s Robinhood. In 2021, they kicked off their IPO at $38, only to end up 8% in the red at $34.82. Ouch. And don’t even get me started on Uber’s 2019 debut, which closed below its $45 offering price. I mean, it was like watching a car crash in slow motion.

Even Airbnb, which had a decent IPO in 2020, only managed a 112% jump from $68 to $144.71 on the first day, but it still wasn’t enough to outdo Circle’s fireworks display.

Circle’s valuation after this IPO extravaganza is sitting around $19 billion—smaller than Meta or Airbnb’s at debut, but when it comes to stock price fireworks, Circle’s the star of the show.

Now everyone’s talking about how CRCL is one of the few ways to dip your toes into the crypto world without having to deal with the headaches of actually owning crypto. And if you think this is the end, just wait—Gemini, the crypto exchange, has already filed to go public. Things are getting wild, folks!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-06-07 19:33