Oh, what a curious day it is! Nasdaq has just pranced into the SEC’s office, waving a 19b-4 form like a golden ticket, all set to list the 21Shares SUI ETF!

This cheeky little move is a giant leap for the SUI token, as it tiptoes back from its recent mischief and mayhem in the ecosystem. Who knew finance could be so thrilling? 🎉

Soaring Metrics Strengthen Case for SUI ETF Approval

With a flourish, the filing has been posted to the SEC’s public register, kicking off the grand review process for what could be the first altcoin-based ETF in the US since Ethereum. Hold onto your hats, folks!

The Sui Foundation, in a blog that sounds like it was written by a particularly excited squirrel, declared this filing as the official start of the US spot SUI ETF review process. 🐿️

“The 19b-4 filing, now officially posted to the SEC’s public register, marks the formal beginning of the review process,” they squeaked with glee.

This filing follows 21Shares’ earlier S-1 registration in April, a significant leap in the grand adventure of institutionalizing the Sui ecosystem. It’s like watching a caterpillar turn into a butterfly, but with more spreadsheets!

With over $300 million already splashed around the globe in SUI-based ETPs (exchange-traded products), primarily through Euronext Paris and Amsterdam, the demand for a regulated US exposure is growing faster than a weed in a garden! 🌱

Nasdaq just filed to list the 21Shares SUI ETF — a spot ETF backed by the SUI token.

From $300M+ in global ETP inflows to a potential U.S. listing, institutional momentum for Sui is very real.

Next stop: institutional adoption! 🚀

— Sui (@SuiNetwork) June 10, 2025

Sui’s unique technological architecture is like a magical castle, supporting all sorts of whimsical uses from DeFi and gaming to real-world asset (RWA) tokenization. It’s a playground for the imaginative! 🎠

According to the wise folks at DeFiLlama, Sui ranks eighth in total value locked (TVL), with a whopping $1.944 billion currently deployed across its platforms. That’s a lot of shiny coins!

Its stablecoin market cap has soared to over $1.1 billion, up more than 190% year-to-date (YTD). And in May alone, Sui blockchain’s stablecoin transfer volume exceeded $110 billion! Talk about a busy bee! 🐝

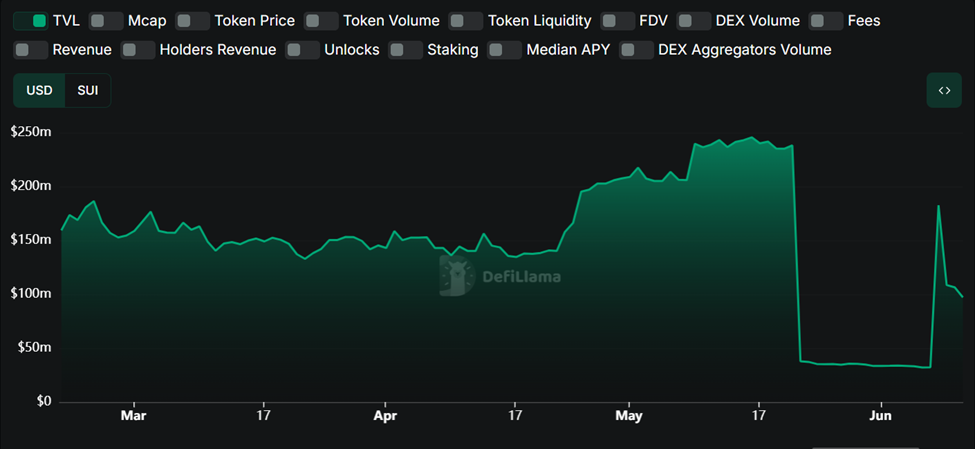

SUI Recovers After Cetus Hack Incident

But wait! Just when you thought it was all sunshine and rainbows, BeInCrypto reported a $260 million Cetus hack on Sui, which sent the network into a tizzy! A network freeze amid decentralization concerns? Oh dear!

Cetus, a key decentralized exchange (DEX) and concentrated liquidity protocol, faced a bit of a storm, but fear not! The network has bounced back, reassuring everyone that it’s as resilient as a rubber band! 🏋️♂️

The platform is like a sturdy bridge, supporting traders, liquidity providers, and DeFi applications built on Move-based chains like Sui. A true hero in the world of finance!

To restore user confidence, Sui threw a $10 million security overhaul party! They shifted towards shared accountability and direct support for dApp builders to prevent future vulnerabilities. How thoughtful! 🎈

Against this backdrop, the SUI price has rebounded like a bouncy ball! It’s up 18% since the start of June and is trading at $3.47 at the time of writing. A modest gain of nearly 2% in the last 24 hours! 🎉

Mysten Labs President Kevin Boon declared that the Sui ecosystem has become a primary destination for serious builders and institutions. A place where dreams come true!

“…the milestone of a NASDAQ filing is a powerful moment. We are proud to help 21Shares build towards a world where every investor can access SUI,” he said, sounding quite proud.

This move has sparked whispers of a broader “Altcoin ETF Summer,” and Bloomberg analyst Eric Balchunas is all ears! 👂

Get ready for a potential Alt Coin ETF Summer with Solana likely leading the way (as well as some basket products) via @JSeyff note this morning which includes fresh odds for all the spot ETFs.

— Eric Balchunas (@EricBalchunas) June 10, 2025

However, when asked about potential demand, Balchunas pointed out that not all altcoin ETFs could match the level of demand seen with Bitcoin ETFs. A wise observation indeed!

“…the further away you get from BTC, the less assets there will be,” Balchunas noted, sounding quite sage.

He also mentioned that Osprey’s aggressive Solana filing might speed up the SEC’s timeline for altcoin ETF decisions. A race against time!

Meanwhile, the SEC has delayed a decision on the Hedera ETF application, extending the comment period. Oh, the suspense! ⏳

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein,” said SEC chair Paul Atkins, sounding very official.

While the market remains cautiously optimistic, the progression of the 21Shares SUI ETF marks a significant moment in the mainstreaming of alternative Layer-1 ecosystems. Will Sui become the next major asset class to break into the financial market? Only time will tell, but institutional demand seems ready for a grand adventure!

Read More

2025-06-11 09:52