In the grand theater of human folly, Bitcoin, that shimmering illusion of wealth, continues its dance—rising and falling with the grace of a drunken ballerina. Recently, it has ascended nearly 2% in a single day and a modest 3.6% over the week, teasing the dream of endless riches at around $109,192. Yet, wise men and some not-so-wise traders like Peter Brandt whisper warnings—a storm may be brewing, a collapse so colossal it makes the Soviet economy look stable.

The Horror Scenario

According to this venerable seer, the cryptocurrency could plummet by as much as seventy-five percent—imagine losing three-quarters of what you thought was yours, vanishing into the ether, leaving behind only memories and shattered hopes. Today’s lofty $109,800 could sink to a mere $27,290—a number so grotesque it might be mistaken for an early April Fool’s joke, but alas, it is no jest. Such a fall would send us spiraling back to the bleak dawn of 2023, erasing years of effort, of dreams, of believers’ prayers.

Echoes of Past Folly

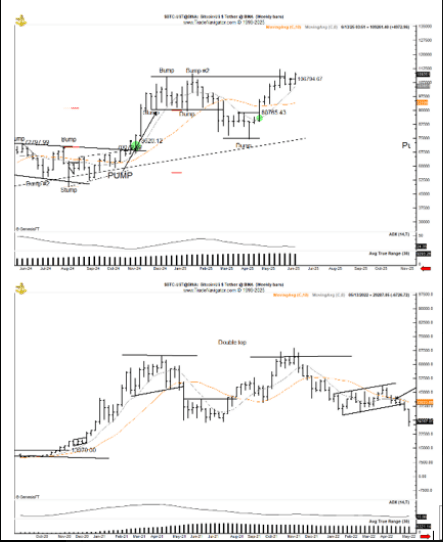

Brandt paints a picture awfully reminiscent of 2022, a year of great hopes dashed. Back then, Bitcoin reached for the sky—$65K in spring, nearly $70K in November—only to plummet, losing more than half of its gilded facade. Now, the charts whisper warnings, as if history, tired of novelty, seeks its repeat, a tragic comedy on an endless loop.

Could Bitcoin be merely reciting its 2022 script, preparing to stage another tragic 75% correction? It’s a question that hesitates at the lips, charged with idiocy and impending doom.

— Peter Brandt (@PeterLBrandt) June 10, 2025

This current cycle, if anything, seems to echo the past. Peaks above $108,000, then dips beneath $100K—yet the optimism persists, like a drunkard clinging to his last coin until the sober dawn arrives. Last month, it nearly reached $112,000 before teetering—perhaps on the brink of another spectacular tumble?

Signs and Omens

Markers that glow red louder than a Christmas tree in December: the 9-period EMA crossing under the 21-period EMA—a classic signal of impending doom, as reliable as the weather vane on a stormy day. Should Bitcoin fail to close above $108,000 for a week, expect chaos and panic, the kind that makes traders forget their mothers’ names.

The Market’s Mood and Danger

The derivatives market jostles with uncertainty—volume surges, open interest nudges upward, and ratios hint that traders bet heavily on decline. When so many are convinced of a fall, a squeeze can ignite like a powder keg—unless Bitcoin manages to hold support, then the joke’s on them.

Funds are slipping away—over fifty-seven million dollars in a week—mere pocket change in the grand scheme, yet a sign of nervousness. Meanwhile, Ethereum, the more stable sibling, draws in nearly three hundred million. Money flows like gossip—shifting, rearranging, but hardly fleeing entirely.

Now, at this precipice, traders hold their breath. Will Bitcoin capitulate and stumble into the mid-$20,000s? Or, perhaps, will it defy the prophets of doom and ascend to heights still unseen? The critical battleground remains at $108,000, where fate awaits, and the line between disaster and salvation is drawn in the dust.

And Peter Brandt warns—should the fall come, it will be swift and unforgiving, catching the unprepared unawares. Better to clutch your risk tightly, for in this game, fortune favors the cautious—or the utterly reckless.

Read More

2025-06-11 23:48