Ah, Ethereum (ETH), the darling of the digital realm, is once again stealing the spotlight! As leveraged bets and institutional inflows dance together like a pair of clumsy lovers, the futures market is reaching dizzying heights. Who knew finance could be so entertaining?

Analysts, those ever-watchful hawks, are keeping a keen eye on Ethereum, whispering sweet nothings about an impending altcoin summer, with ETH strutting its stuff as the likely star of the show. 🌞

Leverage and Institutions Drive Ethereum’s Market Momentum

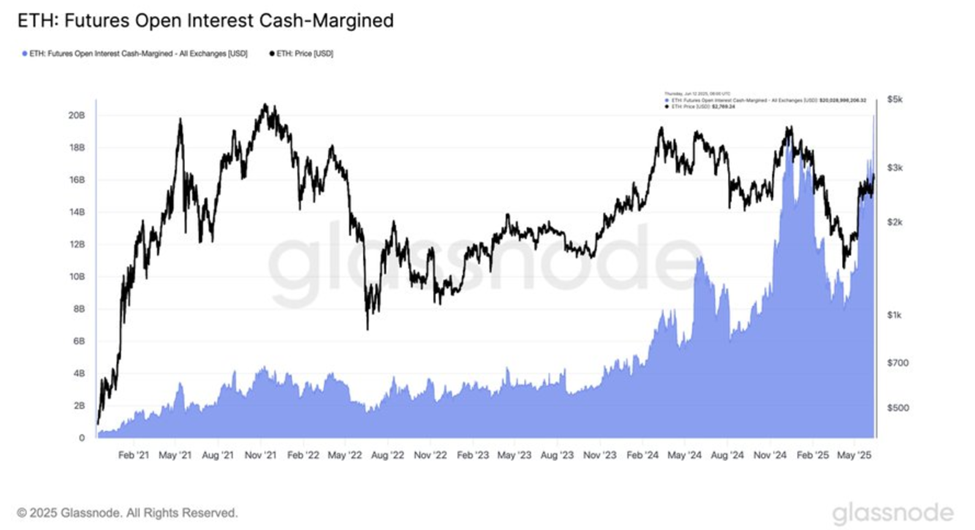

According to the wise sages at Glassnode, Ethereum futures open interest has soared to an all-time high (ATH), surpassing a staggering $20 billion! Meanwhile, ETH’s spot price is playing coy, lingering below the magical $2,800 mark. Oh, the drama!

“Ethereum futures open interest (cash-margined) just hit a new all-time high — topping $20 billion… leverage continues to build as traders load up using stablecoins,” Glassnode quipped in a post. Talk about a rollercoaster ride! 🎢

Just two days prior, the astute analysts at CryptoQuant pointed out that open interest in Ethereum futures had previously peaked at 7.17 million ETH. This extension is like a buffet for speculative appetites! 🍽️

Cash-margined contracts are the life of the party, driving much of this activity and cranking up the market’s volatility. Who doesn’t love a little chaos?

On-chain data reveals that retail investors are diving headfirst into derivatives, while Bitcoin’s on-chain activity is about as lively as a snail race. 🐌

“Futures trading frequency among small investors just spiked above its 1-year average… the Bitcoin network feels like a ghost town: low on-chain activity and retail volume… while ETH open interest hit an ATH, and retail trading frequency is spiking,” CryptoQuant observed. Spooky! 👻

BlackRock’s ETH Buying Spree Signals Deepening Institutional Bet on Ethereum

And just when you thought it couldn’t get any wilder, BlackRock enters the scene with a fresh wave of institutional buying! This asset manager has been on a shopping spree, snatching up ETH for two consecutive weeks, adding a jaw-dropping $163.6 million to their collection. 💸

BLACKROCK HAS BOUGHT ETHEREUM FOR 2 WEEKS STRAIGHT!

They’ve amassed a total of $570M ETH in the past 2 weeks. They must have a secret stash of stablecoins! 🤑

— Arkham (@arkham) June 11, 2025

Lookonchain, the blockchain detectives, report that whales are also getting in on the action, withdrawing millions of dollars worth of Ethereum like it’s going out of style. 🐋

Abraxas Capital, a heavyweight in the institutional ring, withdrew 44,612 ETH ($123 million) from Binance and Kraken. Talk about a power move!

Whale/institution 0xFC82 withdrew 33,500 $ETH ($93.5M) from #Binance over the past 2 days. 🐳

— Lookonchain (@lookonchain) June 12, 2025

While retail trading volumes on centralized exchanges (CEXs) are as low as a limbo stick, long-term Bitcoin holders are hoarding their treasures. Yet, Ethereum seems to be shifting gears towards active speculation and accumulation, with traders and analysts taking note. 📈

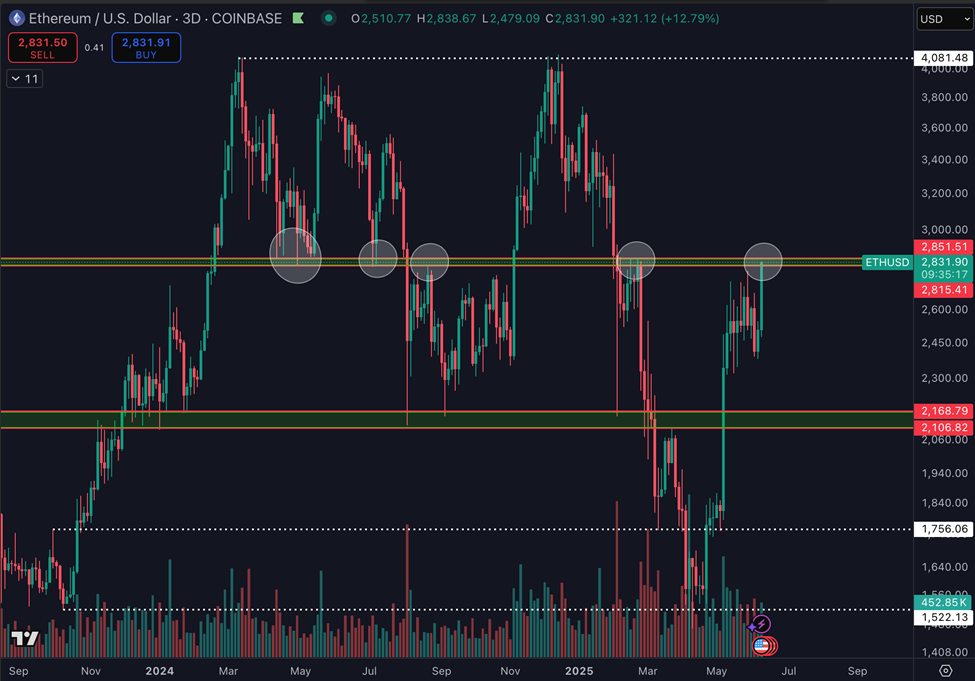

“The $2,800 level is important throughout this cycle. It has sparked the biggest moves after retesting or breaking above/below it,” analyst Daan Crypto Trades observed. Wise words! 🧙♂️

Analyst Duo Nine echoed this sentiment, believing Ethereum is gearing up for a sharp rally, potentially beyond the $3,000 psychological level. Buckle up, folks! 🚀

Ethereum actually looks good here. Clear higher highs.

Once $2,800 breaks, 3k and beyond opens up. Ethereum will be the last major altcoin to pump before the bear market starts. 🐻

— Duo Nine YCC (@DU09BTC) June 12, 2025

The general sentiment among analysts is that Ethereum is the obvious play right now, with narratives likely to continue building around it as positive vibes grow. 🌈

However, this surge in leverage comes with risks. Historically, high open interest levels and excessive retail positioning have led to sharp liquidations. Lookonchain highlights that some traders are also opening short positions for ETH. Yikes!

Smart trader 0xcB92, who made $5.18M on $ETH, is shorting $ETH again.

An hour ago, he opened a short position of 21,963 $ETH ($60.8M), with an unrealized profit of $187K and a liquidation price of $2,948. Talk about living on the edge! 😱

— Lookonchain (@lookonchain) June 11, 2025

With many positions backed by stablecoins in cash-margined futures, any volatility could trigger a cascade. Hold onto your hats! 🎩

As of this writing, Ethereum was trading for $2,755, down by 0.27% in the last 24 hours. The saga continues! 📉

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-06-12 15:02