Oh, the cryptocurrency market-like a bad reality TV show that keeps recycling its own plotlines. Investors are squinting at charts like they’re trying to spot Bigfoot, wondering if 2026 is just 2016 in a trench coat. Spoiler: It’s not. The cycles look similar, but the drama’s dialed down. Think of it as crypto’s midlife crisis: same haircut, fewer pyrotechnics.

Bitcoin’s Halving Cycle, the Crypto Version of a Midlife Crisis

Back in 2016, Bitcoin’s halving was the main event. July 2016: $651. December 2017: $19,700. That’s a 2,900% gain because apparently, back then, Bitcoin thought it was a growth stock and a lottery ticket. Fast-forward to 2024’s halving: Bitcoin hits $63,000, then creeps up to $126,200 by October 2025. A 100% return? Cute. Inflation-adjusted, that’s basically a participation trophy.

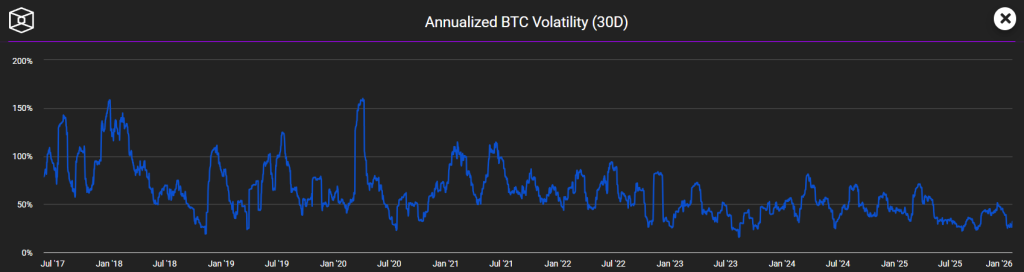

Same timeline, less fireworks. In 2016, the market was a $10 billion indie film. In 2026? A $1.8 trillion Marvel franchise. Institutions are here now, acting like buzzkill babysitters. Volatility? Gone the way of the dodo. Speculation? About as spicy as a lukewarm oatmeal.

Altcoins: The Party Never Ends (But the Music Got Worse)

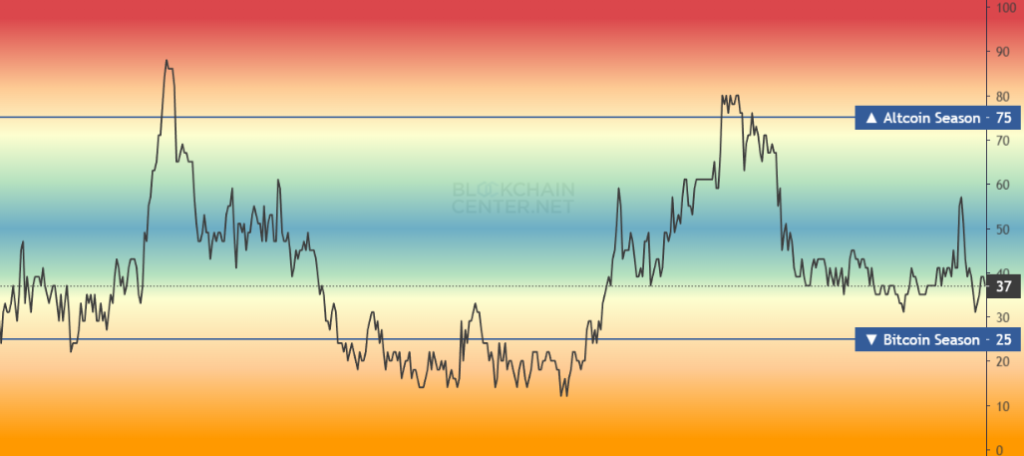

Remember 2016? Altcoins were the main event. Ethereum shot up 17,400%-from “What’s Ethereum?” to “Why is my screen on fire?” XRP jumped 64,000%, which is wild when you realize XRP was basically the Energizer Bunny of crypto. Fast-forward to 2025: ALT/BTC bottoms out again. Altseason Index hits 55. Cue the confetti cannon. Except now, regulators are hovering like helicopter parents, so don’t expect any 64,000% miracles. The most exciting thing? “Moderate gains.” Yaaas.

Bitcoin Dominance: The Comeback Kid (or Just Desperate for Attention)

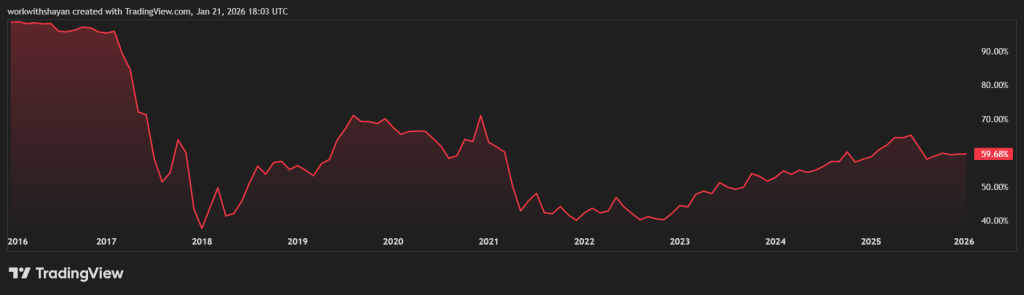

In 2016, Bitcoin dominance was 82.6%-the crypto world’s version of a monoculture. By 2017, altcoins ate its lunch. Fast-forward to 2026: Bitcoin dominance is 59-61% and rising. Institutions are hoarding Bitcoin like it’s the last roll of toilet paper in 2020. Altcoins? They’re the quirky side characters now, begging for screen time. Will Bitcoin dominance keep climbing? Maybe. But institutions love Bitcoin like a basic white wine spritzer-safe, predictable, and never, ever fun.

Post-Halving Returns: The Slow Death of Excitement

Let’s crunch the numbers (and yes, they’re as depressing as tax season):

- 2012 Halving: 9,483% return. Basically, if you missed this, your crypto FOMO is eternal.

- 2016 Halving: 2,931% return. Still wild, but you had to wait 17 months. Impatience tax.

- 2020 Halving: 702% return. Okay, now we’re just being polite.

- 2024 Halving: 38% return. Congrats, you broke even after inflation.

Bitcoin’s growth curve? Flatter than a pancake at a keto brunch. Institutional money killed the hype. Volatility? Down 55% since ETFs showed up. Fun fact: Bitcoin’s volatility floor in 2016 was $366. Now it’s $76,329. Because nothing says “thrilling” like a $76k floor, right?

Market Sentiment: From “WAGMI” to “HODL My Company 401(k)”

In 2016, crypto was a bunch of hoodie-clad nerds shouting “WAGMI” into Discord. Now? Institutions are here, treating Bitcoin like a retirement fund. ETF flows move billions daily. Bitcoin’s tied to interest rates now. The romance is dead. The new question: “How will this look on my 10-K?”

The Bottom Line: Crypto’s Midlife Spread

2026’s crypto cycle is 2016’s twin, but with fewer pyrotechnics and more spreadsheets. Timing patterns? Still there. Explosive gains? Gone. Institutional money? The new designated driver. So if you’re here for the 2017-style chaos, pack it in. This is the “I used to party, now I blog” era. But hey, at least Bitcoin won’t wake up in a Taco Bell parking lot with a tattoo you regret. Probably.

Read More

- Darkwood Trunk Location in Hytale

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- Best Controller Settings for ARC Raiders

- How To Watch A Knight Of The Seven Kingdoms Online And Stream The Game Of Thrones Spinoff From Anywhere

- Ashes of Creation Rogue Guide for Beginners

- PS5’s Biggest Game Has Not Released Yet, PlayStation Boss Teases

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- Olympian Katie Ledecky Details Her Gold Medal-Winning Training Regimen

- Nicole Richie Reveals Her Daughter, 18, Now Goes By Different Name

- Arc Raiders Guide – All Workbenches And How To Upgrade Them

2026-01-21 22:42