If you missed the news—perhaps due to being trapped under something large and heavy, or distracted by the riveting debate over whether pineapple belongs on pizza—Israel kicked off Thursday night with the kind of surprise party Iran absolutely didn’t want. Fighter jets, explosions, diplomatic statements trying to sound calm, the whole shebang. Markets worldwide burst into tears, but bitcoin, bless its heart, mostly just frowned a bit. 🧐

Bitcoin Plays Hard To Get While Bombs Fall

So, in a move likely to cause considerable commotion in global embassies and potentially in several cardiac wards, Israel lobbed 200 fighter jets at Iran’s nuclear facilities, introducing a lot of stress into otherwise placid trading screens everywhere. The resulting market panic was textbook chaos—stocks down, news anchors gesturing at angry charts, and somewhere a YouTuber started prepping their “10 Signs of the Coming Financial Apocalypse” video. Naturally, bitcoin decided to do its own thing, sneaking off with only a 2.8% drop—a percentage point less than its crypto mates. One can only assume bitcoin was busy rewatching old Martin Scorsese movies and couldn’t be bothered.

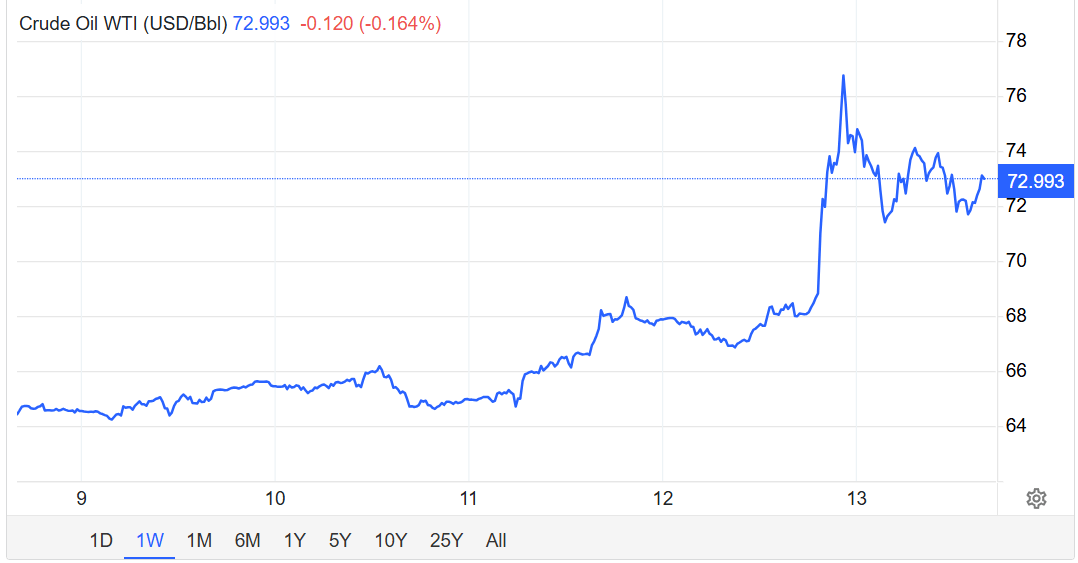

Iran, for those who’ve not googled it recently, is a veritable oil spigot, churning out more than four million barrels a day. After Israel’s wild Thursday, oil prices did their best impression of SpaceX and went from $68 to $75 a barrel. The Dow, always dramatic, plunged 550 points, probably because it sensed the attention drifting away and needed to remind everyone it still exists.

Investors, displaying their notorious herd mentality, stampeded towards gold in the classic move of “When in doubt, buy something shiny you can’t eat.” Gold appreciated 1.45% and approached its all-time high, missing it by just $70—a mere rounding error for the kind of people who actually weigh their wealth in ounces. Bitcoin, meanwhile, lagged behind physical gold but had the satisfaction of performing slightly less poorly than its younger crypto siblings, which essentially collapsed while uttering dramatic last words quoted by Coinmarketcap.

As one philosopher put it (well, an X user with a cool nickname): Stack Hodler assured humanity that geopolitical disasters are basically a gift for bitcoin buyers. You can almost hear the world’s central bankers clutching their pearls in horror.

Markets: The Carnage in Numbers 🔢

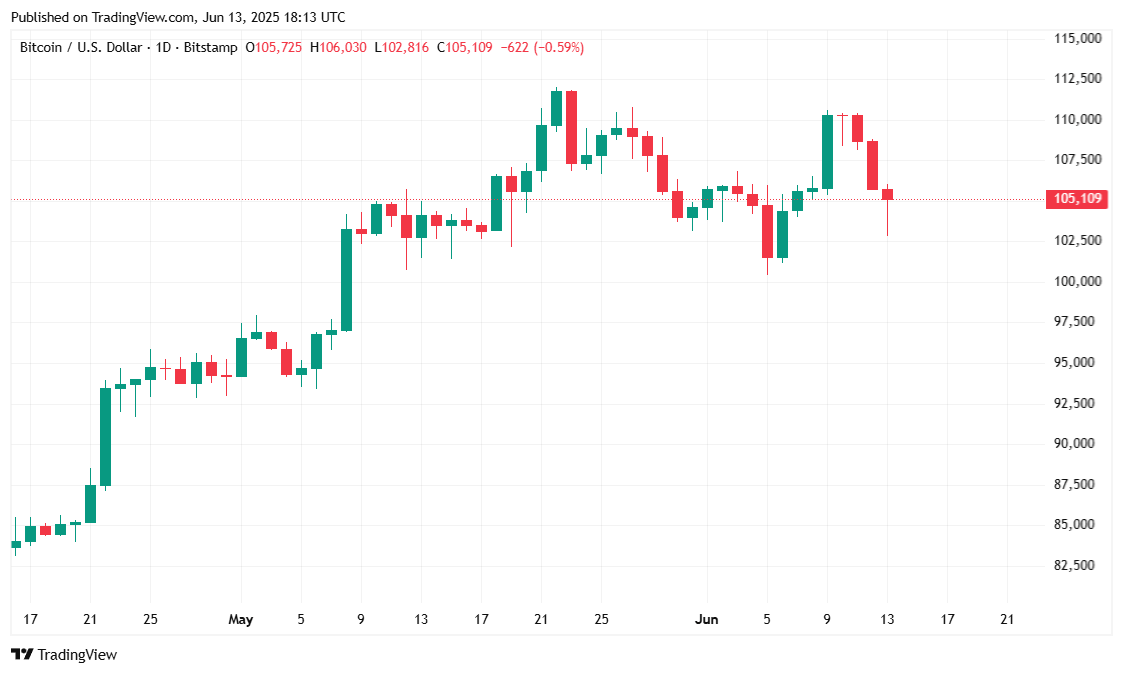

Bitcoin (BTC) logged a 2.8% drop in the last 24 hours, trading at a wallet-draining $105,079.80. (Yes, that comma is in the right place, and it’s still not enough to buy a first-floor apartment in London.) Despite the wobbles, it managed a feeble 0.23% gain over the week, apparently channeling the spirit of a slightly motivated sloth. Prices ranged from $102,822.03 to $107,872.21, a swing that would make most other asset classes blush and reach for the anti-nausea pills.

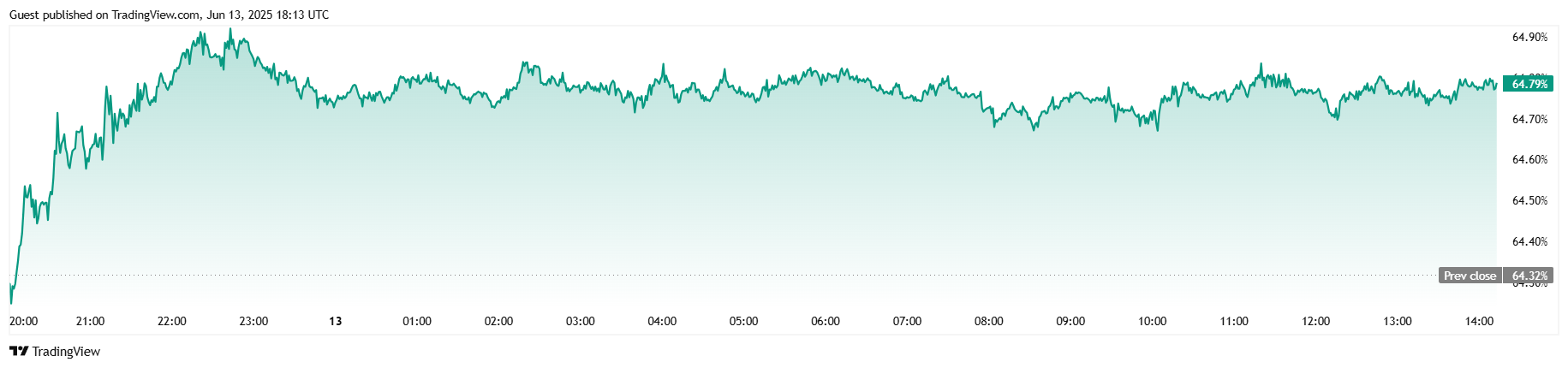

Trading volume leapt 38.22% to $73.20 billion, creating plenty of opportunities for people to regret their decisions in real-time. Bitcoin’s total market cap dipped (again) to $2.08 trillion, but—drumroll—its dominance of the crypto market actually rose by 0.64% to 64.79%, probably because most other coins were hiding under the metaphorical couch.

On the crystal-ball-gazing end (the derivatives market), futures open interest dropped 5.26%, stopping at $69.80 billion. This signals traders switching from “YOLO” to “maybe later.” Per Coinglass, $1.61 million in long positions were liquified, while shorts lost only $164,600—a rare win for the pessimists, who are now annoyingly smug. 😏

Read More

2025-06-13 22:29