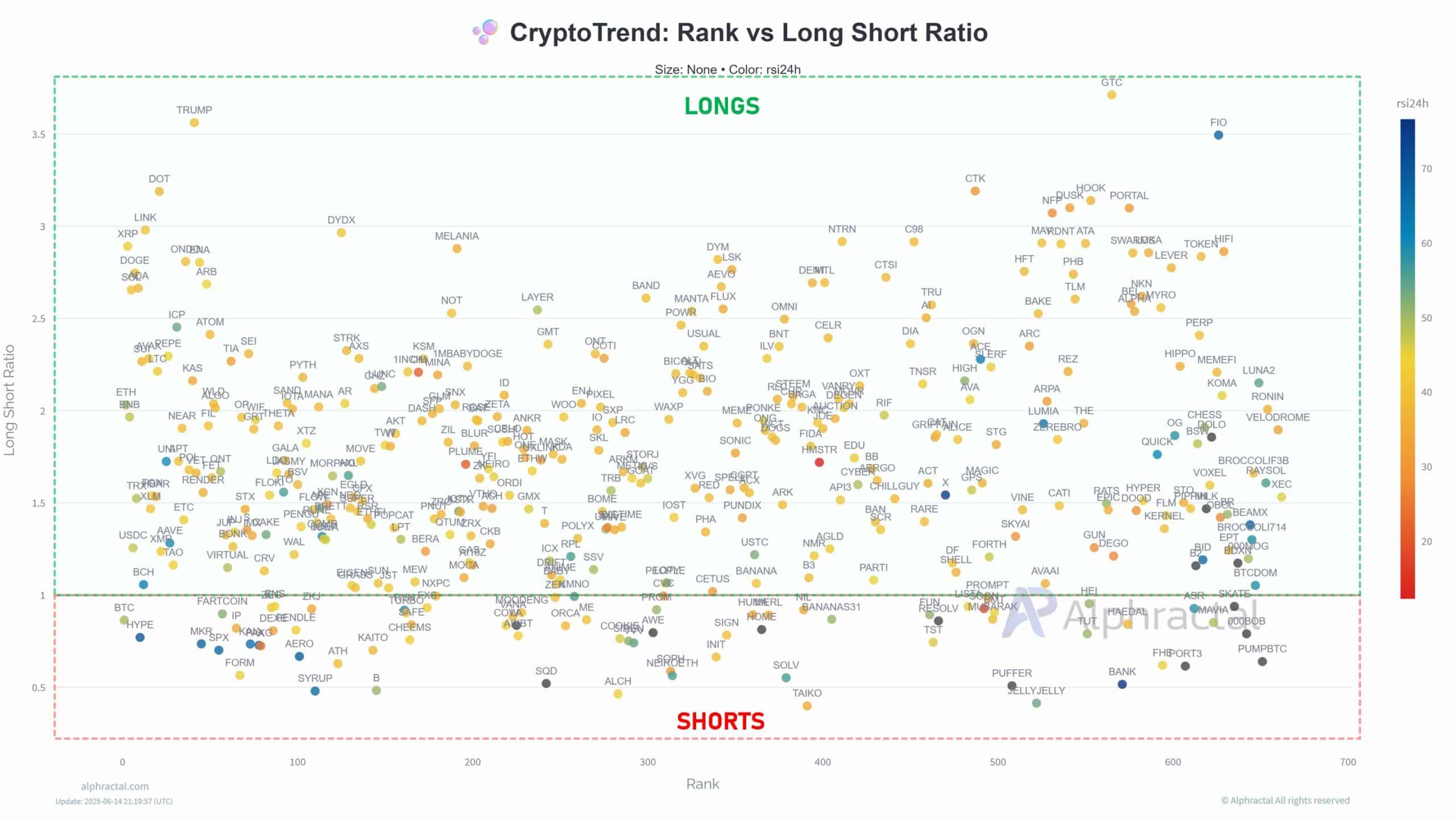

- Ah, the altcoins! A veritable cornucopia of bullish sentiment, with over 70% leaning towards optimism.

- Is the market preparing for a grand squeeze or a dismal slide into despair?

Two weeks have passed since Bitcoin [BTC] flirted with its all-time high, now teasing the elusive $105k mark. This level has become a veritable pressure cooker for market sentiment. The last time it cracked, BTC plummeted to $100k, leaving traders in a state of anxious anticipation, like a cat watching a mouse hole.

Historically, such indecision ignites a flurry of alt rotations, as capital scurries for short-term gains outside the shadow of BTC. Yet, despite the promising setup, many altcoins remain mired in the red, suffering double-digit losses weekly. Oh, the irony!

According to the wise sages at AMBCrypto, an altseason is not yet upon us. However, with BTC in a state of limbo and the market structure thinning like a poorly made soup, there may just be enough room for the astute bulls to position themselves for the next reversal. 🐂

Crowded longs hint at imminent market rebalancing

While spot prices languish in a state of subdued ennui, the perpetual market is gearing up as if something monumental is on the horizon.

Across the board, over 70% of altcoins are exhibiting a strong long bias, and on Binance, the big players are not holding back. High-cap assets boast an average of over 60% of traders leaning long. It’s like a party where everyone is wearing the same outfit!

But this is no mere random optimism; it appears to be a calculated risk. After last week’s brutal liquidation cascade, traders seem to be wagering on a near-term market rebalancing, with eyes peeled for a potential short squeeze. 🎢

Such a bold move, considering the recent volatility! What if Bitcoin tumbles toward $100k? That’s the scenario short-sellers are likely preparing for, opening the door for late-arriving shorts to press the downside. A delightful conundrum, isn’t it?

Yet, if the market holds steady and brushes off the turbulence, those late shorts could find themselves in a rather uncomfortable position. That’s precisely what the bulls seem to be banking on with all this long exposure across altcoins. 🐂💪

At this juncture, it’s a coin flip, and whichever side plays their cards wisely will dictate the next move. A thrilling game of chance!

Market positions for a strategic altcoin rally

With Bitcoin dominance once again above 65%, it is evident that altcoins are still taking their cues from BTC. Should Bitcoin descend back to $100k, one can bet that alts will follow suit like obedient ducklings.

The last drawdown serves as a testament. While BTC fell by 9.6% from its ATH, Ethereum [ETH] experienced a sharper correction of 10.25%. The reason? Elevated long exposure across altcoins exacerbated the downside pressure. Oh, the drama!

However, AMBCrypto has recently highlighted a pivotal structural shift in the current cycle, suggesting that Bitcoin’s full retrace to $100k is becoming less likely. If BTC stabilizes, altcoins could not only stage a relief rally but potentially lead the charge, especially if a short squeeze accelerates the upward momentum. 🚀

Thus, this “dip” may not be a harbinger of doom. Instead, it could represent a golden opportunity for those keen to seize the next move early. Fortune favors the bold, after all!

Read More

2025-06-15 20:12