In a move that could make even the most stoic banker chuckle, JPMorgan Chase has gallantly filed a service mark for “JPMD,” heralding a brazen foray into the chaotic realms of blockchain, digital assets, and the ever-elusive decentralized finance infrastructure. Who knew finance could be this thrilling? 🎢

JPMorgan’s Daring Dance with Digital Assets: The “JPMD” Saga Begins!

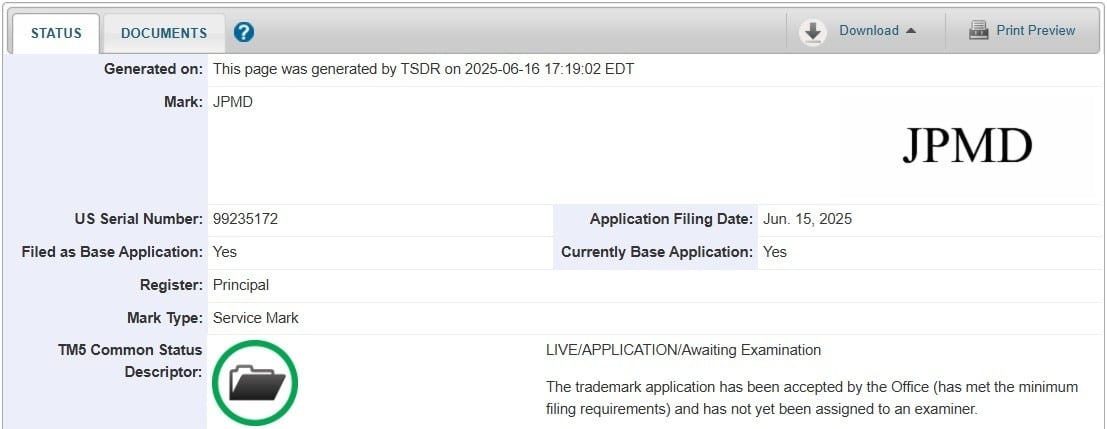

On the fateful day of June 15, JPMorgan Chase Bank, in a fit of audacity, submitted a service mark application for the illustrious “JPMD.” This bold declaration signals a grand expansion of its dominion over blockchain-based financial services. The application, now resting comfortably with the U.S. Patent and Trademark Office (USPTO), awaits the discerning eye of an examining attorney. The mark, a simple yet profound collection of characters, is claimed in standard form, devoid of any artistic embellishments—because who needs flair when you have ambition? 😏

With “JPMD,” the bank plans to dive headfirst into a veritable ocean of digital asset and blockchain-enabled services. The application outlines a cornucopia of key services covered by this mark:

Providing trading, exchange, transfer, and payment services for digital assets, namely, virtual currency, digital currency, digital tokens, payment tokens, decentralized application tokens, and blockchain-enabled currency. Quite the mouthful, isn’t it? 🍬

But wait, there’s more! The bank’s ambitions stretch further into the realms of issuing and redeeming digital currency, electronically transmitting and exchanging digital tokens, and engaging in financial securities exchange services—all while riding the wave of distributed ledger technology. It’s like a financial buffet, and they’re serving it all! 🍽️

The application also tantalizingly hints at plans for a financial futures exchange, financial custody services, and even sharing fraud data using the mystical powers of distributed ledger infrastructure. These services aim to support digital asset trading, currency conversion, payment processing, and the sharing of financial information through decentralized technologies. The scope is as vast as the ocean, including managing stored value accounts and enabling secure online transactions. Who knew finance could be so… adventurous? 🌊

JPMorgan’s filing is not just a mere formality; it’s a strategic effort to carve out a unique brand identity under the “JPMD” banner as it plunges deeper into the digital finance abyss. The choice of a service mark, rather than a trademark, reflects the ethereal nature of the services being offered. After all, in the world of finance, what’s more real than a good old-fashioned illusion? 🎩✨

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-06-17 06:29