- Binance volume has surged like a teenager’s mood swings while mid-term holders have doubled, signaling that institutional accumulation is on the rise. Who knew finance could be so dramatic?

- Crowd interest and leverage have dropped faster than my enthusiasm for a Monday morning meeting, highlighting market indecision and weak demand momentum. Yawn!

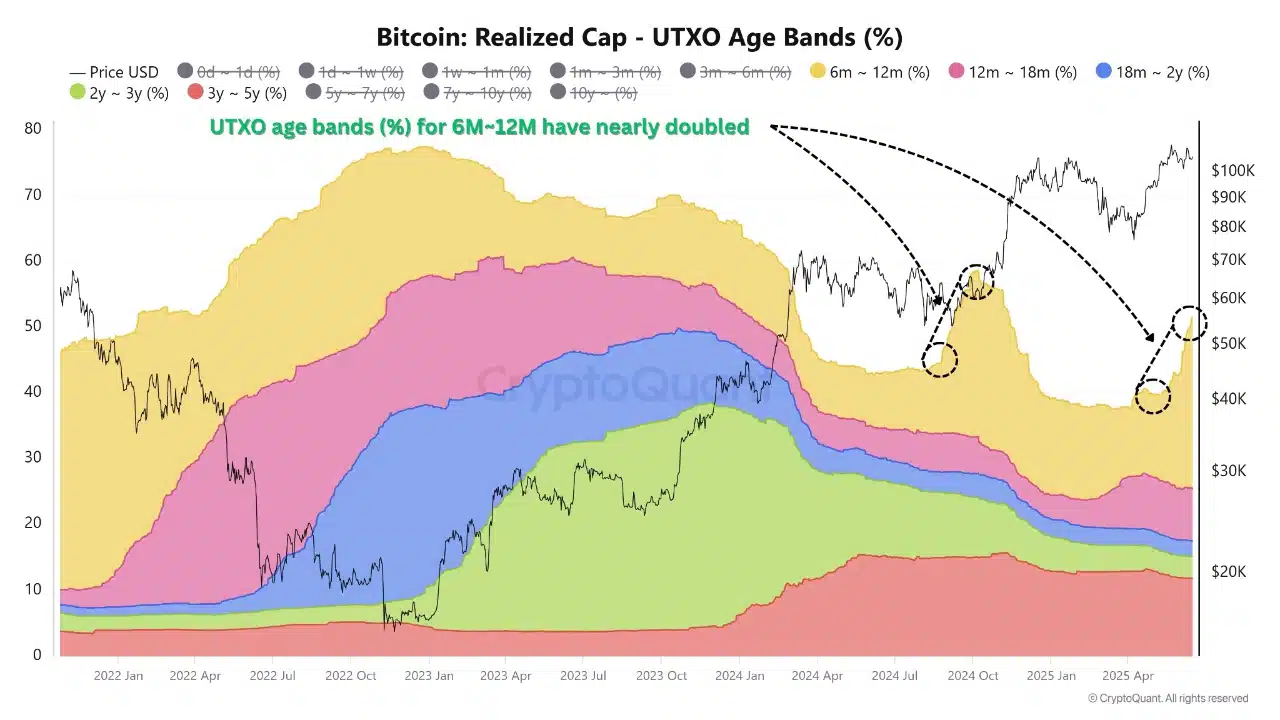

Bitcoin’s [BTC] UTXO band has doubled from 6 million to 12 million in June, indicating that holders are more convinced than ever, despite BTC dropping 1.79% to $104,950. It’s like watching a soap opera where the main character just can’t catch a break!

This spike shows that more investors are opting to hold through volatility rather than take profits, reducing available supply. It’s like they’re saying, “I’ll just hold onto this rollercoaster for dear life!” 🎢

Historically, such behavior from mid-term holders—often considered the “smart money”—has preceded strong rallies. If this trend continues, Bitcoin could build a bullish setup based on accumulation. Fingers crossed, right?

However, short-term demand remains as fragile as my willpower in a bakery, and traders should remain cautious until key confirmation signals return. 🍰

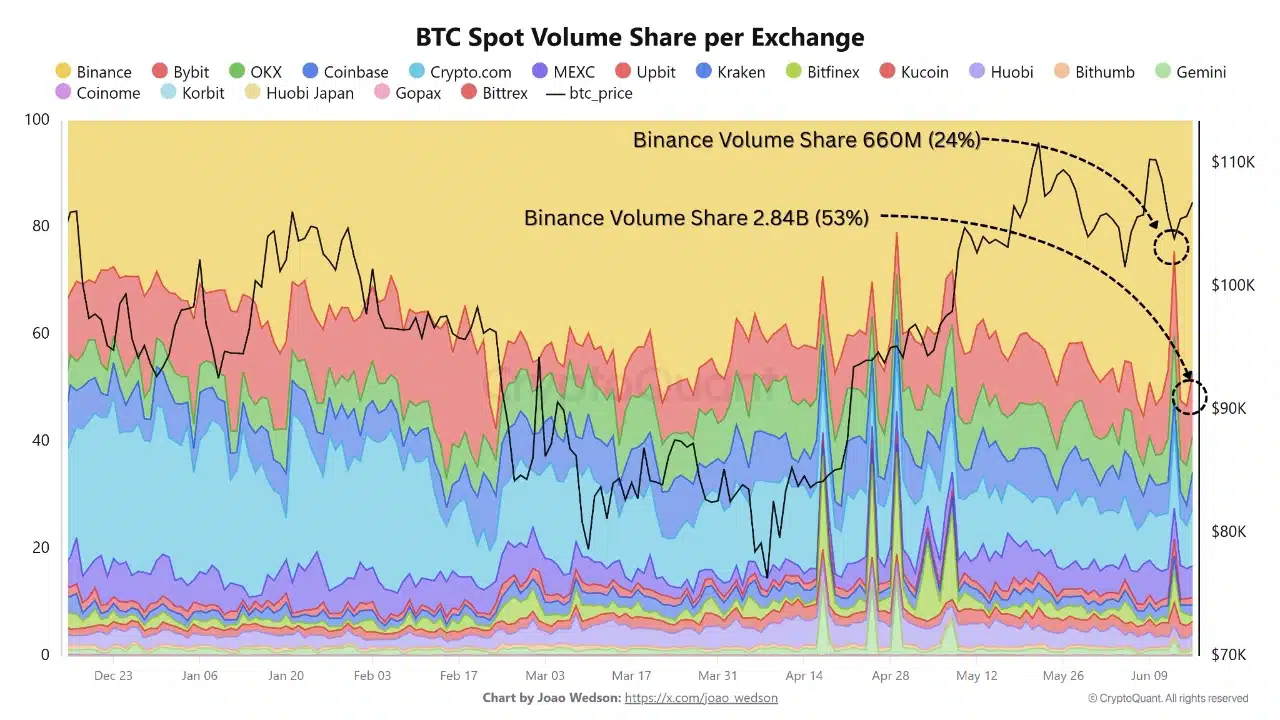

Why is Binance absorbing most of the spot market activity?

Binance’s share of Bitcoin spot trading volume has surged from 24% to 53% in just one day—a dramatic shift that’s more shocking than a plot twist in a reality show. 📺

This spike is likely driven by institutional players reallocating their activity, drawn by Binance’s deep liquidity and cost-effective trading structure. It’s like they found the best buffet in town!

Such a sudden rise in exchange dominance often signals an impending high-volatility phase, especially if fueled by coordinated accumulation or strategic positioning ahead of major price moves. Hold onto your hats, folks!

Additionally, this rapid consolidation of volume highlights growing centralization in crypto trading infrastructure. If sustained, it could have lasting implications for price discovery and market dynamics. Who knew crypto could be so… centralized?

Does a Stock-to-Flow ratio of 580 confirm extreme scarcity for BTC?

At the time of writing, Bitcoin’s Stock-to-Flow (S/F) ratio surged to 580—a level well above historical averages. It’s like Bitcoin is trying to win a gold medal in scarcity!

This metric measures the relationship between Bitcoin’s circulating supply and its annual issuance, and such a sharp increase typically points to tightening supply and long-term bullish potential. But let’s not get too excited just yet!

However, the elevated reading may be skewed by factors like reduced miner selling or short-term fluctuations in on-chain activity. It’s like trying to read the tea leaves while someone keeps spilling the tea!

While a high S/F ratio supports the narrative of a looming supply shock, it’s not a standalone signal for price appreciation. Sustained price growth still depends on rising demand and broader market participation. So, let’s keep our fingers crossed!

Without renewed investor interest and increased activity, elevated S/F levels alone may fall short of sparking immediate upside momentum. It’s like waiting for a bus that never arrives. 🚍

BTC social and derivatives metrics show indecision as conviction stalls

BTC’s Social Dominance dropped to 19.88% while Binance Funding Rate hovered at a neutral 0.001%, reflecting fading crowd engagement and trader indecision. It’s like a party where no one wants to dance!

This combination suggests a low-conviction environment, where neither bulls nor bears are assertively in control. It’s a standoff, folks!

Historically, falling social interest paired with flat funding has preceded major volatility as markets await catalysts. The lack of extreme sentiment or leverage reduces short-term breakout momentum. It’s like waiting for a firework show that never starts! 🎆

Therefore, without a spike in engagement or directional funding, Bitcoin may remain range-bound. If these metrics shift sharply, they could signal the start of Bitcoin’s next big move. Stay tuned!

Negative DAA Divergence still persists despite recent price stability

The Price-DAA Divergence remained negative, suggesting that address activity has not kept up with recent price movements. It’s like a race where the tortoise is still in the lead!

This persistent divergence raises concerns about the strength of the current market structure. Typically, growing address activity supports sustainable rallies, while divergence often signals speculative or hollow price action. It’s like a balloon that’s lost its air!

The continued gap implies fewer unique users are transacting on the network, despite price hovering above $100K. Where is everyone? Off on a crypto vacation?

Which force will prevail—conviction or exhaustion?

Bitcoin’s market is currently caught between opposing forces: strong accumulation by long-term holders and waning interest from the broader crowd. It’s like watching a tug-of-war where no one is winning!

Mid-term UTXO growth and Binance’s rising market share point to increasing institutional confidence and long-term conviction. But on the flip side, negative divergence in Daily Active Addresses (DAA), muted social sentiment, and neutral funding rates expose weak retail engagement. It’s a real nail-biter!

For BTC to stage a sustainable breakout, alignment between institutional accumulation and retail enthusiasm is essential. Until that balance emerges, Bitcoin remains at a pivotal point—hovering between the potential for a breakout and the risk of market fatigue. Grab your popcorn! 🍿

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-06-18 21:20