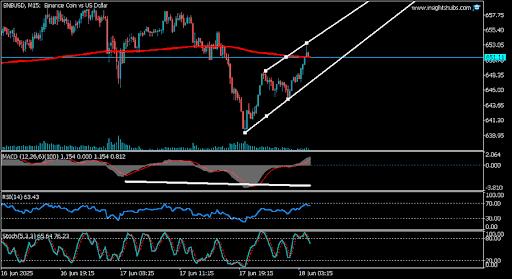

Ah, BNB, that fickle creature of the cryptocurrency world, finds itself at a most critical juncture. Like a tightrope walker teetering between two precarious cliffs, it dances around the $653 mark, testing the limits of its 200-period moving average. Meanwhile, the $640 level stands firm, a steadfast guardian for the bulls, who are valiantly trying to maintain their fragile structure. 🐂💪

The 200 MA: A Relentless Ceiling for Our Brave BNB

As our dear friend Thomas Anderson recently noted in a post on X, the M15 BNB chart reveals a price testing resistance at the $651.50 level, marked by a rather conspicuous horizontal yellow line. One might say it’s like a warning sign on a treacherous road—beware, dear traders! 🚧

This little escapade follows a bounce off the ascending white trendline support, suggesting that buyers are still clinging to their hopes of a short-term uptrend. Yet, alas, the price remains just shy of the 200-period moving average (the red line), which looms like a forbidding cloud over our hopeful bulls. ☁️

Ah, the momentum indicators! They are as mixed as a fruit salad at a summer picnic. The MACD continues to show negative values, hinting that bearish pressure is still lurking in the shadows, while the RSI has begun to recover from its previous oversold state. This delightful combination suggests a potential for a short-term bounce within the ascending channel—if only the stars align! 🌌

M30 and H1 Charts: A Dance of Alignment

In a recent update, our analyst friend delved deeper into the M30 chart, where the price is currently trading at $650.10, just below the 200-period moving average (that pesky red line) hovering around $653. This area has become a key short-term resistance zone, and the price action reflects a dramatic battle between buyers and sellers—like a Shakespearean play unfolding before our very eyes! 🎭

The immediate resistance to watch remains near the $653 mark, aligned with the 200 MA on both the M30 and H1 timeframes. Should the bulls muster enough strength to break through and sustain above this level, we might witness a fresh wave of upward momentum toward the next resistance at $657. A continuation of the ascending channel’s structure could hint at a burgeoning bullish control in the short term. 🌟

However, should the price fail to breach the $653 resistance, we may see consolidation begin to lose its steam. In such a scenario, a retreat toward the previous swing low near the $640 level becomes likely. This support area has already proven its strength and could serve as the next line of defense if bearish pressure increases. Traders are watching closely, as these levels may very well determine BNB’s next directional move. 📉

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-06-18 21:42