Please sit down, dear reader—unless you’re already flat on your back from Bitcoin’s latest trick. A recent scroll through the arcane tomes of Fidelity reveals that 17% of all BTC—yes, those invisible coins that people boast about at dinner parties—have lain motionless for a solid decade. That’s roughly $360 billion in assets sleeping the sleep of the just. Or the lost. Or both.

One could almost hear the ghost of Gogol chortling in his grave: the wizards at Fidelity lament that more BTC is vanishing into ancient history each day than sweaty little miners in their digital salt mines can ever hope to replace. Add to this the ever-hungry corporations and you have a recipe for a currency that might circulate less than a Moscow trolleybus in a quarantine.

Are the Ancient HODLers Taking Over?

Thanks to the faith of the devout HODLers, whales remain perched atop their mountainous treasure hoards, casting bored glances at the mortals below. Yet, as the years tick by—the crypto industry now being a moody teenager at 15—the pile of ancient, snoozing coins just gets taller. Fidelity, with its ledger and calculator, gazed into the abyss and delivered revelations:

As of June 8, 17% of all bitcoin falls into the category of “ancient supply”—meaning these coins have not moved in a decade or more. What could this mean for scarcity, market dynamics, and investors’ conviction? Find our team’s thoughts:

— Fidelity Digital Assets (@DigitalAssets) June 18, 2025

As a lord of the ETF manor, Fidelity has good reason to peer into the digital forest for signs of ancient beasts. The assertion that nearly a fifth of all Bitcoins now resemble the fossilized bones beneath Lenin’s mausoleum is something to marvel at. Their abacus claims 3.4 million BTC are “ancient,” which means more than $360 billion sits and collects intellectual dust. Much like certain government projects, only with more zeroes and less paperwork.

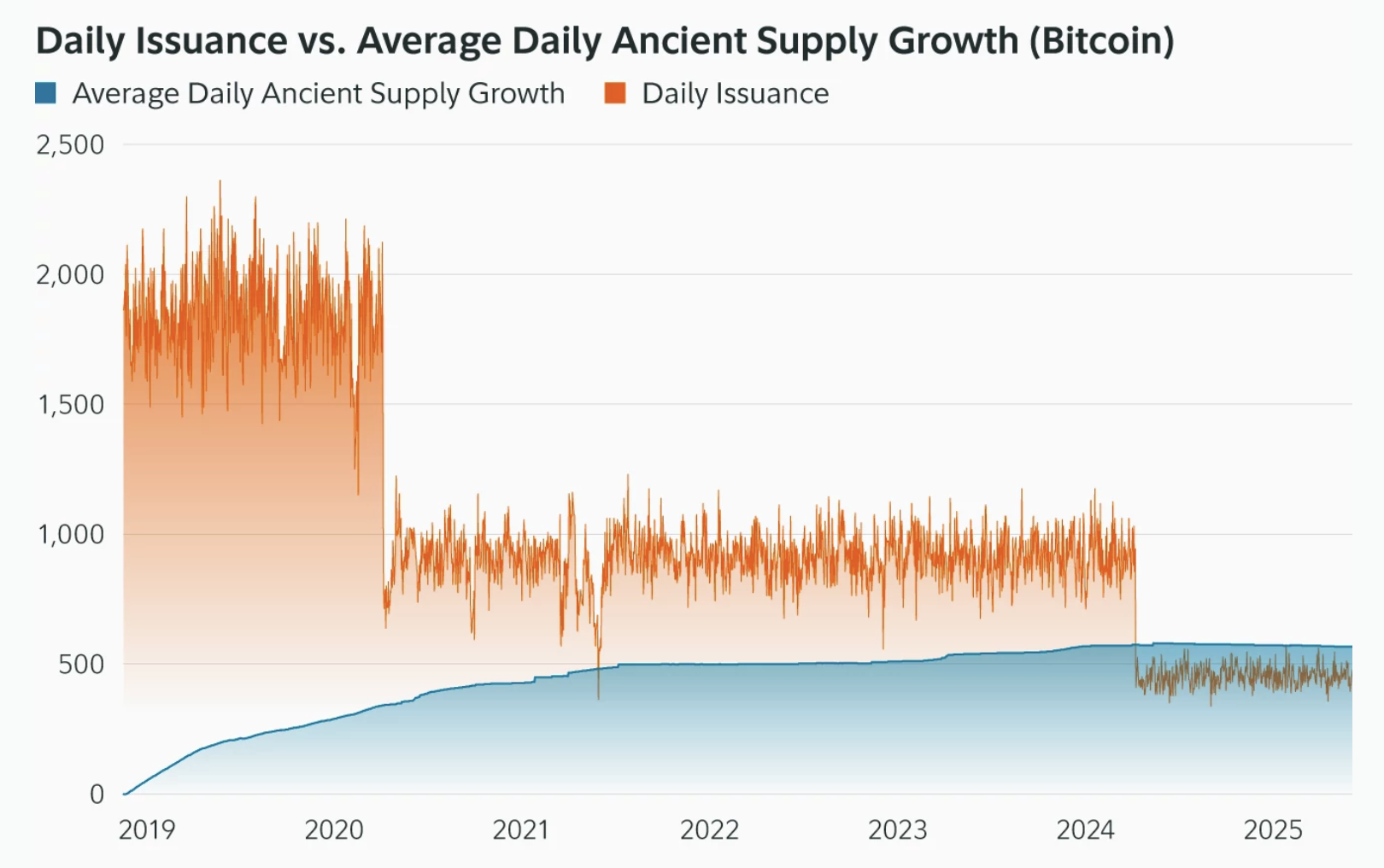

However, the juiciest morsel: it seems this ancient horde grows faster each day than Bitcoin’s trembling miners can mint new tokens.

If the scene strikes you as a bit gloomy, imagine: each day, 566 new “digital relics” are minted (by inaction, naturally), while just 450 newborns see the blockchain’s unflattering light. The miners sweat, the ETFs gobble, and the old coins slumber undisturbed, snoring audibly through the wires.

“Lost” Coins: The Phantom Menace

A dark specter hovers over the ancient supply: many of these are lost forever, victims of lost keys, misplaced hard drives, or drunken wallet misadventures. Chain diviners whisper that perhaps 20% of all Bitcoin is presently as unreachable as the train to Vitebsk during a blizzard.

Separate from the forgetful masses are the legendary 1.8 million coins attached to Satoshi Nakamoto himself, sitting untouched for over ten years—as if their creator had ascended to a higher plane and left the keys at the pearly gates. Every lost coin shrinks what mere mortals can actually use, skewing the occult forces of supply and demand.

When the supply curve tightens, so does volatility. Imagine a market where a single whale’s sneeze sends the price tumbling, and you’re not far off. As the available Bitcoin shrivels, the mighty whales gain even more sway—much like certain politicos, only with better hair and more convincing spreadsheets. 🐳📉

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-06-18 23:48