- It seems Bitcoin’s demand has been on a slow, meandering decline since May’s peak, like a snail on a leisurely stroll.

- Low profit-taking levels suggest that investors are still clinging to their coins like a cat to a warm laptop.

In the grand bazaar of cryptocurrency, Bitcoin’s [BTC] recent price movements resemble a tightrope walker who’s lost their balance, with neither bulls nor bears quite sure who’s in charge. It’s a bit like watching a game of chess where both players are simultaneously trying to eat the pieces.

Most holders appear to be in no rush to exit their positions, signaling a sentiment of holding that could rival a stubborn mule. 🐴

Despite this, Bitcoin is currently struggling to push higher, much like a balloon that’s been tied to a rock. One key reason? The lack of strong buying demand. Without sufficient demand to match or exceed supply, upward momentum remains as elusive as a cat in a room full of rocking chairs.

Metrics Indicate Waning Demand Pressure

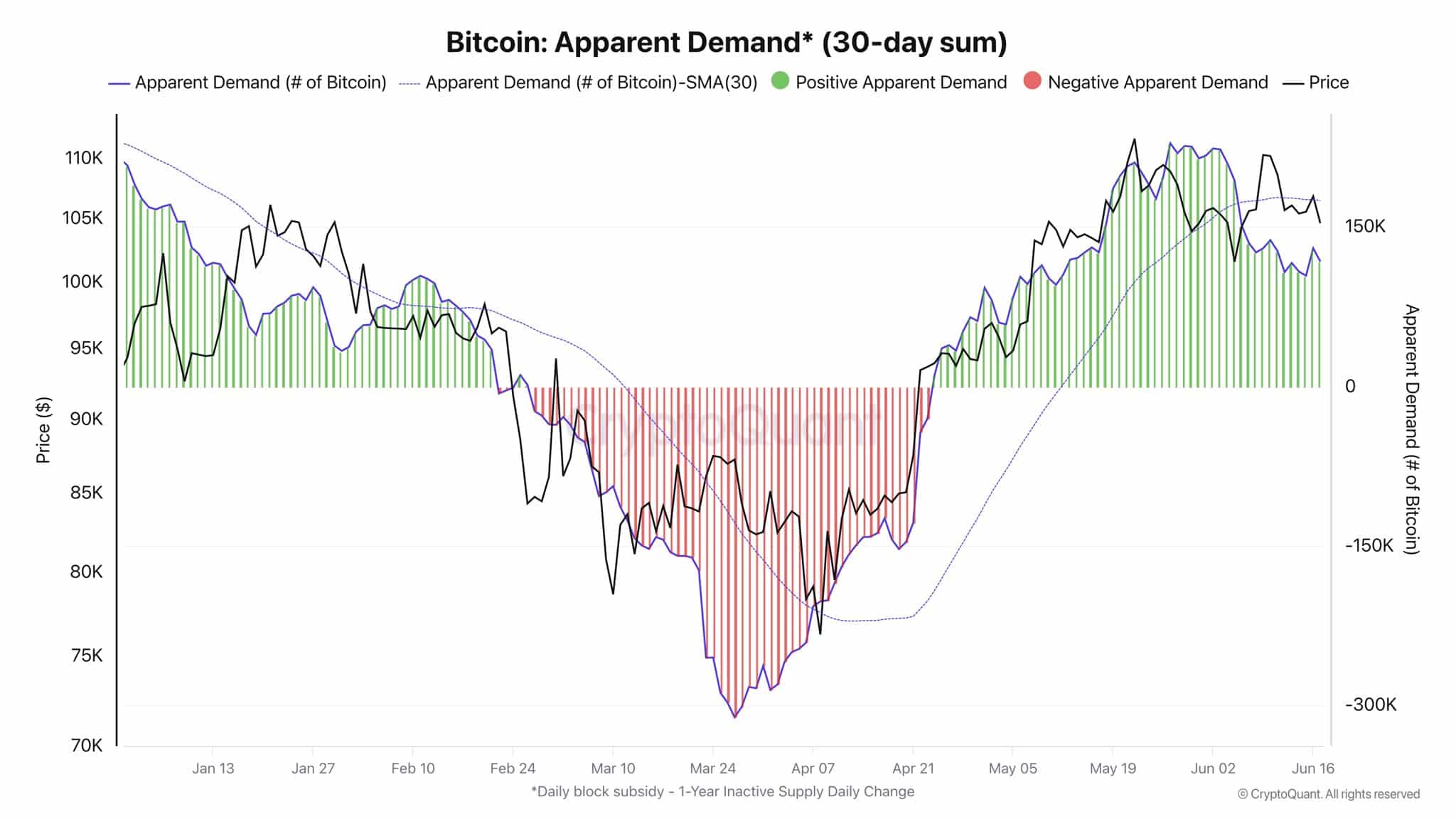

On-chain metrics, those delightful little numbers that tell us what’s really going on, support this view. AMBCrypto’s examination of Bitcoin’s 30-day apparent demand suggests that the king coin is losing its royal charm. 👑

This metric compares Bitcoin’s fresh supply with over a year’s worth of dormant supply, serving as a proxy for market demand. Since Bitcoin’s recent local top in early May, this ratio has been decreasing. While it hasn’t turned negative yet, the decline suggests that fresh BTC demand has been fading faster than a magician’s rabbit.

Support Arises from Holding Behavior

But fear not, dear reader! It’s not all doom and gloom. The steady decline in demand has failed to push the market into a sell-off, largely thanks to the firm grip of long-term holders. They’re holding on tighter than a toddler to their favorite toy.

Even as profit-taking crawls forward due to rising geopolitical tensions in the Middle East, HODLers refuse to budge. The number of investors holding small coins, especially in the 10–100 BTC range, was approaching 32 million at press time. That’s a lot of folks holding onto their digital treasure!

This has kept the market in a state of equilibrium. Selling pressure is present, but it’s being mitigated by enough buying interest to discourage sharp declines, much like a well-placed cushion on a hard floor.

Market is Balanced, but at a Breaking Point

Nothing holds forever, not even the most stubborn of Bitcoin holders. The current equilibrium, courtesy of the strong holders’ sentiment, could fade faster than a summer breeze if the demand for BTC doesn’t materialize. 🌬️

Until then, Bitcoin’s price will likely remain at this spot of muted tension, like a cat waiting for the perfect moment to pounce on an unsuspecting laser dot.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-06-19 17:54