Ah, the token, that fickle creature of the market, has recently displayed a notable bullish divergence across multiple timeframes, all while the price continues its wretched descent. It’s as if the universe is mocking us, isn’t it? 😂

In the midst of this cautious market, key indicators whisper sweet nothings of an accumulation phase forming at the current support zone. Traders, like hawks, are perched, eyes wide, waiting for any sign of directional confirmation. Will it be a glorious ascent or a tragic fall? Only time will tell! ⏳

Bullish Divergence Signals from Analysts on X

In a recent post on X, the ever-optimistic analyst CryptoCracker (@LearnCryptology) unveiled a detailed 4-hour chart analysis of Chainlink Price Prediction. He dubbed it the “Bullish Divergence X4.” This formation, a curious spectacle, tracks four successive lower lows in price, matched with four higher lows on the RSI, all along a steady support trendline around the $13.20 mark. Quite the mathematical ballet! 💃

According to our dear analyst, this structure reflects a repeated pattern of buyers stepping in at key support levels, despite the overarching gloom of bearish sentiment. Could this be the dawn of an accumulation phase? Or just another mirage in the desert of despair? 🌵

The RSI reading, a mere 38.11, shows a consistent upward movement, contrasting sharply with the declining price levels. This divergence suggests a weakening of bearish pressure over time, even as the price tests lower ranges. A glimmer of hope, perhaps? 🌈

While no breakout has been confirmed, the RSI’s trajectory may indicate early signs of underlying momentum shifting toward buyers. CryptoCracker concluded that a breakout above recent highs, combined with rising RSI and volume, would be necessary to validate the bullish thesis and signal a short-term reversal. Fingers crossed! 🤞

Chainlink Price Prediction: Volume, Price Action, and On-Chain Trends

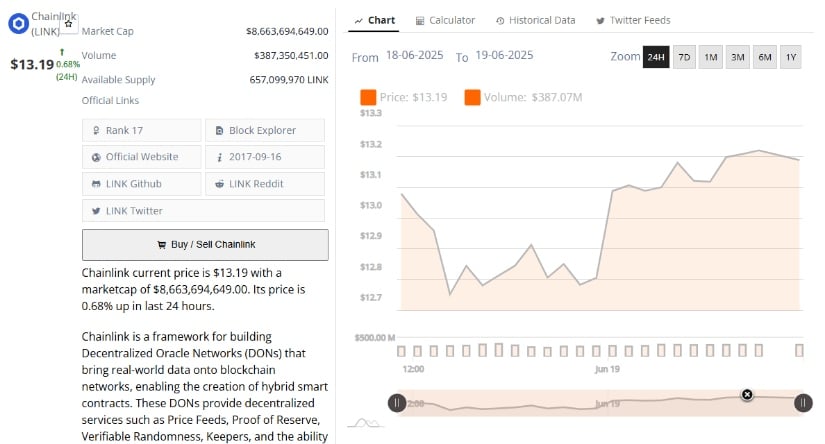

On the one hand, data from Brave New Coin indicates that Chainlink’s current price has stabilized around $13.19, with a modest 0.68% increase in the past 24 hours. During this period, trading volume reached approximately $387 million, indicating consistent market activity. Not too shabby, eh? 💰

The intraday chart reveals price movement between $12.70 and $13.19, indicating mild volatility and a recovery from session lows. This pattern aligns with typical accumulation behavior, where price remains within a defined range amid balanced buying and selling pressure. A delicate dance, indeed! 💃

In another post on X, analyst Enclave (@encl4ve) highlighted a divergence between LINK’s on-chain utility and its market price. He noted, “Despite languishing price, Chainlink Total Value Secured continues to make new highs.” A classic case of the market not knowing what it wants! 🤷♂️

This discrepancy could be attributed to short-term market dynamics or a structural decoupling between protocol fundamentals and token valuation. As DON usage continues to expand, the market may eventually adjust to reflect the platform’s utility more accurately. Or not. Who knows? 🤔

Weekly Outlook from TradingView Indicates Cautious Sentiment

On the other hand, the weekly chart for LINK/USD Price Prediction on TradingView shows a consolidation structure that has taken shape following a corrective move from the $20 resistance zone. After recovering from a historical low near $4.77, LINK has struggled to maintain upward momentum and is currently trading around $13.19. A true underdog story! 🐶

The recent candlestick patterns reflect indecision, with no dominant trend established in either direction. Price action continues to form lower highs and lower lows, highlighting uncertainty among market participants. A real nail-biter! 😬

The Relative Strength Index (RSI) on the weekly timeframe stands at 44.12, indicating a neutral-to-bearish stance. A previously noted bearish divergence, where RSI made a lower high as the price reached a higher peak, led to the current consolidation phase. Oh, the irony! 😅

Meanwhile, the MACD (Moving Average Convergence Divergence) indicator shows the MACD line below the signal line, accompanied by negative histogram bars. These elements confirm prevailing downward pressure, although they are not signaling an aggressive sell-off. For LINK to shift its weekly trend, a decisive move above resistance levels backed by positive momentum indicators would be required. A Herculean task! 💪

Overall, the current technical setup around $13.20 highlights a possible accumulation zone for Chainlink. However, confirmation of a directional move will depend on upcoming volume trends, sentiment shifts, and broader market behavior. Stay tuned, folks! 📺

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-06-19 22:55