It appears that our dear friend Ethereum is having a bit of a rough day, rather reminiscent of a butler slipping on a banana peel while serving breakfast in bed—unfortunate for all involved! Today, the price has stumbled upon the $2,500 range with all the grace of an inebriated penguin. Just yesterday, there were hints of optimism as punters scratched their chins over a bullish build-up, but alas, the day took a turn, like a poorly-directed farce, plunging into a veritable pit of despair.

Now, while we can all join in a sympathetic nod over this unfortunate turn of events, the underlying currents suggest a growing sell-off, akin to a flock of geese fleeing the scene at the first hint of a fox. Investors, those thoroughbred professionals of the emotional rollercoaster, are scrambling to decipher the top reasons for today’s Ethereum meltdown.

In this delightful little soiree of finance, we shall delve into the current market sentiments and take a cheeky gander at what might be in store for Ethereum’s escapades in the near future. Buckle up, old bean!

Ethereum Options Expiry: When You Can Smell the Panic in the Air!

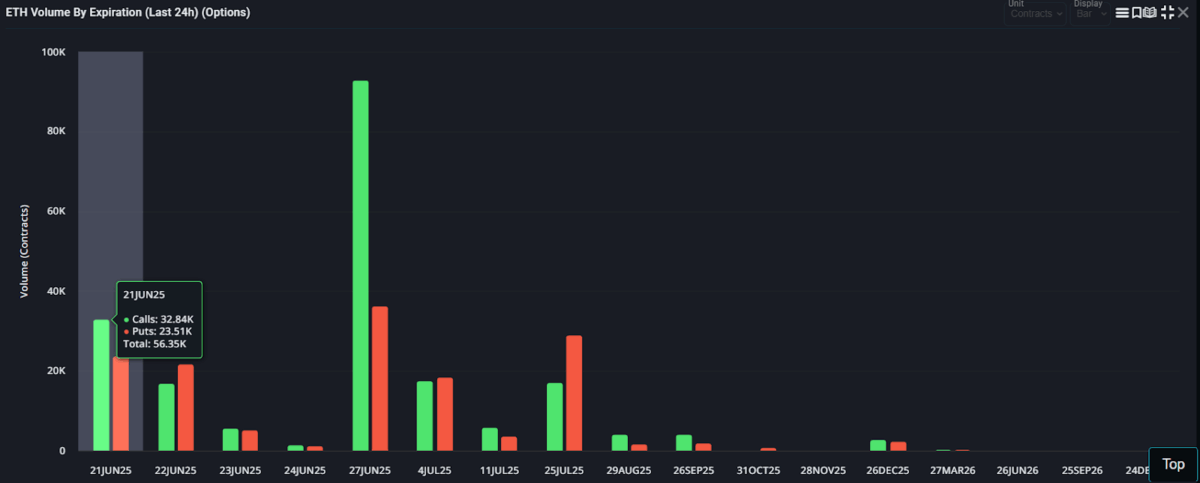

Take a gander at the chart below from Laevitas—which resembles a delightful patchwork quilt, albeit one that signals doom and gloom! You’ll notice the green bars (calls) and the red bars (puts) with enough activity to make a bee jealous! Tomorrow—mark that date, my friend—the total volume of contracts amounts to a nifty 56.35K (32.84K calls, bless their hearts, and 23.51K puts—those poor dears!).

This delightful tableau suggests a hive of near-month expiration trades—volatility is knocking on the door, or was that just a market manipulation dressed as a friendly invitation?

ETH Crypto Experiences Exits Like a Nightclub at the Stroke of Midnight!

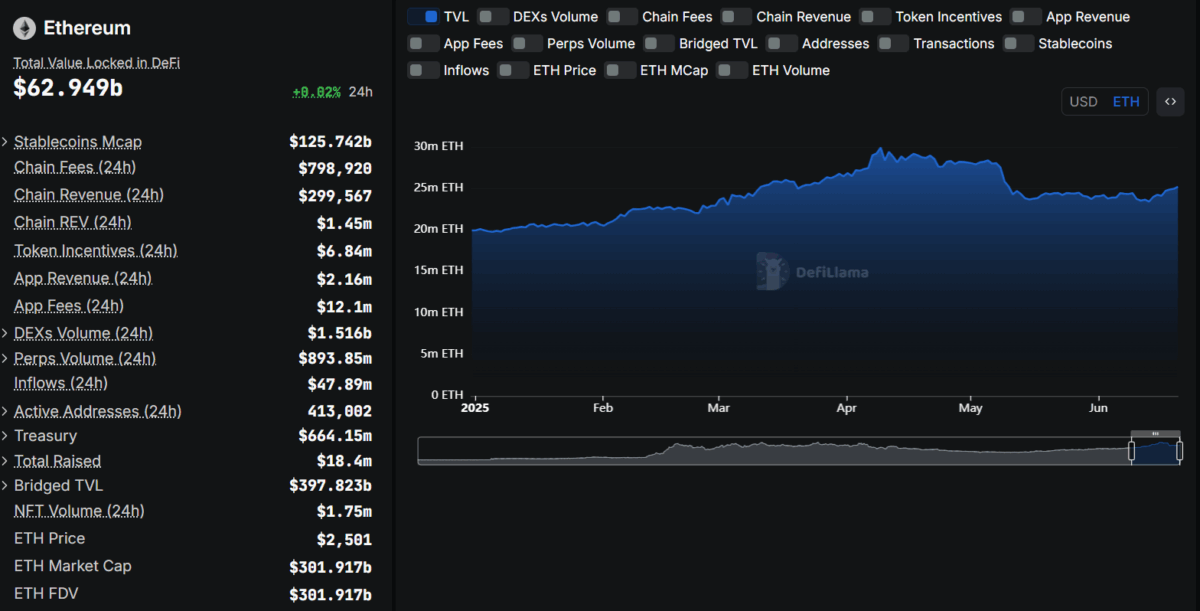

According to our chums at DefiLlama, Ethereum has shed a few pounds, dropping from a robust 27.99 million ETH on the 6th of May to a leaner, meaner 25.22 million today. That’s a loss of approximately 10% in less time than it takes to say “Where did all my money go?”

Moreover, it seems many investors are exiting the Ethereum chain faster than a fish out of water, showcasing an alarming disinterest that should set off all the alarm bells in the financial world.

Oh the Drama! Ethereum Bulls Stumble at Key Moving Averages!

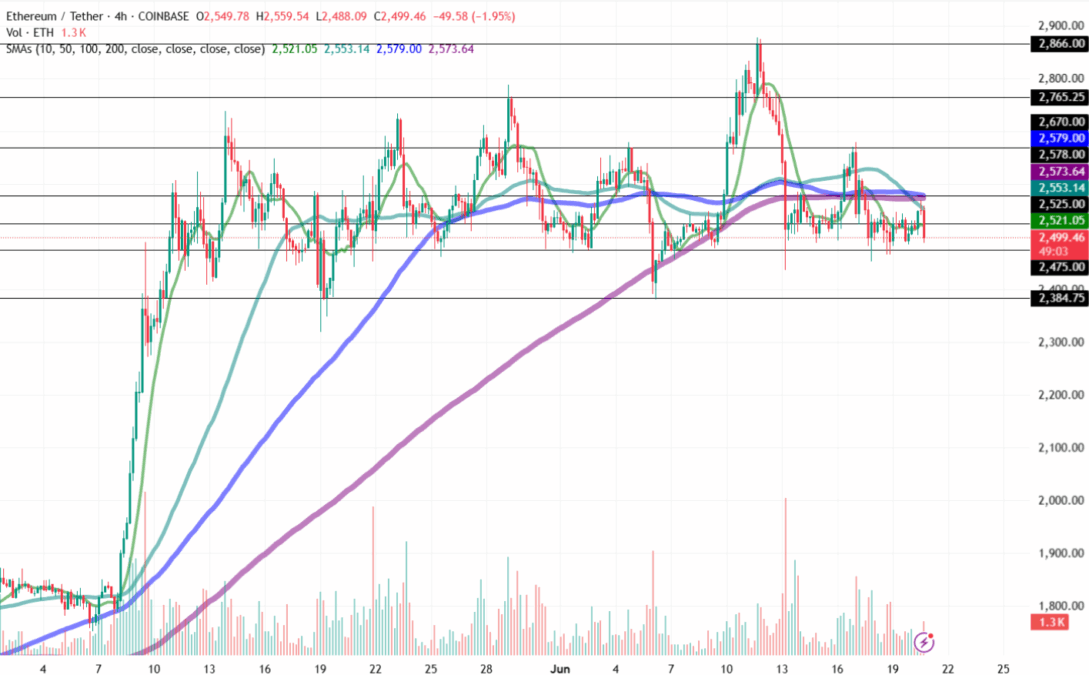

The Simple Moving Averages (SMAs)—those wise sages of market trend analysis—are indicating that the 10, 50, 100, and 200-day averages might just be due for a negative crossover. It’s all about the drama, isn’t it?

Today’s ETH coin price faced a strong pullback at those critical levels, resembling a contestant on a quiz show who buzzes in too soon. A liquidation zone has emerged around $2,565, and it seems Ethereum has dropped below the $2,500 mark, with bearish winds swirling around.

With a surge in volume signaling a selloff that would make even the strongest bear shed a tear, traders are keeping their eyes peeled. Should the storm clouds of negativity persist, we may see ETH tumble towards the crucial support level of $2,384.75 faster than you can say “What happened to my investment?”

However, if the impossible happens and a bullish reversal occurs, there’s a chance we might light the torches and rally toward $2,525. With a bit of luck—and perhaps a sprinkle of fairy dust—we could even see Ethereum scaling back up to the dizzy heights of $2,578 shortly. Crazy times, eh?!

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-06-20 20:53