It seems Solana, poor thing, has lost a bit of its…enthusiasm. Despite all the bustling activity, the price has retreated, slinking back to levels not seen since the early days of January. One almost feels sorry for it. All this frantic building, all these transactions…and for what?

- The price, you see, has decided a little rest is in order. A little dip, a little sigh. Very dramatic.

- The network itself, however, is positively agitated. Transactions are up, fees are up…it’s quite exhausting, really.

- Some clever analysts, those perpetually optimistic souls, suggest a bounce. A rebound. As if one can predict such things.

The SOL token, currently hovering around $127-a rather undignified sum, considering-has fallen by a disheartening 15% from its January peak. And if one dares to look back further, a truly sobering 50% drop from its heady days of 2025. A cautionary tale, perhaps, about the fleeting nature of…everything.

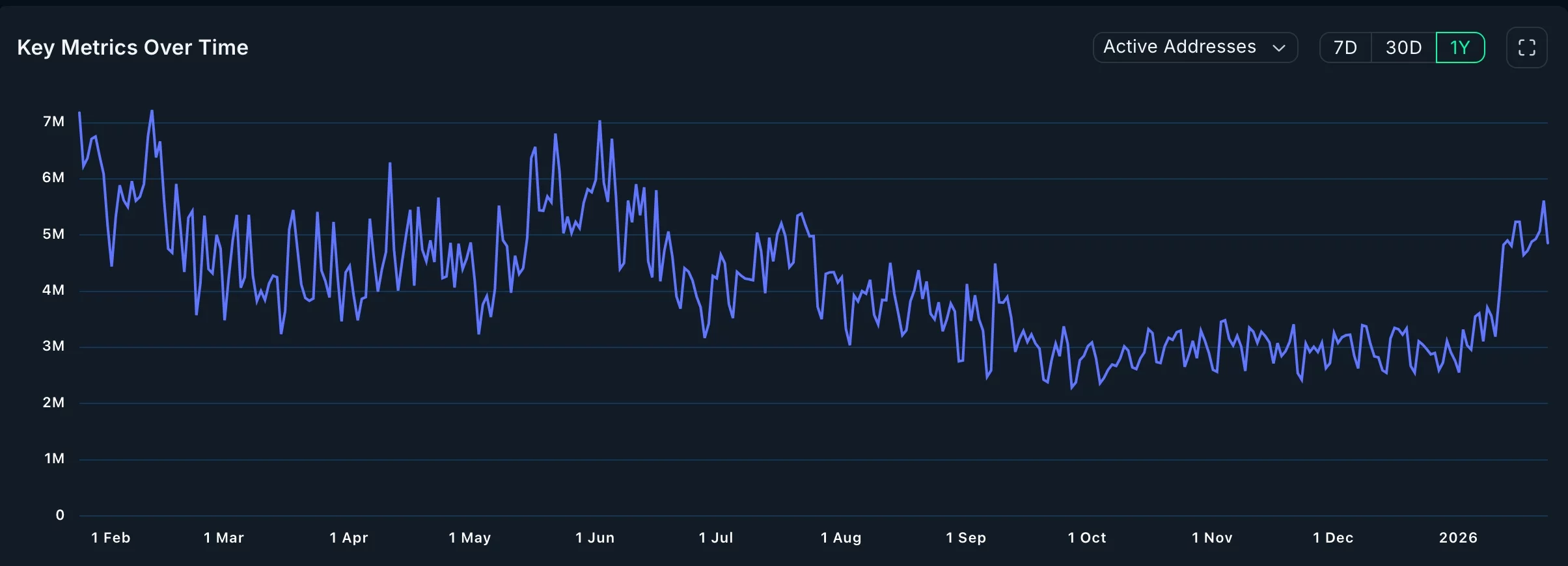

Nansen’s data, always eager to point out the positives, observes that Solana’s network is, quite frankly, rather busy. “Firing on all cylinders,” they say. One imagines the cylinders are quite tired.

Over two billion transactions in a month! An astonishing number, really. Though one wonders if anyone actually needs that many transactions. Ethereum and BSC, those comparatively sedate networks, managed a mere 63 million and 438 million, respectively. How…peaceful for them.

And the users! A 34% jump to 81.2 million. As if adding more people to a crowded room will somehow improve the atmosphere. Fees, naturally, have risen, too-a robust 42% increase to over $20 million. A testament to human greed, no doubt.

All this activity, it appears, has occurred without any significant change in decentralized exchange volume or stablecoin volume. A curious detail. Perhaps people are simply moving things around for the sake of it.

Stablecoin transactions have also “jumped” to over $312 billion, with over 260 million transactions and 4.5 million addresses. One almost expects a little fanfare with all this “jumping.”

They say the Alpenglow upgrade will improve things. It always does, doesn’t it? Another upgrade, another promise. One learns not to hold one’s breath.

Solana price technical analysis

The chart, as charts are wont to do, shows a decline. From a high of $148 to a current $126. Such a tragedy.

And the analysts, ever keen to find patterns in the chaos, proclaim a “bullish chart pattern.” An “inverted head-and-shoulders,” they say. And a “cup-and-handle.” One almost feels dizzy with all the shapes.

The implication is, of course, a rebound. Perhaps even to $148. And if that happens…well, then things might get really interesting. Potentially even $200! A truly fantastical notion. But, should it fall below $118… the analysts become rather quiet. They prefer not to dwell on such unpleasantries.

One wonders if any of this truly matters. The price will go up, the price will go down. Life goes on. And the cylinders continue to fire.

Read More

- Best Controller Settings for ARC Raiders

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- How To Watch A Knight Of The Seven Kingdoms Online And Stream The Game Of Thrones Spinoff From Anywhere

- Ashes of Creation Rogue Guide for Beginners

- PS5’s Biggest Game Has Not Released Yet, PlayStation Boss Teases

- When to Expect One Piece Chapter 1172 Spoilers & Manga Leaks

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- Sega Insider Drops Tease of Next Sonic Game

- Darkwood Trunk Location in Hytale

- New Netflix Movie Based on Hugely Popular Book Becomes An Instant Hit With Over 33M Hours Viewed

2026-01-24 12:42