Silver‘s 35% Plunge Leaves Bitcoin in the Dust-Crypto’s Weird New Obsession with Metals

In what could only be described as a theatrical tragedy woven by the gods of market chaos, tokenized silver futures orchestrated a spectacular liquidation bonanza, surpassing the humble bitcoin in a twist no one saw coming-except perhaps those who read the market tea leaves too closely.

What’s the scoop? Buckle up, it’s a wild ride:

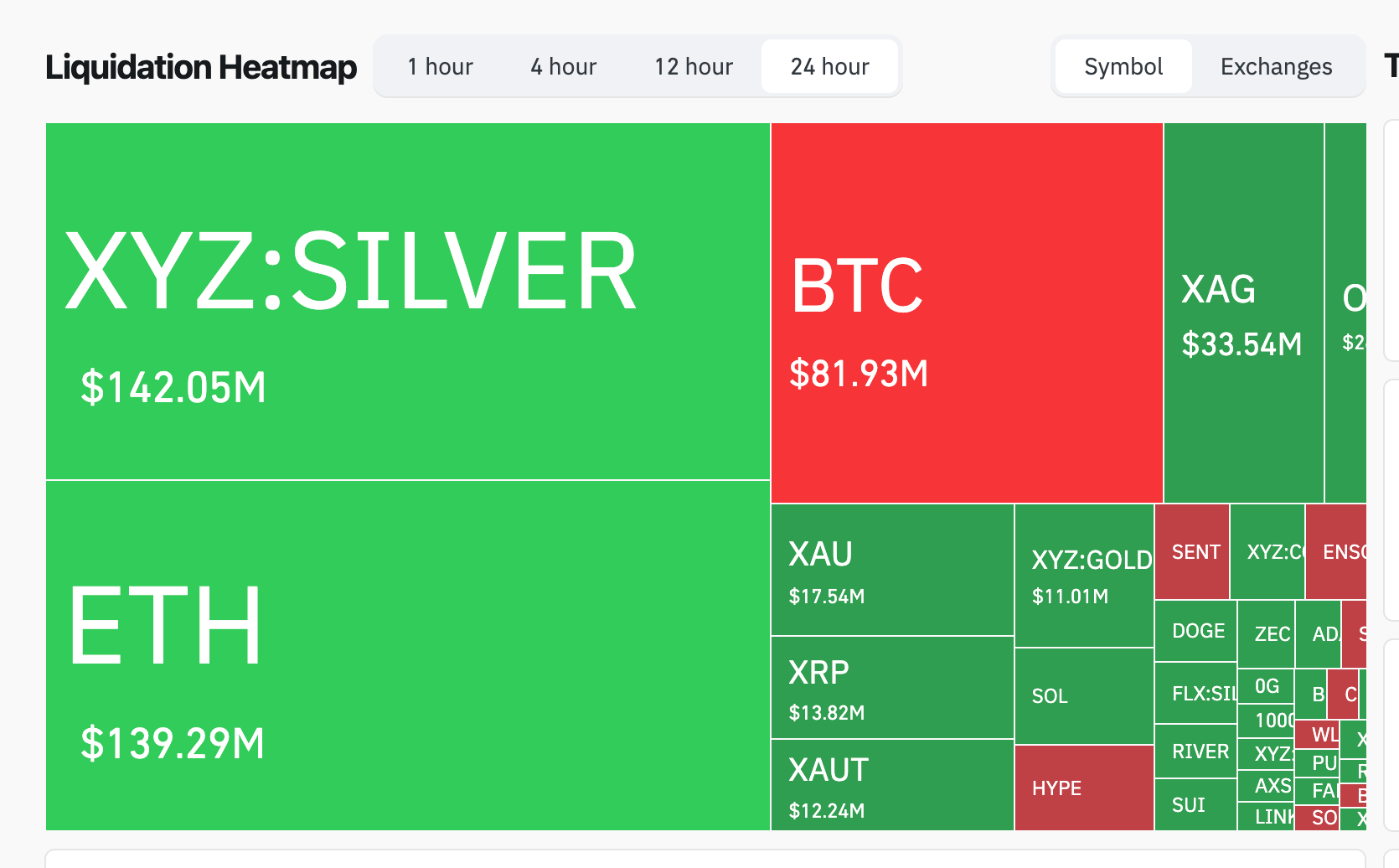

- Tokenized silver futures took center stage, leading a wholesale crypto market wipeout to the tune of $142 million-more dramatic than a Shakespearean tragedy-leaving Bitcoin and Ether eating dust.

- This financial soap opera was triggered by a sudden plunge in silver prices, a sharp reduction in hedge fund bullish bets, and CME’s whimsical decision to crank up margin requirements by a gargantuan 50%. Because who doesn’t love a good margin hike?

- Turns out, crypto markets are becoming the new playground for macro traders, turning digital assets into commodities carnival rides, all while playing dress-up as traditional markets-how charmingly confusing!

Tokenized silver, that shiny obsession of modern finance darlings, led the worst liquidation storm in crypto history. Over 129,117 traders watched as roughly half a billion dollars evaporated faster than you can say “margin call.”

Of these, a princely sum of $142 million was wiped out in silver futures-proof that even precious metals aren’t safe from crypto’s unpredictable hysteria. Bitcoin trailed behind with $82 million, while Ether scored nearly $139 million-clearly, traders prefer their metals with a sprinkle of digital chaos.

The most dramatic single blow was dealt on Hyperliquid, where an $18.1 million leveraged XYZ:SILVER-USD position was forcibly closed. Apparently, the market’s swing was so wild that even the most daring leveraged traders couldn’t hold their ground-for now.

This unprecedented spectacle reveals that crypto markets, normally dominated by Bitcoin and Ether, are adopting a bizarre new role: macroeconomic playgrounds where traders bet on everything from metals to rates, as if the market’s primary purpose was a giant crystal ball.

Silver’s recent rollercoaster was kicked off by an extraordinary rally followed by a swift reversal-like a bad breakup, but with more charts and less heartbreak. Hedge funds, perhaps unnerved by the sudden shift, trimmed their bullish silver bets to a 23-month low, reducing net-long exposure by over a third, as if to say, “Maybe silver isn’t the path to eternal riches after all.”

Adding fuel to the fire, CME announced a hefty hike in margin requirements-up to 50% on some silver futures. Because nothing says “fun” like needing more collateral during a market whimper.

Meanwhile, tokenized metals-those charming innovations allowing leverage without the fuss of traditional futures-became the star of the show, trading around the clock and tempting traders during macro chaos. Who needs boring old assets when you can gamble on a digital representation of silver at 3 a.m.?

Interestingly, Bitcoin was surprisingly subdued on the liquidation list, showing that even in destruction, the king remains somewhat resilient-though not immune to the chaos.

All these antics underscore a curious new trend: crypto venues are evolving into macro trading arenas, where traders play dress-up as kings of commodities and currencies, all while pretending the whole circus is normal.

Whether this tumultuous chapter in metal markets ends with stability or further chaos remains to be seen-and if history is any guide, expect the unexpected, preferably with a side of sarcasm.

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- All 6 Takopi’s Original Sin Episodes, Ranked

- Emmerdale star Joshua Richards on Bear’s shocking descent into modern slavery – and past role exploring “horrifying” subject matter

- Best Werewolf Movies (October 2025)

2026-01-31 11:30