It is with no small amount of amusement that I must draw your attention to the pronouncements of one Mr. Raoul Pal, a gentleman who has taken it upon himself to refute the prevailing notion that our beloved cryptocurrency is languishing in a state of disrepair. Instead, he suggests, with an air of confidence, that it is merely the unfortunate victim of transient US liquidity vexations-those pesky little disturbances associated with Treasury cash management and the ever-dreadful specter of government shutdowns.

In a rather spirited discourse shared on the social platform X (where one might find all manner of opinions, often inflated and unsavory), Mr. Pal endeavors to dismantle what he deems “false narratives.” His assertion that BTC and its fellow travelers are irrevocably broken and that this cycle has met its demise appears to him a most tantalizing “narrative trap,” particularly as one observes prices plummeting with alarming regularity-indeed, “puking each and every day,” as he so colorfully puts it.

Upon receiving an inquiry from a GMI hedge fund client regarding the beleaguered SaaS equities, Mr. Pal found himself compelled to reevaluate the situation, leading him to the remarkable conclusion that both SaaS and BTC share the same fate-a veritable mirror image of market woes! “Huh?” you might exclaim, which precisely encapsulates the bewilderment one feels upon realizing there exists yet another factor that has eluded our collective understanding.

Could the Crypto Decline Be Attributed to US Liquidity Follies?

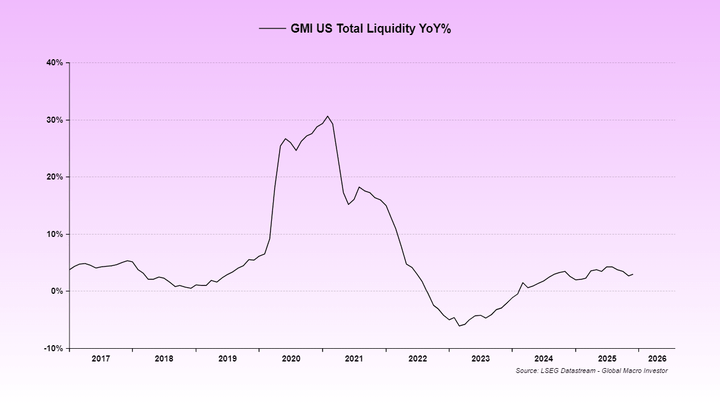

Mr. Pal’s diagnosis? A lack of liquidity, my dear readers. He elucidates that the liquidity of our fair US has been stymied by not one, but two episodic shutdowns, as well as certain “plumbing issues” within the financial system. He posits that the reverse repo facility of the Federal Reserve was effectively drained dry by the year 2024, leaving us bereft of the customary offsets that might have softened the blow during the Treasury General Account (TGA) rebuild in the sultry months of July and August.

In his surprisingly engaging narrative, he correlates the disappointing performance metrics of macroeconomic indicators to this very liquidity shortfall, boldly stating that the anemic conditions of the ISM are attributable to such deficiencies. One cannot help but chuckle at the intricacies of financial terminology, which often seem to mask the simple truths of human folly.

Though Mr. Pal typically trains his keen analytical eye upon global total liquidity-given its historical rapport with Bitcoin and American technology stocks-he now asserts that our domestic measures hold sway over the current phase of this tumultuous cycle. The crux of his argument hinges on the contention that long-duration, high-volatility assets, such as our dear Bitcoin and those equally beleaguered SaaS stocks, are the most vulnerable to a liquidity withdrawal. How delightfully convoluted!

He also points to the recent rally in gold as an additional impediment to liquidity influxes. “The rally in gold essentially siphoned off all marginal liquidity,” he laments, thereby depriving both BTC and SaaS of much-needed sustenance. It seems that poor liquidity has a penchant for wreaking havoc upon the riskiest of assets.

Moreover, Mr. Pal characterizes the latest government shutdown as an aggravating circumstance, wherein the Treasury “hedged” by refraining from drawing down the TGA after the preceding shutdown, thus exacerbating the liquidity drain. Such delightful chaos! This, he claims, constitutes the “current air pocket” responsible for the “brutal price action” we observe across riskier investments.

Yet, amidst this disarray, he proclaims that relief may be forthcoming; the signs, he insists, suggest that the ongoing shutdown shall soon reach its resolution, thereby clearing the final liquidity hurdle. The prospect of a “liquidity flood” looms on the horizon-ah, what joy that would bring to beleaguered investors!

Extending his critique to the expectations surrounding the Federal Reserve, Mr. Pal dismisses the notion that Kevin Warsh would adopt a hawkish stance on policy matters, describing such sentiments as “utter nonsense.” His belief is that Mr. Warsh’s mandate corresponds more closely with the leniency of the “Greenspan era playbook,” marked by rate cuts and an economy invigorated by productivity gains.

In a moment of candor, Mr. Pal concedes that GMI had previously overlooked the pivotal role of US liquidity in our current predicament, having long emphasized global measures. “There is no disconnect,” he states with a wry acknowledgment, attributing their oversight to a chain of unforeseeable events that culminated in this liquidity debacle.

Ultimately, his missive is less a proclamation to pinpoint the nadir of this cycle and more a reminder that, oftentimes, patience exceeds the importance of price in these cyclical trades. “PATIENCE!” he urges, while maintaining an optimistic outlook for the year 2026, should the anticipated policy and liquidity developments come to fruition.

At the time of this writing, Bitcoin trades at a rather impressive $77,510.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Ashes of Creation Rogue Guide for Beginners

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Heather Rae El Moussa Reacts to Critics of Christina Haack Friendship

- 10 Best Anime Heroes Who Followed Goku’s Legacy

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

2026-02-03 01:06