CoinDesk Indices

What to know:

You are perusing Crypto Long & Short, our weekly dispatch where the investor’s breath fogs the glass of charts. Sign up to catch it in your inbox every Wednesday, like a stubborn note slipped under the door by a night-wind clerk.

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Lukas Enzersdorfer-Konrad on how the EU’s regulatory clarity could allow tokenised markets to scale

- Andy Baehr tells BNB to “suit up”

- Top headlines institutions should pay attention to by Francisco Rodrigues

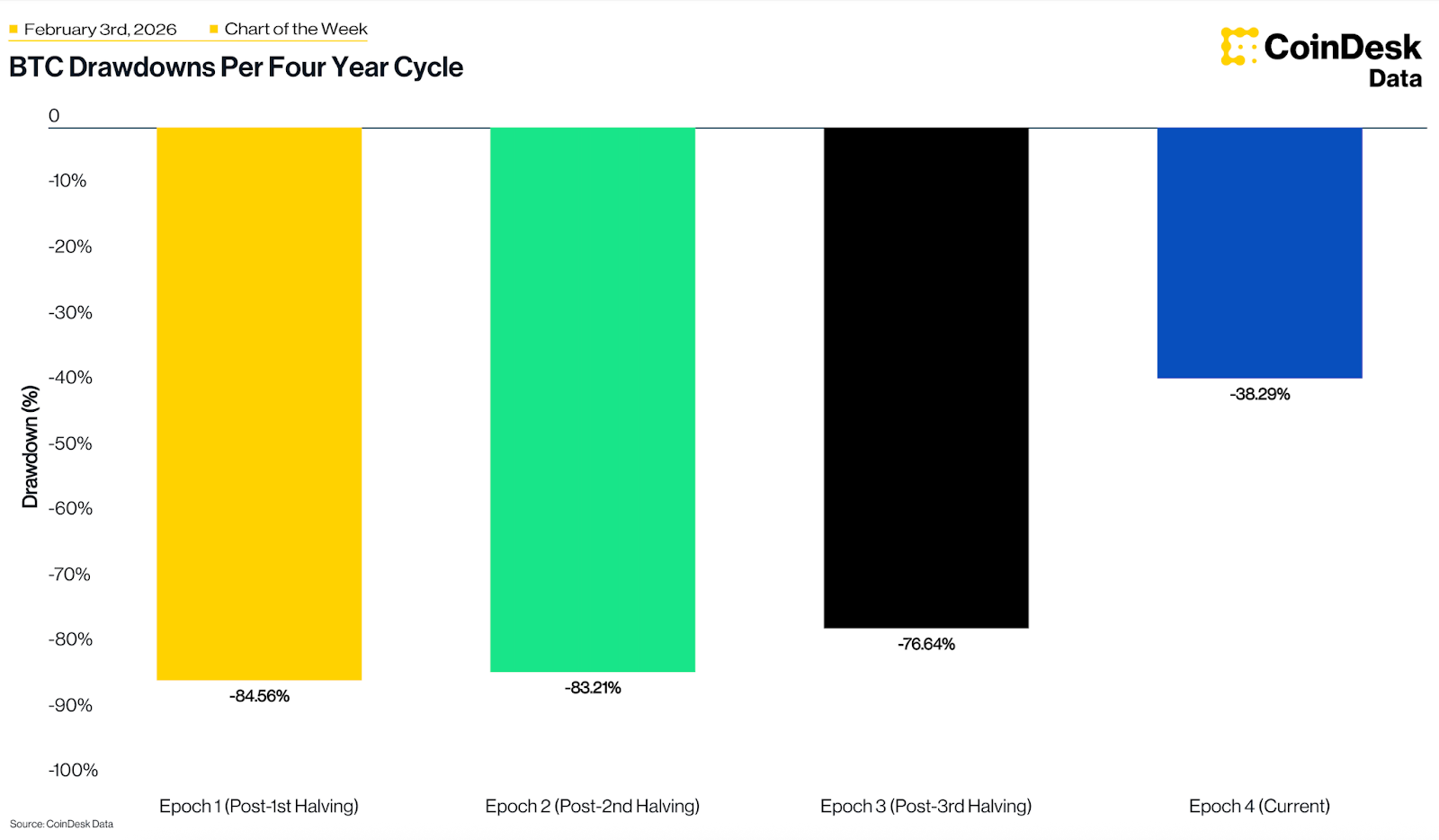

- “Bitcoin‘s drawdowns compress as markets mature” in Chart of the Week

-Alexandra Levis

Expert Insights

Europe’s role in the next wave of tokenisation

– By Lukas Enzersdorfer-Konrad, chief executive officer, Bitpanda

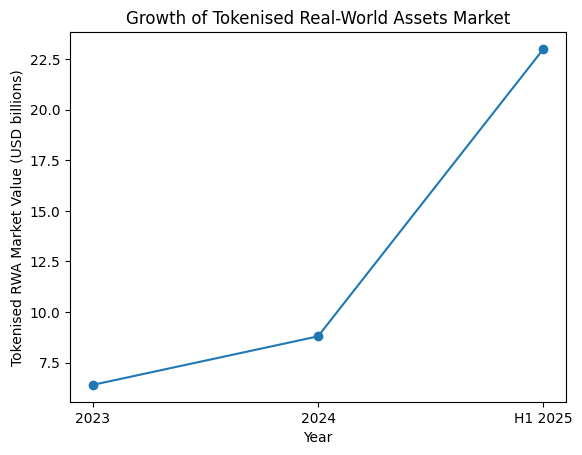

The tokenisation of real-world assets (RWAs) has shed its rumor of frost and stood up as a legitimate body, the backbone of institutional faith in circuits of blockchain. In the first half of 2025 alone, tokenised RWAs swelled by 260%, reaching $23 billion in on-chain echo. Across the years, the field shed its masquerade and learned to walk upright, a structural tremor moving markets from a fragile dream to steel-backed certainty. This is a quiet, stubborn dawn: a shift in how markets are built and, like a stubborn linchpin, how they endure.

Tokenisation begins to stand as the foundation of institutional blockchain adoption, with BlackRock, JPMorgan and Goldman Sachs having publicly explored or deployed related ventures, and giants nodding to its potential. Yet growth remains a careful horse: most assets still live behind permissioned doors, shrouded by regulatory fog and the stubborn walls of interoperability. Scalable public-network rails remain under construction, slowing the march from pilots to a crowded shore of mass participation. In short, tokenisation works, but the rails to travel the world are not yet finished.

What’s missing? Regulation, the kind of clear compass that allows balance sheets to sail and long-term plans to take root. Retail citizens need transparent rules that shield without closing doors. Markets crave standards they can trust. Without these threads, liquidity stays shallow, systems stay segregated, and innovation hesitates at the gate.

Europe has unmistakably stepped forward as an early steward here. With MiCA now in force and the DLT Pilot Regime opening structured digital-securities experiments, the region has moved beyond scattered sandboxes into a continental chorus. The European market becomes the first to weave a unified regulatory mantle over tokenised assets. Compliance stops being a burden and becomes a competitive edge, offering the legal, operational, and technical certainty that invites imagination to dance with scale.

The continent’s regulatory-first posture already gathers momentum. Under MiCA and the EU’s DLT Pilot Regime, banks have begun issuing tokenised bonds on regulated infrastructure, with European issuance reaching over €1.5 billion in 2024 alone. Asset managers test on-chain fund structures for retail, while fintechs tie digital-asset rails to licensed platforms. These are more than pilots; they are the cart becoming the vehicle, turning compliant infrastructure into a living road for all.

A new phase: interoperability and market structure

The next frontier of tokenisation will lean on interoperability and shared standards, places where Europe’s regulatory clarity could again set the tempo. As more institutions bring tokenised products to market, the risk of stubborn silos-liquidity pools parted by proprietary schemes-looms as a parody of traditional finance grafted onto digital skin.

While traditional finance spent years chasing speed, the coming wave will be forged in trust: who builds and governs the rails, and whether institutions and retail alike can rely on them. Europe’s clarity around rules and market structure offers a real chance to set global standards rather than merely follow them.

The EU can reinforce this stance by championing cross-chain interoperability and common disclosure standards. Laying down shared rules early would let tokenised markets scale without replaying the fragmentation that slowed earlier financial revolutions.

Headlines of the Week

– By Francisco Rodrigues

President Donald Trump’s surprising nomination of Kevin Warsh to lead the Fed introduced new variables that unsettled markets. The precious metals rally gave way to a brisk selloff, while cryptocurrency prices endured a correction, yet the players moved to carve out value.

- Bitcoin is the ‘newest, coolest software’: Inside Kevin Warsh’s complicated crypto history: Trump tapped former Fed governor Kevin Warsh, a crisis veteran with Wall Street experience, as the next Federal Reserve Chair.

- Australia’s corporate regulator flags risks from rapid innovation in digital assets: The Australian Securities and Investments Commission flags digital assets and AI risks in its latest annual report.

- The hidden reason bitcoin didn’t rally as gold and silver surged: Analysts point to orderbook data showing sell-side pressure below $90,000 that nipped upside momentum in the bud, even when broader conditions looked favorable.

- Hyperliquid’s HYPE emerges as crypto market haven: The token rallied as it merged traditional assets with crypto; silver futures volume surged on the platform, with HYPE rising as prediction markets and options loomed on the horizon.

- Binance moves 1,315 bitcoin into user protection fund as it prepares to buy $1 billion BTC: The exchange shifted around $100 million in bitcoin into its Secure Asset Fund for Users, a dramatic rearrangement of protection reserves.

Vibe Check

Suit up, BNB

– By Andy Baehr, head of product and research, CoinDesk Indices

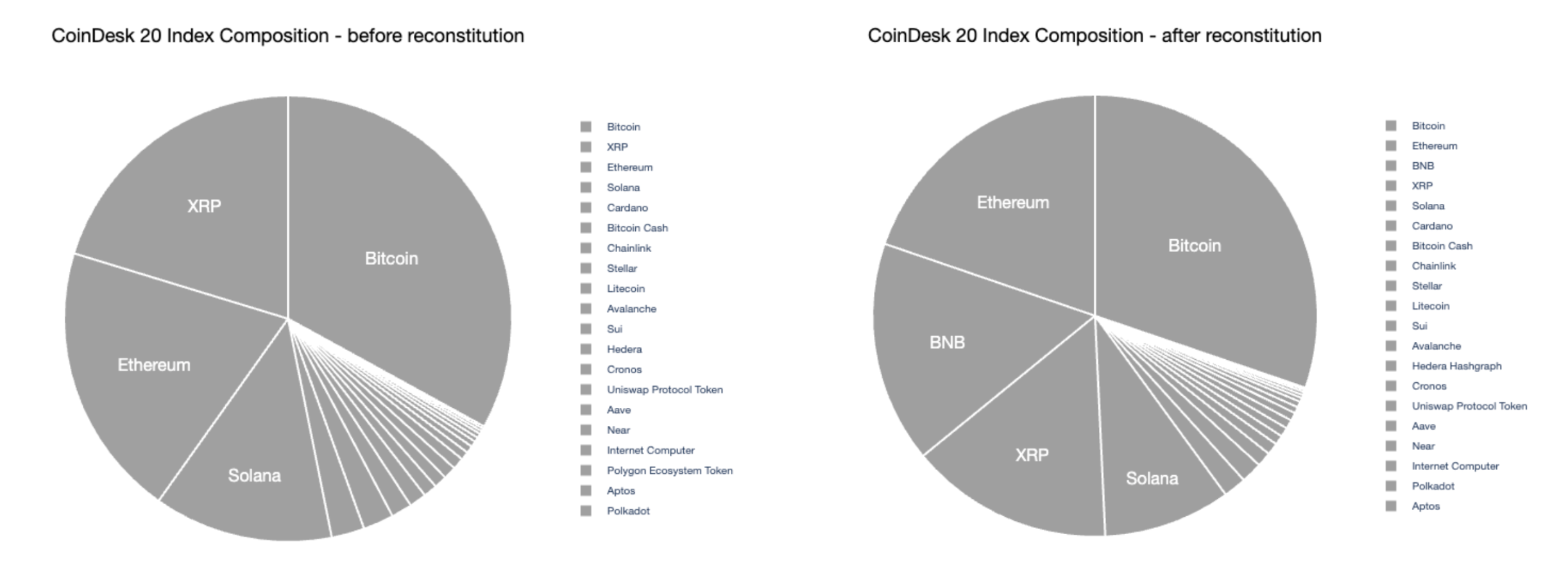

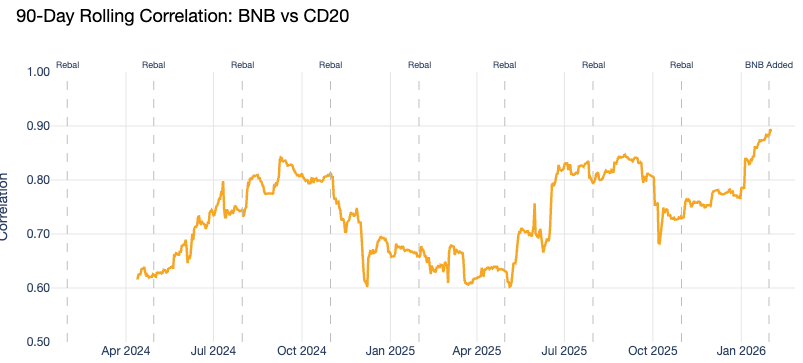

Last week’s CoinDesk 20 (CD20) reconstitution brought BNB into the index for the first time. It wasn’t about size alone-BNB has long been a leviathan in market cap. It was about meeting liquidity and other gatekeepers that decide inclusion. For the first time, BNB cleared those gates.

The result? One of the largest shifts since the index’s birth in January 2024. BNB enters the CD20 with a weight over 15%, a heavyweight debut that changes the texture of the lineup.

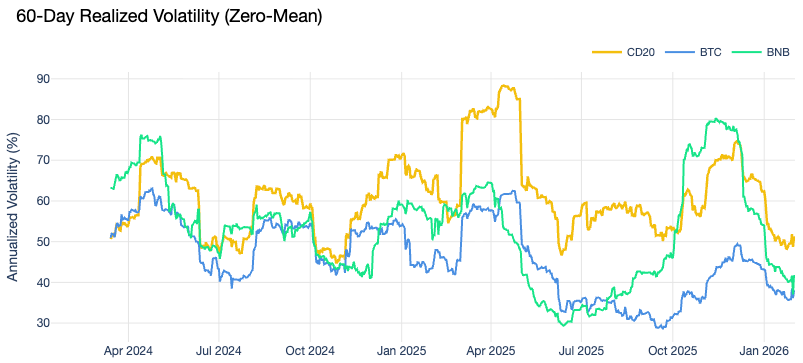

From a portfolio-building view, this is not a trivial tremor. BNB has shown lower volatility than many peers, a thread that could soften the whole fabric of the index. Its correlation with others has loosened lately, offering a delicate fabric of diversification. The possible consequence: a calmer, more varied tapestry.

For a big name, the cost is shared esteem: others drift downward as weights adjust to welcome the newcomer. The pies tell the same tale-old holdings shrink to make space for a newer star.

As crypto steps into what we might call its “sophomore year” of institutional maturity, the CoinDesk 20 begins its own third season of life. The index grows alongside the market it seeks to describe.

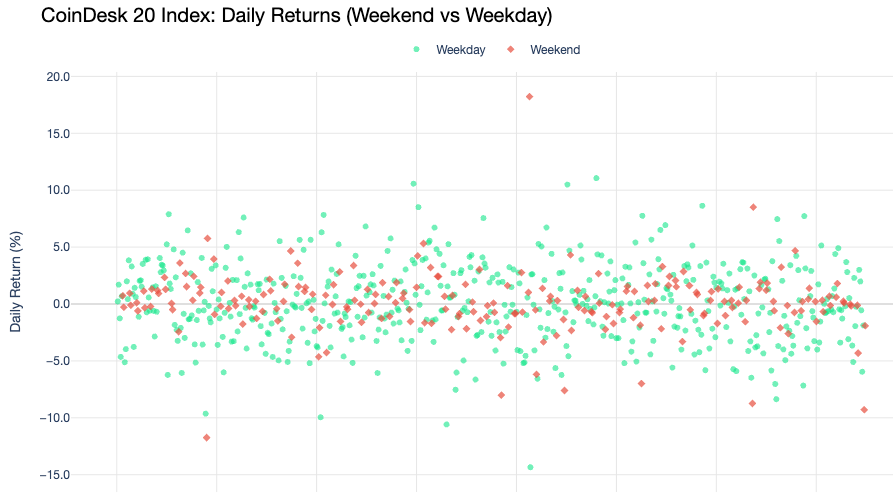

Sunday scaries (real or imagined?)

This past weekend wore its roughness like a coat two sizes too tight. Bitcoin wandered below $75K, billions in liquidations whispered into the night, and if you inhabit crypto, you witnessed the theater live. Whether a 24/7 marketplace is a blessing or a curse, it is simply the weather now.

After weekends such as this, it begins to feel like a pattern-crypto drinking the world’s anxieties while traditional markets sleep. We tested that feeling against the numbers.

The scatter plot shows daily returns for the CoinDesk 20, weekends shaded specially. There are moments of heavy downside on Saturdays and Sundays, yes-but many weekends are quiet as a church, and plenty of weekdays roar without fitting a narrative.

Perhaps memory inflates: painful weekends haunt our minds more than serene ones. The drama of markets yawning while others sleep heightens the weight. Yet the data argues that Sunday scaries may be more perception than pattern.

Still, after a weekend such as this, the feeling remains real even if the science smiles faintly. We keep indexing through it all-watching, measuring, and trying to distinguish signal from sentiment.

Chart of the Week

Bitcoin’s drawdowns compress as markets mature

Bitcoin’s peak-to-trough declines have steadily narrowed, from a brutal -84% in the early epoch after the first halving to a current cycle maximum of -38% as of early 2026. This shrinking pain hints at a market maturing, as institutions and spot ETFs stand as a steadier floor than the wild 80% drops of the past. In history, Bitcoin took roughly 2 to 3 years to recover from cycle bottoms to new highs, though speed is increasing-Epoch 3 recovered its peak in 469 days.

Looking for more? Receive the latest crypto news from coindesk.com and explore our robust Data & Indices offerings by visiting coindesk.com/institutions.

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Gigi Hadid, Bradley Cooper Share Their Confidence Tips in Rare Video

- Gold Rate Forecast

- 50-Hour Square Enix RPG Joins Xbox Game Pass

2026-02-04 20:48