What to know:

By Jacob Joseph (All times ET unless indicated otherwise)

Bitcoin remains ensnared within the tight corset of the $66,000-$70,000 range, a situation most peculiar and unbecoming for one of such lofty aspirations. At the hour of composition, the BTC price had managed a modest ascent of 1.04% over the preceding twenty-four hours. Ether, that ever-capricious companion, was exchanged at $2,020, a rise of 1.43% on the day.

Institutional positioning remains a central theme, as if the very fate of the realm depended upon it.

Digital asset treasury companies and public institutions, those modern-day matrons of finance, were among the most ardent patrons of demand in mid-2025, their fervor propelling prices to record heights. Yet with bitcoin now languishing more than 50% below its October zenith, the landscape has shifted with the grace of a startled goose. Many treasury-focused firms now find themselves in dire straits, their fortunes diminished. Metaplanet, that once-proud titan, reported a net loss of $619 million this week, while Harvard Management Company, ever the prude, trimmed its exposure to bitcoin ETFs.

Ether treasury firms, too, are recalibrating their strategies. ETHZilla disclosed last evening that tech billionaire Peter Thiel and his Founders Fund, that most dubious of alliances, had divested their entire 7.5% stake in the company. The firm, in its wisdom, has also reduced its ether holdings through multiple sales since October.

Still, not all are retreating from the dance. Michael Saylor’s Strategy, that indefatigable suitor, continued to build its bitcoin position, adding 2,486 BTC earlier this week and bringing total holdings to 717,131 BTC. Meanwhile, two Abu Dhabi-based funds-Mubadala Investment Company and Al Warda Investments, emissaries of wealth from a distant land-disclosed yesterday that they collectively held more than $1 billion in BlackRock’s Bitcoin ETF at the end of last year.

BitMine Immersion Technologies, that most industrious of enterprises, announced yesterday its continued resolve, adding 45,759 ETH over the past week and bringing its total holdings to 4.4 million ETH. Of these, approximately 3 million are currently staked, generating additional yield as if by alchemy.

Meanwhile, in a separate development disclosed yesterday, BlackRock advanced its plans for a U.S.-listed yield-generating ether product. An amended S-1 filing signaled further progress toward the iShares Staked Ethereum Trust ETF, with a BlackRock affiliate purchasing 4,000 seed shares at $25 each, providing $100,000 in initial capital for the trust.

While these developments provide constructive long-term signals, it may be premature to declare an end to the recent drawdown, even with bitcoin and ether trading roughly 50% and 60% below their all-time highs. One might as well predict the outcome of a country dance from the flutter of a moth’s wings.

At the same time, TradFi indexes, those staid relics of the old world, are beginning to show signs of fatigue, as rising AI-related capital expenditures outpace earlier estimates and place increasing pressure on corporate cash flows. Stay alert! Or perhaps not-madness may yet be a more prudent course.

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 2 of 4: ETHDenver

Market Movements

- BTC is up 0.86% from 4 p.m. ET Tuesday at $68,227.58 (24hrs: -0.09%)

- ETH is up 1.03% at $2,019.54 (+2.24%)

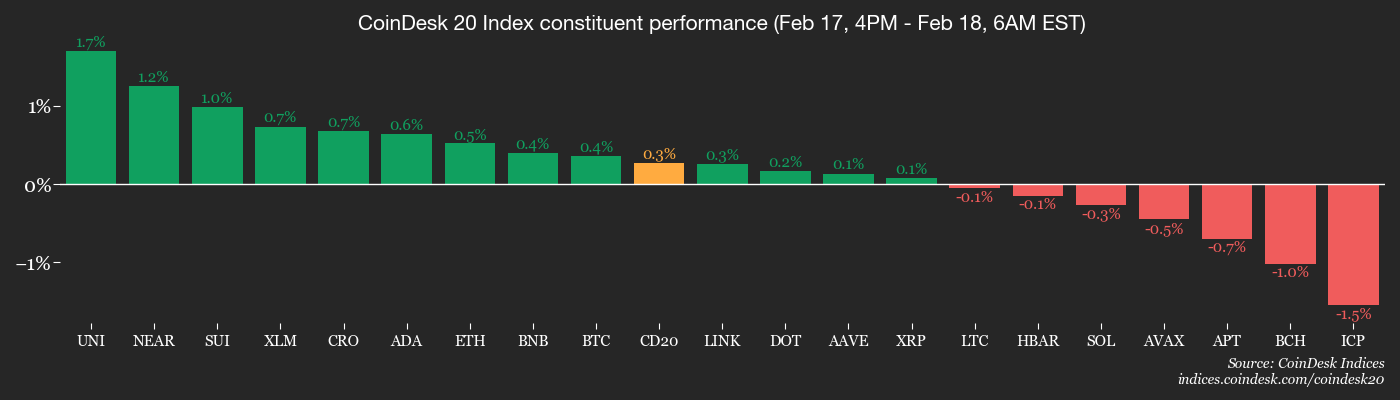

- CoinDesk 20 is up 0.55% at 1,994.39 (+0.54%)

- Ether CESR Composite Staking Rate is down 3 bps at 2.81%

- BTC funding rate is at 0.0018% (1.9425% annualized) on Binance

- DXY is up 0.13% at 97.28

- Gold futures are up 0.58% at $4,934.20

- Silver futures are up 2.92% at $75.68

- Nikkei 225 closed up 1.02% at 57,143.84

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 1.03% at 10,664.40

- Euro Stoxx 50 is up 0.93% at 6,077.76

- DJIA closed on Tuesday unchanged at 49,533.19

- S&P 500 closed up 0.1% at 6,843.22

- Nasdaq Composite closed up 0.14% at 22,578.38

- S&P/TSX Composite closed down 0.54% at 32,896.55

- S&P 40 Latin America closed down 0.62% at 3,694.06

- U.S. 10-Year Treasury rate is up 1.9 bps at 4.073%

- E-mini S&P 500 futures are up 0.52% at 6,896.50

- E-mini Nasdaq-100 futures are up 0.59% at 24,914.00

- E-mini Dow Jones Industrial Average Index futures are up 0.47% at 49,844.00

Bitcoin Stats

- BTC Dominance: 58.56% (-0.01%)

- Ether-bitcoin ratio: 0.02947 (-0.11%)

- Hashrate (seven-day moving average): 1,062 EH/s

- Hashprice (spot): $34.12

- Total fees: 2.29 BTC / $155,681

- CME Futures Open Interest: 116,675 BTC

- BTC priced in gold: 13.7 oz.

- BTC vs gold market cap: 4.5%

Technical Analysis

- The chart shows bitcoin’s price against the dollar in one-week candles.

- The latest reading shows the price remains below the 200-week exponential moving average (EMA).

- Historically, breaks below the EMA have established a “bottom” in a bear market. Whether that’s the case now remains to be seen.

- The lack of divergences in the RSI suggests we are unlikely to see a sustained rebound in the short term.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $166.02 (+1.03%), +1.37% at $168.29 in pre-market

- Circle Internet (CRCL): closed at $61.62 (+2.63%), +2.21% at $62.98

- Galaxy Digital (GLXY): closed at $21.30 (-1.66%), +0.80% at $21.47

- Bullish (BLSH): closed at $32.00 (+0.85%), unchanged in pre-market

- MARA Holdings (MARA): closed at $7.51 (-5.18%), +1.33% at $7.61

- Riot Platforms (RIOT): closed at $14.65 (-3.75%), +1.43% at $14.86

- Core Scientific (CORZ): closed at $17.23 (-3.42%)

- CleanSpark (CLSK): closed at $9.28 (-5.79%), +0.86% at $9.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.00 (-3.24%)

- Exodus Movement (EXOD): closed at $10.09 (-10.47%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $128.67 (-3.89%), +1.27% at $130.30

- Strive (ASST): closed at $8.18 (-1.80%), +0.86% at $8.25

- SharpLink Gaming (SBET): closed at $6.66 (-2.77%), +0.30% at $6.68

- Upexi (UPXI): closed at $0.72 (-6.37%)

- Lite Strategy (LITS): closed at $1.10 (-1.79%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$104.9 million

- Cumulative net flows: $54.21 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $48.6 million

- Cumulative net flows: $11.73 billion

- Total ETH holdings ~5.73 million

Read More

- Best Controller Settings for ARC Raiders

- How to Get to Heaven from Belfast soundtrack: All songs featured

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- 10 Most Memorable Batman Covers

- Ashes of Creation Mage Guide for Beginners

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

- Wife Swap: The Real Housewives Edition Trailer Is Pure Chaos

- The USDH Showdown: Who Will Claim the Crown of Hyperliquid’s Native Stablecoin? 🎉💰

- 7 Best Animated Horror TV Shows

- The Best Members of the Flash Family

2026-02-18 15:52