It is a truth universally acknowledged, that a cryptocurrency in possession of a considerable market cap must be in want of liquidity-or at the very least, a dramatic exit from Binance. XRP, that most capricious of assets, has been observed retreating from Binance’s embrace with such subtlety that even CryptoQuant’s metrics have raised their proverbial eyebrows, murmuring about “renewed accumulation” after a year of losses sharp enough to make Mr. Darcy wince.

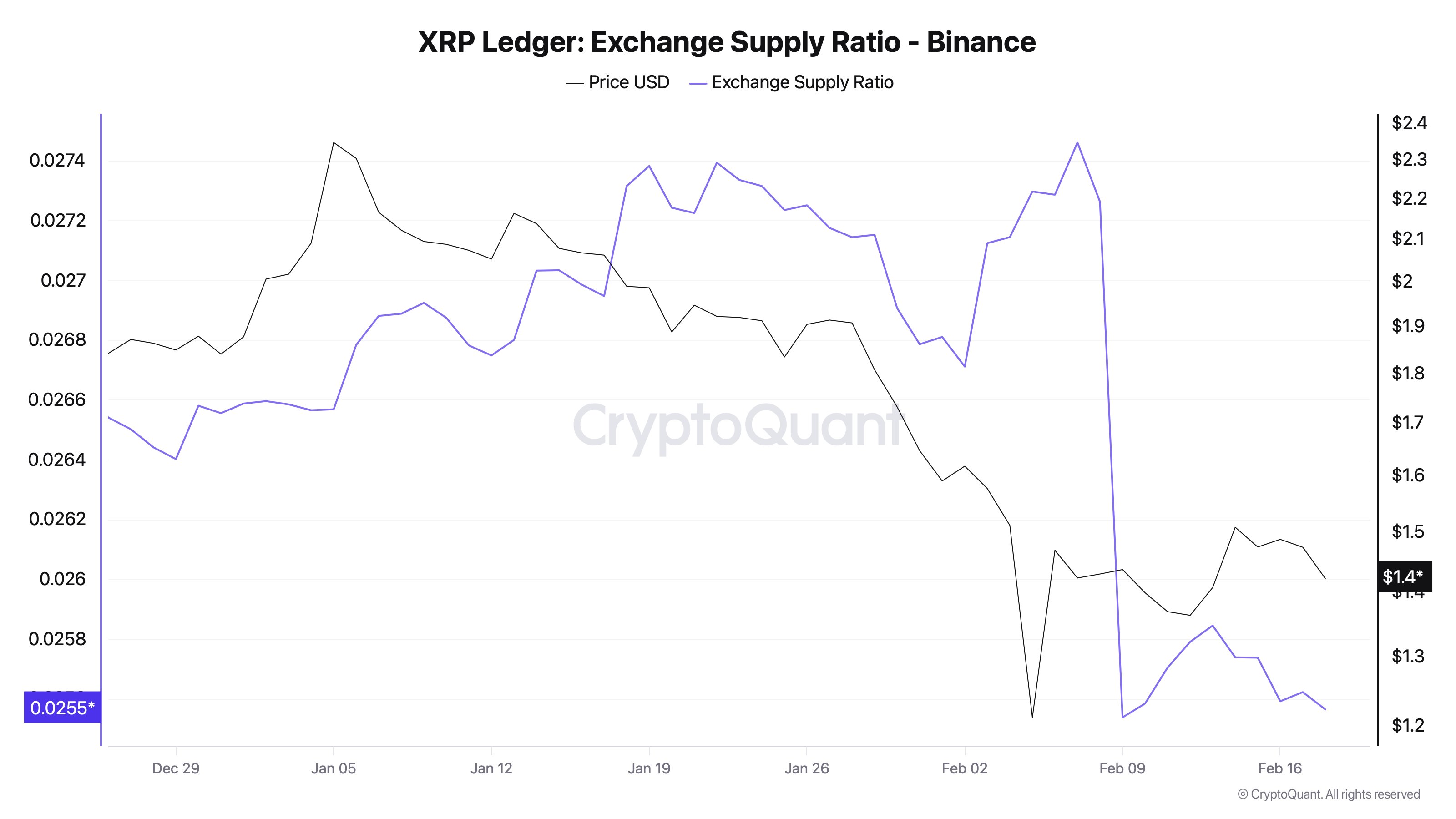

One Mr. Darkfost of CryptoQuant (known to society by his Twitter handle @Darkfost_Coc) has declared the matter of utmost significance. He notes, with the solemnity of a man tallying inheritance taxes, that Binance’s “supply ratio”-a numerical measure of how much XRP lingers on the exchange-has declined. This, he insists, signals a shift from speculative fervor to “custody,” which is to say, the digital equivalent of hiding one’s coin in a locked drawer rather than leaving it temptingly on the gaming table.

The Binance Proportion Diminishes: A Migration of XRP Beyond the Exchange

CryptoQuant, ever the astute observer of market manners, explains thus: When reserves swell, it is as though investors hold a fire sale in their parlors, eager to offload their burdens. When reserves dwindle, however, one might imagine a grand exodus to private vaults, where coins may be ogled in solitude. “Funds are moved into private custody solutions,” Darkfost remarks, as though describing the latest fashion in Regency-era hat-making.

Over the past ten days, Binance’s XRP supply ratio fell from 0.027 to 0.025-“about 200 million XRP left the platform,” he notes, with the gravity of a coroner reporting a suspicious departure. Yet let us not be too hasty! Not all such movements are the work of eager investors; exchanges, like nervous debutantes, frequently reshuffle their holdings for reasons best known to themselves.

Still, Darkfost assures us Binance’s ledgers are as transparent as a well-polished looking glass, allowing one to distinguish between the genuine transactions of earnest coin-holders and the bureaucratic fiddling of exchange operators. A relief, to be sure, though one wonders how many custodians were consulted in this determination.

A 40% Drawdown: A Setback Fit for a Tragic Novel

Our narrator reminds us that XRP has suffered a correction of 40% since New Year’s Day-a loss so profound it might inspire a Gothic lament. Yet such misfortunes, he suggests, may now attract “longer-horizon investors,” who see in this downturn an opportunity to hoard digital trinkets at a discount.

Thus, the logic unfolds: fewer coins on exchanges mean fewer temptations for panicked sellers, and more coins in wallets suggest the patient resolve of collectors. Whether this signals a bullish proposal or merely a speculative flirtation remains to be seen. At press time, XRP lingered at $1.4161, a price as indecisive as a heroine at a country ball.

Read More

- Best Controller Settings for ARC Raiders

- Netflix’s Stranger Things Replacement Reveals First Trailer (It’s Scarier Than Anything in the Upside Down)

- The Best Members of the Flash Family

- ‘Crime 101’ Ending, Explained

- 7 Best Animated Horror TV Shows

- Arknights: Endfield launches January 22, 2026

- How to Froggy Grind in Tony Hawk Pro Skater 3+4 | Foundry Pro Goals Guide

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Wife Swap: The Real Housewives Edition Trailer Is Pure Chaos

- 10 Best Anime to Watch if You Miss Dragon Ball Super

2026-02-19 18:58