The Supreme Court, ever the paragon of legal precision, has declared Trump’s tariffs unlawful, and in a twist of fate, Bitcoin has leapt above $67,000, leaving crypto markets in a state of confused elation.

The U.S. Supreme Court, in a moment of rare clarity, has declared Trump’s global tariffs unlawful, sparking a flurry of debate among financial pundits and crypto enthusiasts who are now questioning their life choices.

Lower courts, ever the reliable sidekicks, agreed with many of those claims, and the Supreme Court’s ruling brings the legal process to a dramatic close, leaving the parties involved to ponder their next move.

Court Rejects Use of Emergency Powers

The Supreme Court, in a 6-3 decision that left many scratching their heads, ruled that the president lacked the authority to impose those tariffs under the International Emergency Economic Powers Act. One wonders if the president was ever truly in charge.

The justices said the law does not give the president the power to levy broad tariffs during peacetime. The decision ends a major White House trade measure that had remained active during long court challenges, much like a stubborn British weather pattern.

These tariffs, which targeted imports from Canada, China, Mexico, and most other countries, were as effective as a screen door on a submarine in the face of global trade.

The White House had projected that these tariffs would raise a staggering $1.5 trillion over a decade, a figure so large it’s probably just a typo.

They were announced after national emergencies tied to fentanyl and trade deficits, and the policy endured through years of legal battles, much like a stubborn British weather pattern.

SUPREME COURT STRIKES DOWN TRUMP’S GLOBAL TARIFFS

The Supreme Court ruled Friday that President Trump’s global tariffs are illegal, rejecting his use of emergency powers to impose trade duties.

• The tariffs, covering imports from Canada, China, Mexico, and nearly all…

– *Walter Bloomberg (@DeItaone)

Several lawsuits argued that these tariffs were, in essence, unauthorized taxes on American buyers, a claim that would make even the most ardent tax protester blush.

Lower courts, ever the reliable sidekicks, agreed with many of those claims, and the Supreme Court’s ruling brings the legal process to a dramatic close, leaving the parties involved to ponder their next move.

The court decision now leaves federal agencies to manage the next steps in trade enforcement and tariff procedures, a task that sounds as thrilling as watching paint dry.

Market Focus Turns to Crypto and Currency Conditions

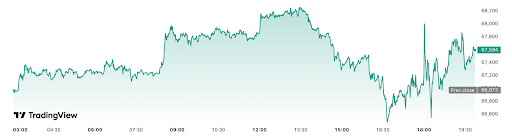

Bitcoin, ever the resilient underdog, surged higher after the ruling, trading above $67,000 during the afternoon session, much to the delight of those who thought it was a good idea to invest in a digital asset that’s basically just a fancy ledger.

Traders viewed the move as a reaction to the end of a major trade policy that shaped economic uncertainty. Market data showed strong activity on major exchanges as the news spread, much like a group of people waiting for the bus that never comes.

Bitcoin had traded near $66,800 earlier in the day after new inflation numbers were released. The PCE report came in at 2.9% year over year, a number that sent early market pressure racing through the veins of traders who had already sold their stocks and bought Bitcoin.

The ruling shifted the tone, and Bitcoin moved back above a key psychological level during the session, much like a stubborn British weather pattern.

Other major cryptocurrencies also moved higher as traders reacted to the ruling. Market platforms reported added volume, and several assets rose during the same period, much like a group of people waiting for the bus that never comes.

The broader crypto market showed a steady response as traders monitored new statements around the court decision, a task that sounds as thrilling as watching paint dry.

Related Reading: Trump’s Crypto Advisor Warns: Pass Bill Now

Policy Questions Continue After the Court Ruling

The Supreme Court, in a move that left many scratching their heads, did not rule on tariff refunds, leaving questions about whether the U.S. may need to return up to $150 billion, a figure so large it’s probably just a typo.

Several traders and analysts now watch for new guidance from federal agencies as the refund issue remains open, a task that sounds as thrilling as watching paint dry.

Decisions about refunds may shape future debates around trade and currency movements, much like a group of people waiting for the bus that never comes.

VanEck’s Matthew Sigel, ever the prophet of doom, said on X that the ruling may reduce tariff revenue and could lead to more money printing, a statement that was met with the same level of enthusiasm as a tax audit.

Bitcoin rallies as Trump tariffs struck down by US Supreme Court

In the absence of tariff revenues, money printing and debasement will accelerate.

– matthew sigel, recovering CFA (@matthew_sigel)

The end of the tariffs brings new attention to U.S. trade policy, as traders continue to track market activity across crypto and traditional assets, a task that sounds as thrilling as watching paint dry.

Market platforms expect more reactions as federal bodies release further updates in the coming days, much like a group of people waiting for the bus that never comes.

Read More

- Best Controller Settings for ARC Raiders

- ‘Crime 101’ Ending, Explained

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Ashes of Creation Mage Guide for Beginners

- 7 Best Animated Horror TV Shows

- The Strongest Dragons in House of the Dragon, Ranked

2026-02-20 23:53