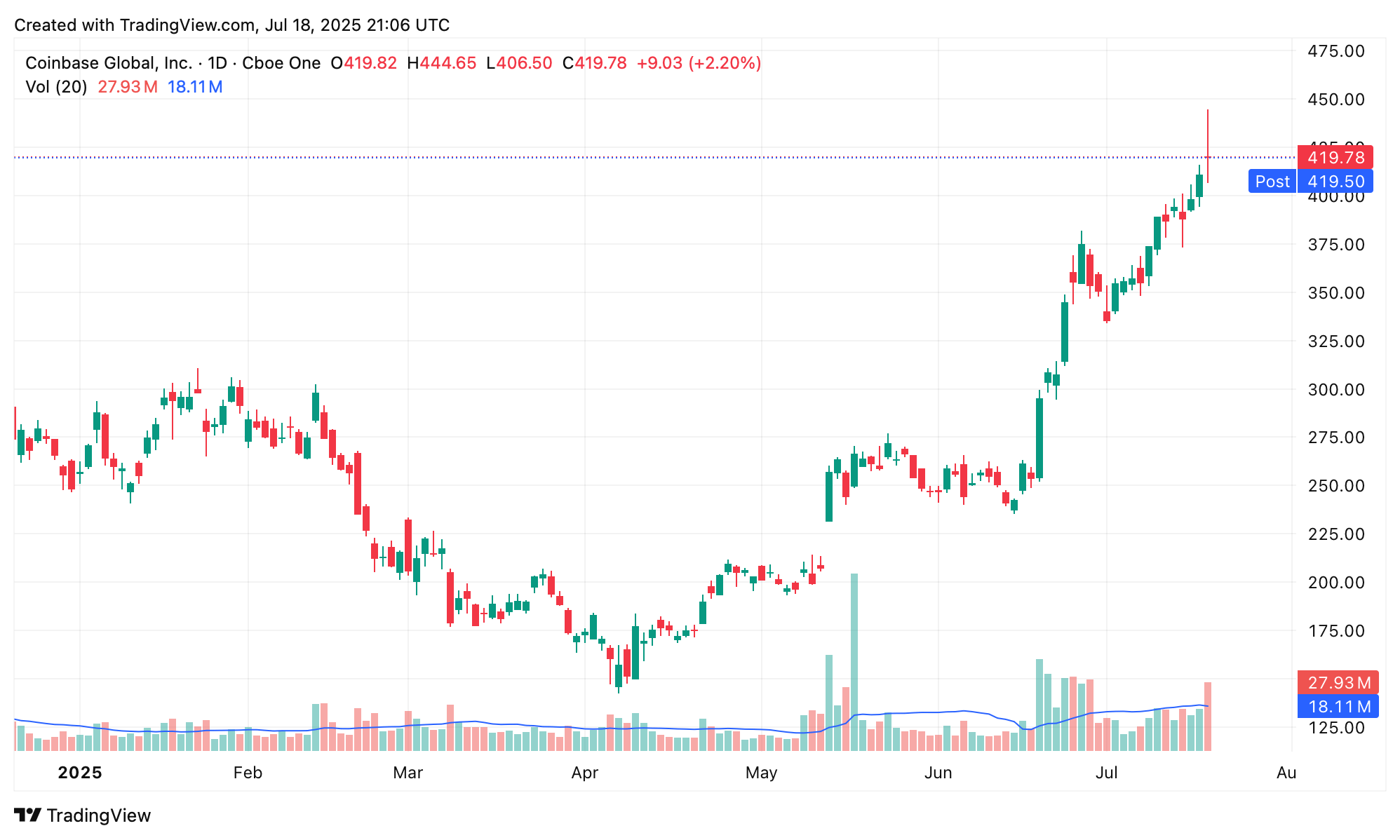

Ah, behold the splendid farce that was Friday! Coinbase’s stock, COIN, took a leap worthy of a high-wire performer, dazzling the audience with a marvelous ascent to $444 per share, thereby smashing its previous record from its 2021 debutante ball—otherwise known as the IPO. Meanwhile, other crypto stock characters flitted to and fro, reflecting the tumultuous dance of bitcoin as the weekend beckoned with the promise of respite.

Crypto Stocks Unleash Fireworks, Awaiting Their Standing Ovation as Coinbase Takes a Bow

After making flirtations with the illustrious $4 trillion mark on Friday, the crypto economy, like a capricious diva, had a slight withdrawal—settling at a mere $3.81 trillion by 5 p.m. The $4 trillion soirée was partially imploded, marking a dip of 0.71% in the previous 24 hours. Bitcoin (BTC), our ever-dramatic lead, let out a theatrical sigh, slipping by nearly 2%, nearly losing its grip on the hallowed $17,000 threshold. As the curtain fell on today’s performance, crypto-related stocks delivered a curious mix of triumph and despair, forsooth!

Glancing at the victor’s circle, Coinbase’s stock COIN undeniably claimed its spot as the belle of the ball, reaching heights of grandeur at $444 per share, only to be relegated to a regal but lesser $419.78 by day’s end—still a commendable gain of 2.2% for the day’s escapade! In the past five days, COIN has risen by a respectable 7.58%, a veritable feast for the soul, showering us with delight as it now boasts a staggering 65% increase from its achingly modest position a mere month ago. Ah, but Strategy’s MSTR—what a contrast! It found itself in quite the tragic tableau, spiraling down not unlike Icarus, a stark 6.2% decline after its brief flirtation with glory earlier in the week.

MSTR, bless its heart, remains down 1.7% over the past week, although a valiant 14% is still serenading its month-long performance. At 4:30 p.m., Strategy closed at $423.22. Ever the overachiever, Circle’s CRCL stumbled along on Friday, dropping a modest 4.81%, yet reveling in a 46% gain for the month! Over the week, CRCL strutted an impressive 9.6% higher, concluding at $223.78, as fevered discussions about bitcoin mining stocks fluttered about like moths to a flame.

In this carnival of charts and numbers, Galaxy Digital (GLXY) seized the lime-light, soaring 3.94% today and accumulating an audacious 26.23% over five days. And lo! Applied Digital (APLD), never one to remain in the shadows, leaped 9.35% today, enjoying a delightful 25.38% boost for the week. The flamboyant Riot Platforms (RIOT) also marked its presence, vaulting 3.98% today with a 10.79% increase over five days.

Meanwhile, Cipher Mining (CIFR)—the shy wallflower of the gathering—crept up a modest 5.56% over the week while indulging in a slight dip of 0.93% today. IREN Limited (IREN) and Cleanspark (CLSK) garnered gentle applause with minor weekly gains of 3.78% and 1.38%, yet found themselves in the perilous red by the curtain call. Bitdeer (BTDR) and MARA Holdings (MARA) inched forth with a meager ascent of just over 1% this week, though relinquished ground today.

Alas, Core Scientific (CORZ) and Hut 8 (HUT) languished in the depths, with CORZ down 1.54% this week and HUT trailing behind with a slip of 2.26% today, both mirror images of melancholy indeed! All in all, a week punctuated with shades of green, albeit with a few bruises to the ego. Though bitcoin may have retreated mildly as the weekend draws near, the pockets of resilience in crypto equities imply the audience—nay, investors—remain optimistic, ready to cheer for their favored stocks as they pirouette to their own peculiar rhythm amidst the drama of fluctuating values!

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 10 Movies That Were Secretly Sequels

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Best Werewolf Movies (October 2025)

- Goat 2 Release Date Estimate, News & Updates

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- 7 Masterpiece Sci-Fi Shows Based On Books

2025-07-19 01:14