Hold onto your crypto wallets, folks, because this week is about to get wilder than a rodeo on Mars! 🐴👽 Three US economic signals are about to shake up the Bitcoin market like a soda can in a toddler’s hands. Why? Because apparently, boring old economic indicators now have more influence on BTC than your Uncle Bob has opinions at Thanksgiving dinner. 🦃📈

Meanwhile, Bitcoin is flexing harder than a gym bro on Instagram 💪, holding steady above $118,000 despite whispers of sell-offs and dropping dominance. But hey, who needs stability when you’ve got chaos, right?

US Economic Signals To Watch This Week (AKA The Plot Twists) 🎢

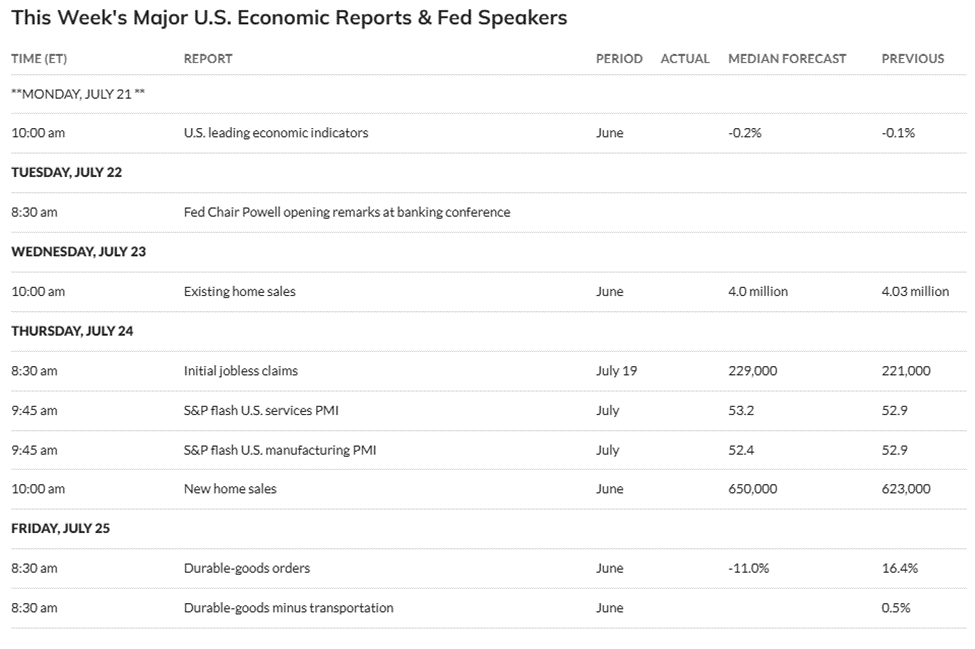

First up, we’ve got Jerome Powell—the man, the myth, the Fed Chair—giving opening remarks at the Banking Conference on Tuesday. Will he drop hints about interest rates or just awkwardly sip water while everyone stares? 🥤🔍

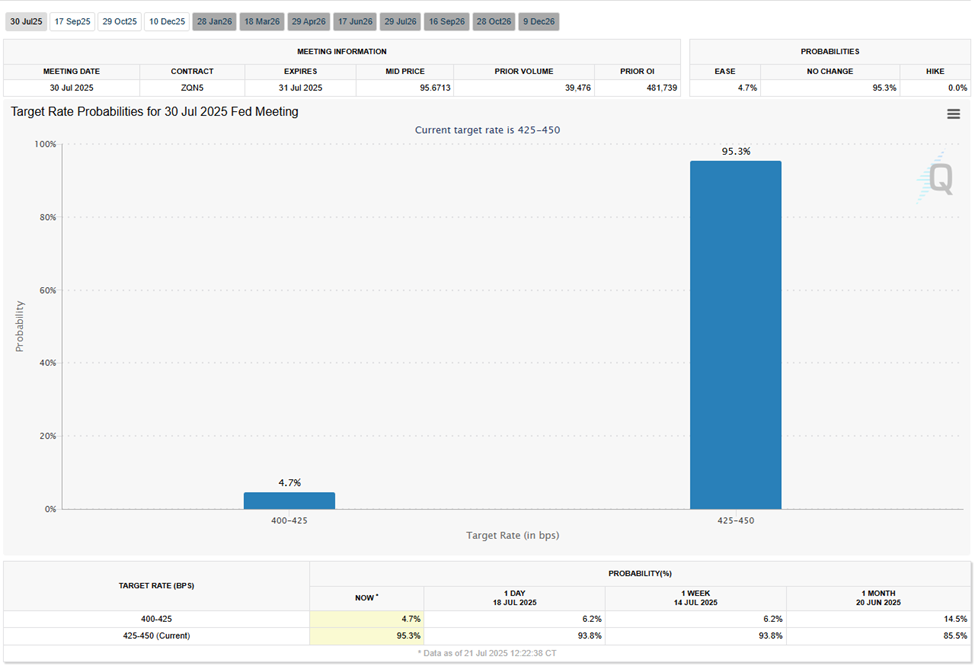

This comes hot on the heels of June’s CPI report showing inflation rising at 2.7%. And guess what? It’s also just before the next FOMC meeting where traders are betting big (95.3% chance!) that rates will stay put. Spoiler alert: Everyone’s watching him like he’s the last slice of pizza at a frat party. 🍕👀

But wait, there’s drama! Rumor has it Trump’s team wants Powell to cut rates faster than a bad haircut. If he doesn’t comply, they might push him outta his chair quicker than you can say “resignation.” 😱🔥

RUMOR MILL SPINNING

Fed Chair Jerome Powell reportedly under pressure from the Trump team — may resign soon over refusal to cut rates.

Word is he could announce it Tuesday in his next speech.

Keep a close eye on the markets. Something’s brewing.

— Wall Street Gold (@WSBGold) July 21, 2025

And let’s not forget the White House criticizing the Fed’s $2.5 billion building renovation. Honestly, if I were Powell, I’d trade places with a hamster running on a wheel—it’d probably be less stressful. 🐹💼

Here’s the kicker: If Powell gets the boot, Bitcoin could skyrocket faster than Elon Musk’s tweets. Rate cuts = liquidity party = weak fiat = Bitcoin bonanza! 🎉🤑

BITCOIN WILL PUMP LIKE THIS WHEN THE FED CONFIRMS A RATE CUT!

— Ash Crypto (@Ashcryptoreal) July 8, 2025

Initial Jobless Claims: The Unemployment Drama 📉🎭

Next, we’ve got initial jobless claims—a number so important it makes economists sweat bullets. Last week’s figure was 221,000, but projections suggest it could climb to 229,000. If it spikes, markets will freak out faster than someone seeing their ex on a dating app. 😱💔

On the flip side, low claims mean a strong labor market—which is great for traditional markets but kinda sucks for Bitcoin. Think of it like choosing between cake and ice cream: Both are good, but one always wins. 🍰🍦

S&P Flash Services and Manufacturing PMI: The Final Boss 🏆📊

Finally, we’ve got the S&P Flash Services and Manufacturing PMI reports coming Thursday. These numbers are basically the Kardashians of economics—everyone talks about them, even if no one fully understands why. 😵💫✨

June’s services PMI hit 52.9, while manufacturing soared to a three-year high of… also 52.9. Weird coincidence or cosmic alignment? You decide. 🔮📊

Strong PMIs boost confidence in traditional markets, which means Bitcoin might get left in the dust like yesterday’s meme stocks. But weaker readings? Oh boy, that’s when Bitcoin shines brighter than a disco ball at a rave. 🪩🚀

As of now, Bitcoin is chilling at $118,286, up a modest 0.35%. Analysts are pointing fingers at falling dominance, miners dumping coins, and the UK government teasing a sell-off. Sounds like the perfect storm for volatility—or a soap opera script. 🌩️📖

Read More

- Best Controller Settings for ARC Raiders

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Why Juliana Pasquarosa, Grant Ellis and More Bachelor Duos Have Split

- Pokémon Legends: Z-A’s Mega Dimension Offers Level 100+ Threats, Launches on December 10th for $30

- Ben Stiller’s Daughter Ella Details Battle With Anxiety and Depression

2025-07-21 10:07