It is a truth universally acknowledged that when Binance Coin (BNB) ascends to unprecedented heights, society must surely take notice. And lo, dear reader, ascend it has—reaching the lofty sum of $804 mere hours ago. While Bitcoin and Ethereum languish in their sideways dalliances, BNB emerges as the gallant hero of this tale, breaking free from mediocrity with the vigor of a debutante at her first ball. Such bullish behavior can only be attributed to Binance’s growing dominance and profitability, which might well rival the wealth of Mr. Darcy himself. 😏

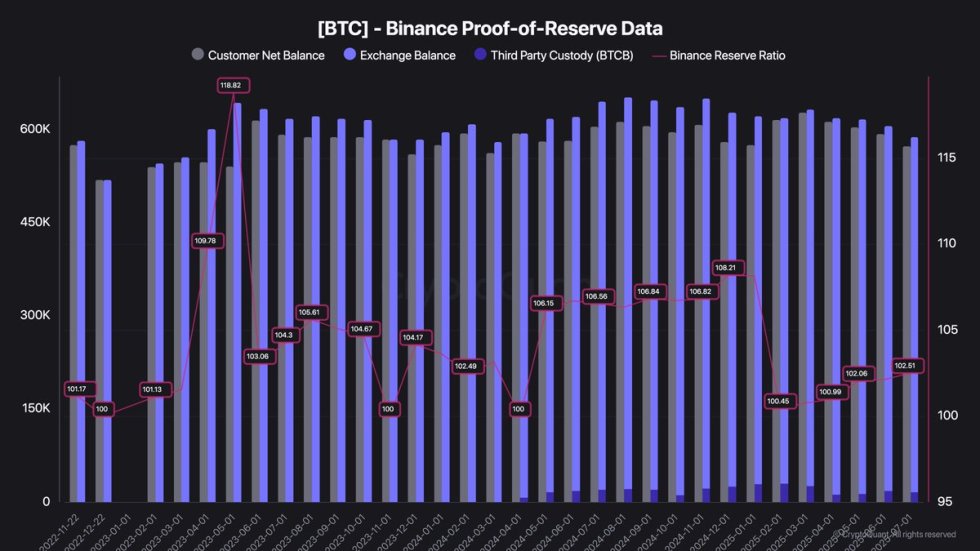

According to the esteemed purveyors of data at CryptoQuant, Binance’s unrealized profits on its BTC reserves have reached an astonishing 60,000 Bitcoin—a veritable treasure trove. Yet, in true Austenian irony, this record comes amidst a steady decline in actual BTC reserves since September 2024. One cannot help but marvel at such strategic acumen; it seems Binance plays chess while others merely shuffle cards. ♟️

As institutions clamor for altcoins like eager suitors at a country dance, BNB’s performance may serve as a harbinger of what lies ahead for the broader market. With Bitcoin and Ethereum stabilizing above key zones (as if reclining on chaise longues), Binance Coin distinguishes itself as the belle of the ball, buoyed by rising exchange profitability and investor confidence. The coming days shall reveal whether this ascent possesses the stamina of a marathon runner or the fleeting enthusiasm of Lydia Bennet. 🏃♀️

A Closer Examination of Binance’s Strategic Reserves

Top analyst Darkfost—whose name evokes images of shadowy intrigue—has illuminated the inner workings of Binance’s Bitcoin reserves. It appears the platform’s core BTC holdings, employed chiefly to sustain exchange activity and the BNB Chain ecosystem, have dwindled from approximately 631,000 BTC in September 2024 to 574,000 BTC today. Far from signaling distress, this reduction reflects a calculated pivot, akin to Lady Catherine de Bourgh rearranging her estate gardens. 🌷

In addition to these strategic reserves, Binance maintains roughly 16,000 BTC in custodial wallets, reserved for purposes most specific: backing the BTCB token and fulfilling user demand within the BNB Chain environment. Such meticulous organization allows Binance to retain flexibility while ensuring liquidity—a feat worthy of admiration, even from Mrs. Bennet herself. 👏

Observing these reserves provides a unique glimpse into macro sentiment. Declining exchange reserves often indicate increasing confidence among long-term holders, who withdraw Bitcoin for cold storage or prolonged keeping, much like Elizabeth Bennet safeguarding her letters from Mr. Darcy. This trend suggests a collective belief that prices will continue their upward march—a notion both hopeful and audacious. 📈

Despite the diminution in total BTC holdings, the value of Binance’s remaining reserves has soared. The ongoing rally in Bitcoin’s price has propelled Binance’s unrealized profit to a staggering 60,000 BTC. This paradox—falling reserves yet burgeoning profits—reveals the strength of the current market phase and Binance’s remarkable ability to navigate it profitably. As the market matures, Binance’s reserve data shall undoubtedly remain a barometer of institutional and investor behavior—a compass guiding us through tempestuous seas. ⚓

Price Analysis: A Breakout Fit for a Duchess

Binance Coin (BNB) has officially embarked upon uncharted territory, achieving a new all-time high of $804. The chart depicts a sustained and aggressive uptrend, with BNB surging from the $670 zone in early July to nearly $800 in mere weeks. Such momentum confirms bullish conviction and strong market confidence, leaving skeptics to ponder whether their cynicism was misplaced. 🐂

All key moving averages—the 50-day ($671), 100-day ($652), and 200-day ($642)—trend upward, with price firmly ensconced above them. This alignment signifies a robust bullish structure, further validated by a noticeable rise in trading volume. Indeed, one might say that BNB dances to the tune of prosperity, twirling past resistance levels with the grace of Jane Fairfax at a piano recital. 🎹

Having cleared all major obstacles, BNB now ventures into price discovery, exploring new highs without the encumbrance of technical resistance overhead. The decisive breach of the $720–740 zone served as the catalyst for acceleration, much like a sudden inheritance propelling a young woman into genteel society. Traders are advised to monitor the $780–790 area as short-term support; so long as BNB maintains this range, the bullish trend remains intact. Should market sentiment hold firm, momentum could propel prices toward $850 or higher, rendering skeptics utterly bereft of arguments. 💼

Read More

- Ashes of Creation Rogue Guide for Beginners

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Can You Visit Casino Sites While Using a VPN?

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- New Look at Sam Raimi’s Return to Horror After 17 Years Drops Ahead of Release: Watch The Trailer

- Marvel Wants You to Believe Wolverine Is the Greatest Anti-Hero (But Actually He’s the Worst)

2025-07-23 20:44