In the grand tapestry of finance, where greed and folly dance hand in hand, Maple Finance’s token, SYRUP, rose like a phoenix on Thursday, its price igniting a “God candle” that would make even the most pious Wall Street analyst weep into their portfolio. On-chain data whispered of whale accumulation, as if the sea creatures themselves had decided to trade sushi for speculation. And lo, assets under management surged to record heights, a feat that would have Tolstoy himself scribbling notes on the futility of human ambition. 🐋💸

- SYRUP’s price leapt over 15%, a leap so bold it could have been choreographed by the ghost of Charlie Chaplin. Whales, those aquatic titans of the crypto sea, devoured the dip like gourmands at a buffet.

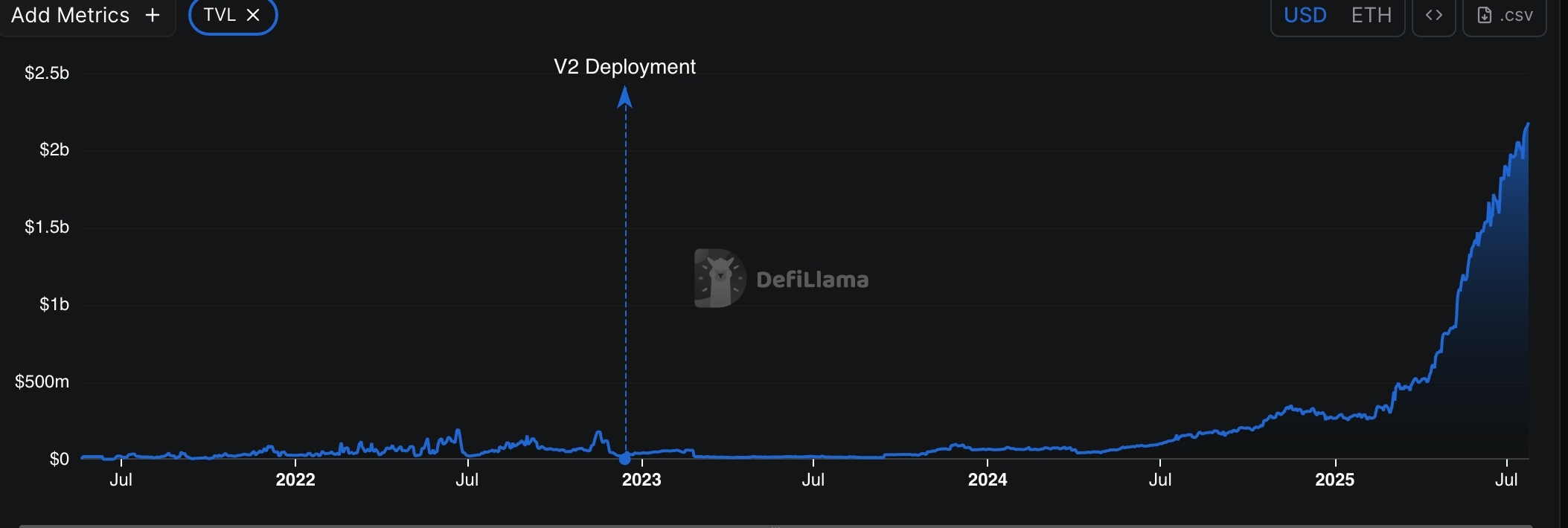

- Total value locked and assets under management soared, reaching stratospheric levels that would make a rocket scientist blush. One might say the market is feeling particularly optimistic—or perhaps just delusional.

- Technical analysts, armed with charts and caffeine, predict further gains, though whether this is prophecy or wishful thinking remains to be seen. 📊🔮

SYRUP’s price climbed to $0.5500, a height unseen since July 11, and a 36% rebound from its yearly nadir. This surge, fueled by a 24-hour volume of $216 million, was as dramatic as a Shakespearean tragedy—if the tragedy were about misplaced commas in smart contracts. 🎭

The network’s growth, as per third-party data, resembles a hare on espresso. Total value locked in the ecosystem hit $2.13 billion, a figure so vast it could drown the January low of $275 million in a bathtub. One imagines the market whispering, “What goes down must come up… unless it’s a bridge loan.” 🏦

Total assets under management, according to the sacred scrolls of Maple’s website, now stand at $3.16 billion. The Blue Chip Secured Lending Fund, with $169 million in assets and a 7.1% APY, offers returns that would make a usurer weep. Meanwhile, the High-Yield Secured Lending fund, with $502 million and a 10% APY, tempts fools and heroes alike. 🎲

Bitcoin yield sits at $177 million, while syrupUSDC inches toward $1 billion—a milestone that will either make investors rich or very, very confused. Maple Finance’s profitability, now $988,000 quarterly (up from $207,000 last year), is a testament to the alchemy of modern finance: turn volatility into profit, or at least the illusion thereof. 💰

SYRUP’s ascent coincided with whale activity, those aquatic behemoths hoarding 3.3 million tokens—up from 9.48 million the day prior. Their holdings reached heights not seen since July 22, a date that now feels as distant as the last time a bear market ended. Smart money investors, ever the optimists, increased their stake to 17.53 million, while exchange balances dwindled by 1.7% in seven days. One wonders if they’re preparing for a liquidity crisis… or a liquidity party. 🎉

SYRUP Price Technical Analysis

The 12-hour chart tells a tale of redemption. On Wednesday, SYRUP plummeted to $0.4033, a nadir that would have moved even the most stoic investor to tears. But lo! On July 24, it formed a “God candle,” a divine sign that whales had smelled opportunity—and the dip was but a passing storm. 🌩️

SYRUP now dances above the 50-period and 25-period moving averages, as if defying gravity itself. It has pierced the upper bounds of a falling wedge, a pattern so bullish it could make a bear market weep into their bear hug. Analysts whisper of a potential $0.6600 target, a 30% gain that would either make bulls gleeful or bears… well, still bearish. 🦁

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Sega Insider Drops Tease of Next Sonic Game

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- All 6 Takopi’s Original Sin Episodes, Ranked

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Neverness to Everness ‘Co-Ex Test’ sign-ups now available

- 10 Great Netflix Dramas That Nobody Talks About

2025-07-24 20:12