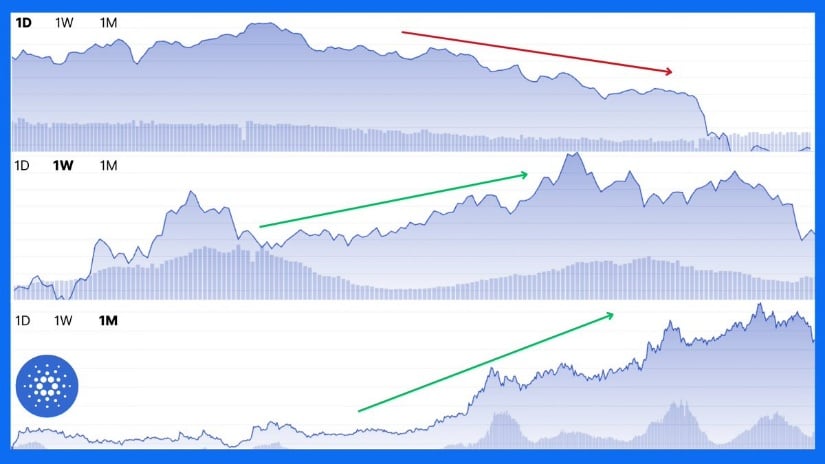

Dear Reader, one cannot help but observe that Cardano’s price structure presents a most promising prospect, a tightening wedge, a robust weekly trend, and a burgeoning liquidity pocket, all aligning with remarkable precision. With global liquidity ascending, ADA may yet be poised for a most triumphant breakout. 🎩💰

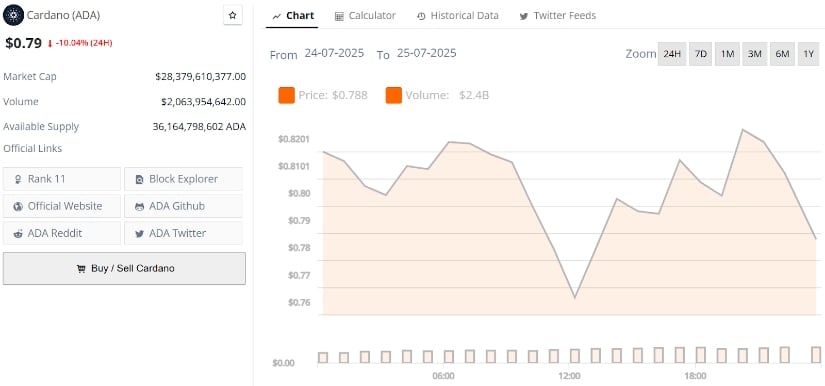

Cardano’s Dilemma: Short-Term Sighs, Long-Term Aspirations

The latest chart, shared with commendable diligence by Blockchain, reveals a most curious divide between short-term and long-term trends. On the daily timeframe, price descends with a most unseemly haste, reflecting short-term weakness. Yet, when one dares to gaze further, the weekly and monthly charts unveil a most bullish trajectory, replete with steady momentum. A most fortuitous alignment of circumstances, one might say. 🧠

In the grand scheme of market structure, higher timeframes reign supreme. Thus, while the daily dip may provoke a sigh, the broader narrative suggests ADA remains steadfast. Should the weekly and monthly trends persevere, this short-term retreat may well be a mere trifle, a healthy consolidation before the next ascent. 🕰️

Cardano’s Rejection: A Tale of Resilience

Cardano’s price, alas, faced a most textbook rejection from its descending resistance trendline, as elucidated in SnekArmy’s chart. The rejection conforms to a clean three-touch structure, a trendline that price has respected since the dawn of 2025. Though the immediate reaction is a pullback, structurally, ADA has not faltered. Instead, it remains ensconced within a tightening wedge. 🧵

This rejection, far from undermining the broader bullish case, reinforces it. The higher timeframes, weekly and monthly, still radiate strength, and price is gradually inching back to retest this descending structure. Should ADA reclaim the recent high, it may yet unlock the fabled $1.20+ zone. 🚀

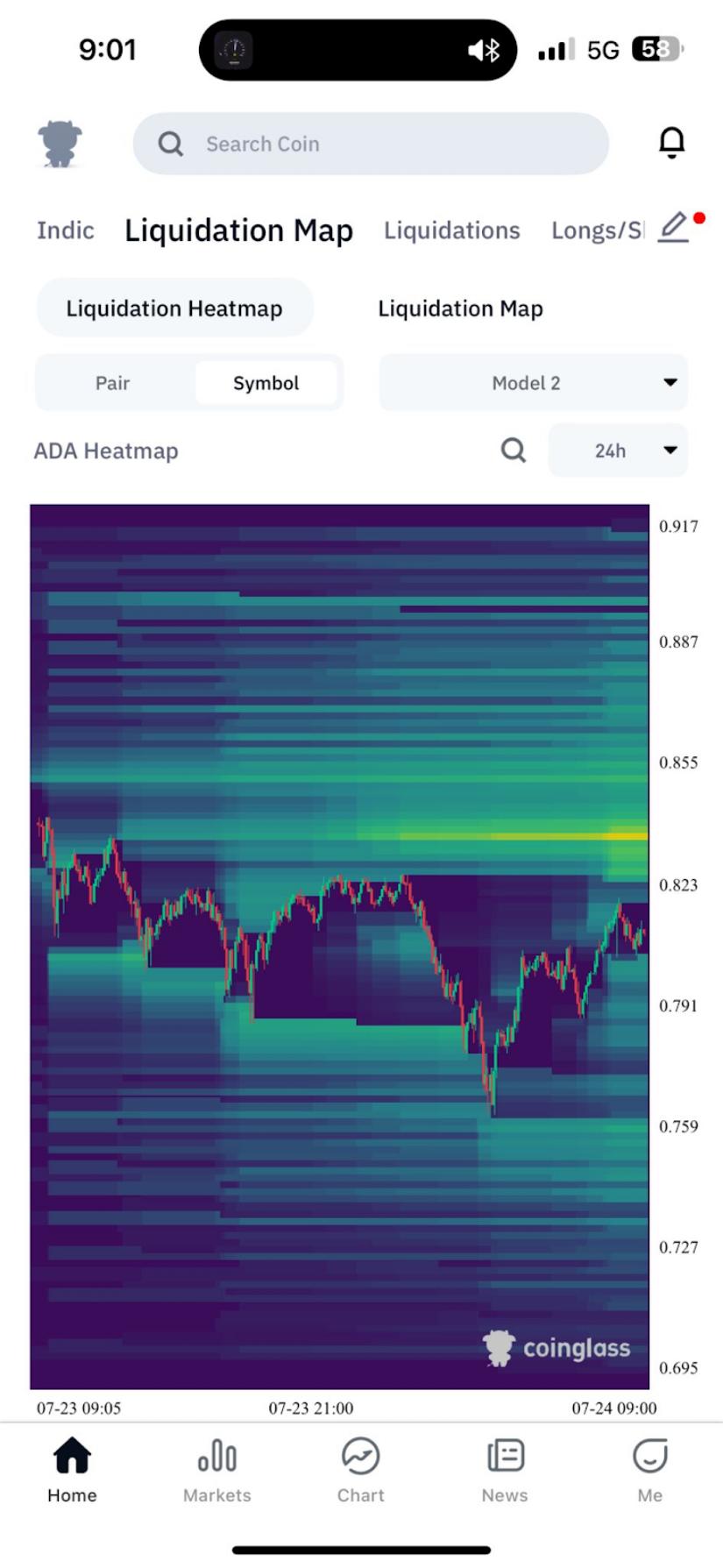

Cardano’s Liquidity Layer: A Treasure Trove?

Recent heatmap data, shared with commendable zeal by Carlos Garcia Tapia, unveils a growing cluster of liquidations just above the $0.855 mark. This area, a liquidity pocket of considerable allure, is likely to attract price, as stop orders from overleveraged shorts lie in wait. 🧾

From a structural standpoint, this aligns seamlessly with the previous descending resistance line, underscoring the significance of this region in the next move. A most fortuitous coincidence, one might argue. 💸

In the context of recent rejection and short-term pullback, this heatmap zone may well become the next logical target if bulls regain their composure. As previously noted, the broader trend on weekly and monthly charts remains unyielding, and a breach of this liquidation layer could serve as a springboard for a more robust upward surge. 📈

Cardano’s Prediction: Global Liquidity’s Grand Design

A fresh chart from Bull Bear Spot overlays Cardano’s price action with M2 global liquidity, a macro metric that often mirrors broad market expansion. Historically, ADA has exhibited a most pronounced directional relationship with this liquidity trend, and once again, the two are in harmonious accord. As observed, when global liquidity ascends, ADA tends to follow. With the yellow M2 curve now breaching new territory, the implication is clear: ADA may not be far behind if this correlation holds. 🌍

This perspective adds yet another layer to the higher timeframe strength. While ADA recently retreated from local resistance, its structural foundation remains unshaken. Should the global liquidity curve continue its upward march, it may provide the macro tailwind necessary for ADA to reclaim the $1.00 mark and ultimately target the $1.50 and $2.00 zones. 🧭

Final Musings: A Most Promising Outlook

Though Cardano’s short-term dip may have raised a slight flutter of concern, the broader narrative remains undeniably bullish. ADA is witnessing a higher timeframe structure hold firm, wedge formations remain intact, and even global liquidity tilts in ADA’s favor. A most auspicious combination, one might say. 🕊️

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Ashes of Creation Rogue Guide for Beginners

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Lords of the Fallen version 2.5 update now available

- XRP’s Cosmic Dance: $2.46 and Counting 🌌📉

- Kate Middleton, Prince William Coordinate During Red Carpet Date Night

2025-07-25 02:46