Oh, Bitcoin. The mischievous little scamp of the financial world has done it again—throwing tantrums and toppling fortunes like a toddler with too much sugar. Just when you thought BTC was cozying up to $120,000, it decided to take a nosedive below $115,000 faster than you can say “blockchain.” 🚀➡️🪂

A Descent Worthy of Discworld Drama

Yes, dear reader, Bitcoin (that ever-so-cryptic BTC) flirted briefly with the $120,000 mark, only to plummet back down to Earth—or at least to $114,518—at 2:45 a.m. EDT on July 25. Bitstamp data captured this rollercoaster moment for posterity. But don’t worry! It dusted itself off and climbed back above $115,000, proving once again that resilience is its middle name. Or maybe its algorithm.

But here’s where things get spicy 🔥: This modest dip—just a casual 2% over 24 hours—triggered the liquidation of over $140 million in long positions. According to Coinglass, those poor souls holding onto their BTC bets made up nearly half of the staggering $382 million wiped out in total during the same timeframe. Ah, the sweet sound of dreams evaporating into thin air. 💸💨

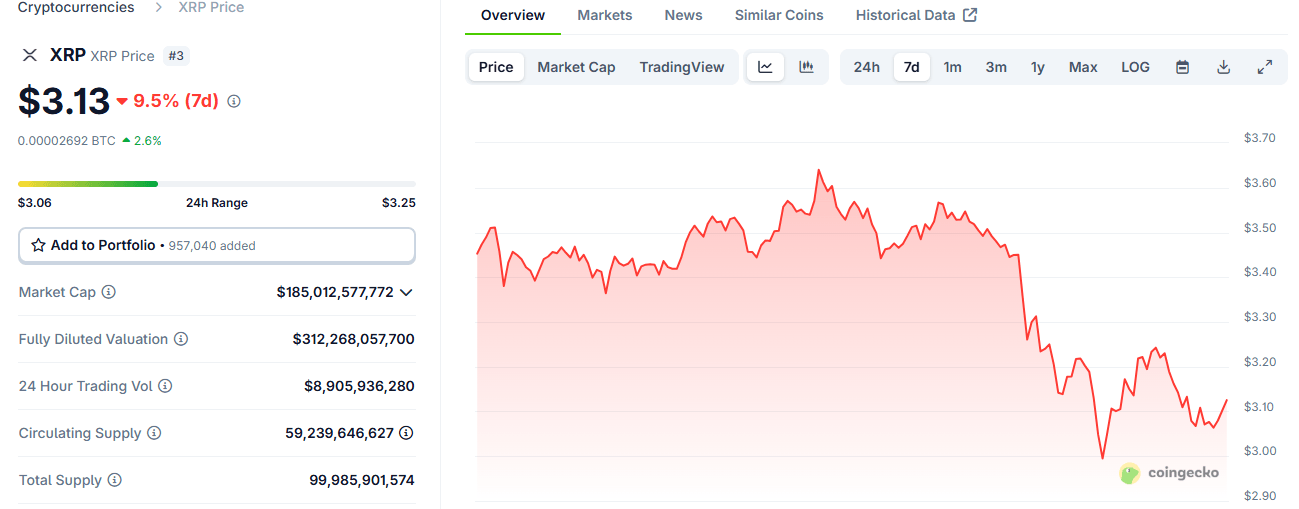

XRP: When Life Hands You Lemons, Make Lemonade… That Turns Sour 🍋

Meanwhile, XRP, everyone’s favorite underdog-turned-heartbreaker, continued its descent from an all-time high of $3.40. Like a soap opera villain, it plunged through the critical $3.00 psychological barrier before staging a feeble comeback to trade above $3.12. And what did this mean for traders? Over $16.45 million in long positions liquidated within 24 hours. Ouch. Since July 21, XRP has lost more than 10% of its value, earning it the dubious honor of being one of the biggest losers in the past week. Bravo, XRP. Truly inspiring stuff. 👏

And let’s not forget about Solana, which dropped by 2.8%, or DOGE, which took a 2.3% hit. Meanwhile, Ethereum (ETH) decided to play nice, gaining nearly 2%. Even BNB managed to inch upward by 0.9% after hitting a new all-time high of $808. Clearly, someone got invited to the party while others were left standing outside in the rain. ☔

By 5:00 a.m. EDT on July 25, Coinglass reported that a whopping 142,437 traders had been liquidated in the previous 24 hours, with total losses reaching $531.69 million. Of these, long positions accounted for just over 70% ($382.88 million). So if you’re wondering why your neighbor suddenly looks so glum, now you know. 😢

In conclusion, the crypto markets are behaving exactly as expected: unpredictably, chaotically, and with enough drama to rival Ankh-Morpork’s finest theatrical productions. Now, who wants popcorn? 🍿

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- XRP: Will It Crash or Just… Mildly Disappoint? 🤷

- Katy Perry and Justin Trudeau Hold Hands in First Joint Appearance

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

2025-07-25 14:34