It is a truth universally acknowledged, that a cryptocurrency in possession of a rounding bottom must be in want of a breakout. And so it was with UNI, which, after months of languishing in the doldrums of consolidation, finally emerged triumphant in early July. A critical resistance was vanquished, much to the delight of traders who had long awaited such a momentous occasion. Though short-term volatility persists (as it always does, for markets are as fickle as Mr. Collins at a ball), the broader structure whispers promises of further upside—if only key support levels can maintain their composure.

A Rounding Bottom Most Fortuitous

The daily UNI/USDT chart, much like a well-crafted novel, reveals the completion of a rounding bottom pattern—a tale that began its ascent in early 2025. This bullish reversal indicator, akin to the transformation of a shy debutante into the belle of the ball, formed after a prolonged downtrend from the lofty heights of $16. Price, like a cautious suitor, curved upward before breaking above the neckline resistance at $9.50 in mid-July. Ah, what a moment it was! Volume rose on the right side of the pattern, confirming buying strength—truly, an affirmation of matrimonial intent between buyers and sellers.

Following this theatrical breakout, UNI reached a high near $12.80 before encountering resistance—a most inconvenient obstacle, one might say. As of writing, the token trades near $10.30, slightly below recent highs but comfortably above the neckline and key moving averages. Both the 9-day EMA and the 50-day SMA slope upward with all the grace of a well-bred horse, serving as dynamic support. Should UNI successfully retest support between $9.90 and $10.00, renewed buying momentum may ensue, propelling it toward a projected target of $13.50 to $14.00. One can almost hear Lady Catherine de Bourgh declaring, “It is inevitable!”

Volume and Sentiment: A Tale of Mixed Emotions

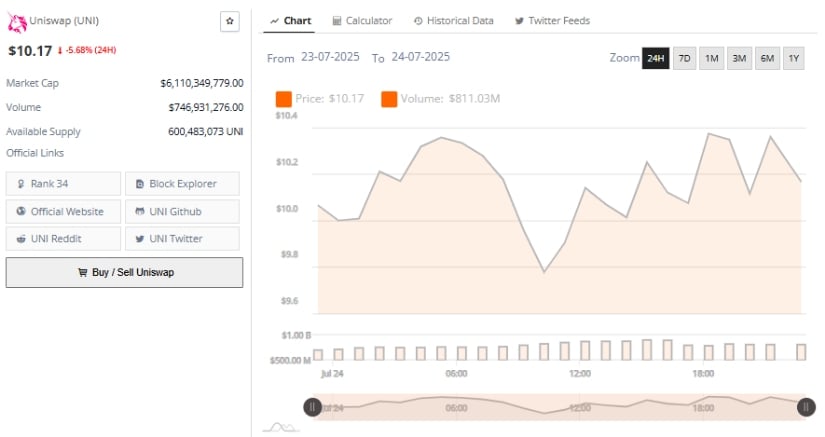

Over the past 24 hours, dear reader, UNI experienced a pullback of 5.68%, closing at $10.17. The price flitted about within a range of $9.70 to $10.30, displaying intraday volatility as capricious as Lydia Bennet’s affections. This decline followed an early rally that lost momentum, likely due to profit-taking and short-term speculative activity—activities not unlike those of Mrs. Bennet scheming over her daughters’ futures. Multiple failed breakout attempts suggest that while sentiment remains generally positive, immediate buying pressure may be waning. How very human of it!

Trading volume for the same period reached $746.9 million, underscoring moderate market activity. Peak volume occurred during morning and evening sessions, aligning with intraday rallies. Alas, the overall volume profile remained flat, offering no indication of sustained accumulation at higher levels. Without strong follow-through after initial rallies, short-term resistance near $10.30 must be overcome with higher volume lest the bullish trend falter. Until then, the risk of a pullback below $10 looms ominously, particularly if broader market conditions shift. Pray, do not let us resemble Mr. Wickham in our fickleness!

Indicators Whisper Sweet Nothings of Momentum

At the time of writing, UNI stands priced at $10.51, with a market capitalization of approximately $6.11 billion. The daily MACD indicator confirms bullish momentum, with the MACD line (0.86) maintaining a respectful distance above the signal line (0.74). The histogram prints consecutive positive bars, much like a diligent scribe recording favorable gossip. The increasing divergence between the two lines suggests a continuation of the current uptrend unless disrupted by significant selling pressure. Let us hope no villainous speculators attempt such mischief!

The Chaikin Money Flow (CMF), currently at +0.18, points to strong capital inflows into UNI. A CMF reading above 0.10 typically indicates sustained accumulation—a most promising sign indeed. The upward CMF trend since early July reinforces this, suggesting broader market confidence. If CMF remains in this positive territory while the MACD stays in bullish alignment, UNI may soon test previous resistance levels around $12.80. Should momentum build, it may even reach the projected $13.50–$14 range in the near term. Oh, how delightful it would be to witness such an accomplishment! 🎉

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Katy Perry and Justin Trudeau Hold Hands in First Joint Appearance

- XRP: Will It Crash or Just… Mildly Disappoint? 🤷

2025-07-25 20:08