Well, well, well! Look at those numbers! Layer 2 solutions are raking in billions faster than a kid in a candy store, growing from a measly zero to “yahoo!” in just three years. These “highway bypass” solutions claim to give Ethereum and Bitcoin a breather by processing transactions off the main chain, all while playing tag with security. 🎢

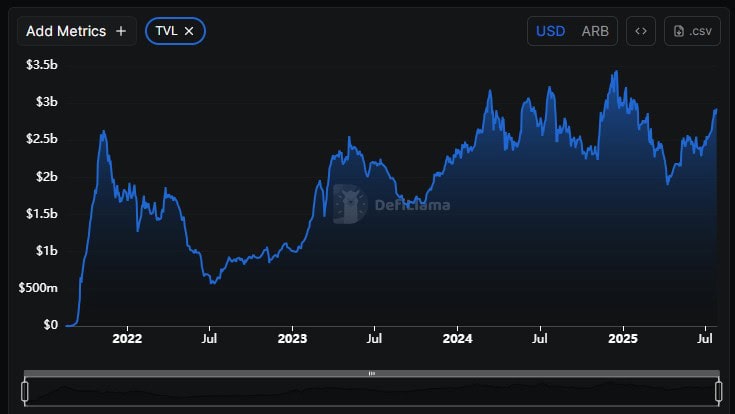

After a buffet feast in 2023, Arbitrum’s TVL is now just sitting there, taking a nap for 18 months. Source: DefiLlama

But wait! As money is showered on these L2 infrastructures like confetti at a wedding, a pressing question arises: Are these groundbreaking scaling solutions the next crypto treasure chest or just another complex tech fix desperately seeking a business model – or worse, a house of cards ready to collapse at any moment? 🎩⏳

The Technical Foundation Behind the Hype

Layer 2 solutions do the ol’ bundling trick, wrapping up transactions like a present before they head off to Ethereum’s mainnet – which, by the way, there’s only a couple of Layer 2s for Bitcoin, and they’re like unicorns at this point. They’re here to tackle Ethereum’s scaling nightmare with a perfect blend of security, decentralization, and quicker transactions. Whoa, slow down there, Einstein! 🧠✈️

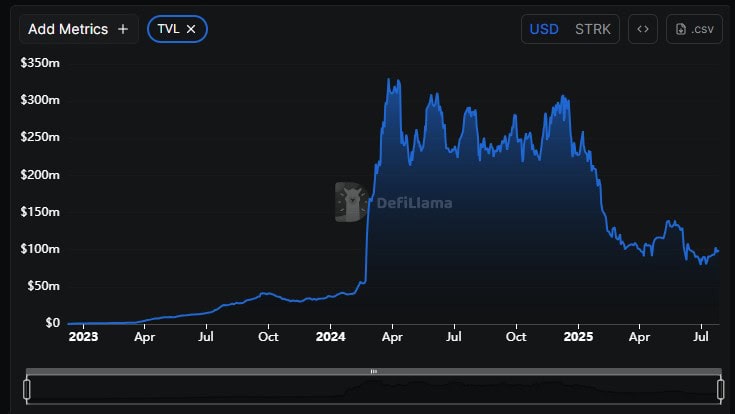

The two heavyweight contenders have entered the ring. Optimistic rollups (a.k.a. “hey, we trust you!”) like Arbitrum and Optimism assume transactions are not naughty by default! That’s a bold move, Cotton! But watch out for the seven-day challenge for withdrawals – talk about a waiting game! Meanwhile, the cryptographic ninjas, zero-knowledge rollups, like Starknet, do their magic instantly, but they might require a PhD to understand their tech. 📜💥

The market seems to have stored that information in the old noggin and has declared Arbitrum the champ, waving its $3 billion TVL badge, while Optimism wallows with around $350 million. Zk-rollups like Starknet do have a promising glow, though, only to crash and burn faster than a bad reality TV show. 🔥📉

Market Leadership and Ecosystem Development

The Layer 2 club has assembled a ragtag group of market players, each swinging their own bat for dominance. Arbitrum keeps swinging high, with the highest transaction volume and an eclectic DeFi mixer going on. 🎉

Uh oh! The ARB token made a splash during one of crypto’s largest airdrops in March 2023, peaking at an all-time high of $2.40 – let’s hope it didn’t spend too long at the top of the rollercoaster before plummeting like a stone all through 2025, while Bitcoin and its alt friends throw a party! 🎢🥳

Then there’s Optimism, which tries to stand out with its governance jazz hands and “Superchain” vision, like it’s auditioning for a talent show. The OP token wears two hats: governance and potential value, but like most dreams, it’s had some ups and downs, particularly through this dumpster fire of a year. 🙈💔

Currently hanging out at $0.72, the OP token’s been creeping up just a smidge in the last 24 hours but it’s been on the down-low all through 2025. Yikes! 🐢

Polygon’s got its fingers in both the sidechain pie and zk-rollup cake. It plays the rebranding game like a high-stakes poker player, moving from MATIC to POL in September 2024. Let’s just say its price performance over the year has been anything but sweet. 🍰😕

Layer 2 Tokens – The Investment Reality Check

So, despite looking sharp with all that TVL swagger, the investment angle for L2 tokens is more tangled than a messy spaghetti dinner. 🍝 Token holders are often just holding a governance ticket rather than feeling the heat of the network’s hustle, as most transaction fees are pocketed in ETH, not the native tokens. Talk about a party with no drinks! 💸

Add to the mix the fees for data availability, which Ethereum is busy cutting down, putting a major dent in L2 profit margins. What a cliffhanger! It leaves us wondering if any of these L2s can hold onto their economic treasures. 🔍⛏️

When we examine transaction volumes, it’s a mixed bag of chips! While the numbers dance a jig across major L2s, a lot of that action looks more like bargain-bin groceries than fancy delicacies. 🍟💩 Making money off these transactions still feels like solving a Rubik’s Cube blindfolded.

Risk Assessment and Historical Failures

But hold your horses, because Layer 2 solutions aren’t just sipping a piña colada! They’re dealing with a wild circus of risks! Woah! Technical risks have turned into drama with bridge exploits leading to hundreds of millions going *poof*! The Ronin bridge says hi, having lost over $600 million. What a heist! 🏴☠️💰

Centralization still lurks like a bad smell across major L2s, where optimistic rollups rely on centralized sequencers. It’s a one-stop-shop for potential disaster and censorship. Everyone’s promising a shot at decentralization, but who’s bringing the popcorn for this sitcom? 🍿🤷♂️

Economic sustainability? That’s another bag of worms! With most L2 tokens trending below their launch prices, it’s like watching a magician pull the wrong rabbit out of a hat! 🐇✨ Lack of clear value mechanics means people are more in it for the drama than the popcorn, and that’s just not a great investment strategy!

And let’s not forget some L2 projects that went belly up or pivoted faster than my Aunt Edna changing her hairstyle! Loopring’s seen a nosedive, others got scooped up by bigger fish, or just vanished into thin air! Poof! 👻

Conclusion: Infrastructure Growth With Investment Uncertainty

Layer 2 solutions are genius tech marvels, boasting impressive TVL, transaction volumes, and ecosystems that would make any proud parent cry. Yes, the infrastructure being built is real, valuable, and probably has a spot in the future of crypto for a good long while. 🛠️🚀

However, investing in L2 tokens feels like playing a game of poker with your emotions. The unclear value, fierce competition, and constantly evolving technology keep us all guessing. Just remember, great tech does not guarantee great investments – something to chew on as we ride this roller coaster! 🎢💭

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Can You Visit Casino Sites While Using a VPN?

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- AKIBA LOST launches September 17

- New Look at Sam Raimi’s Return to Horror After 17 Years Drops Ahead of Release: Watch The Trailer

- One Piece Just Confirmed Elbaph’s Next King, And He Will Be Even Better Than Harald

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Michael B. Jordan Almost Changed His Name Due to NBA’s Michael Jordan

2025-07-27 12:07