Ah, Ethereum—crypto’s darling child—is showing signs of cooling off after its latest rally, slipping ever so slightly from its lofty perch near $3,900. While the broader crypto market clings to its resilience like a stubborn mule, a recent on-chain move has sent traders into a tizzy. Is this the calm before the storm, or just another tempest in a teapot? Let’s dive in, shall we? 🌩️

$47 Million ETH Transfer to OKX: A Whale’s Tale 🐋

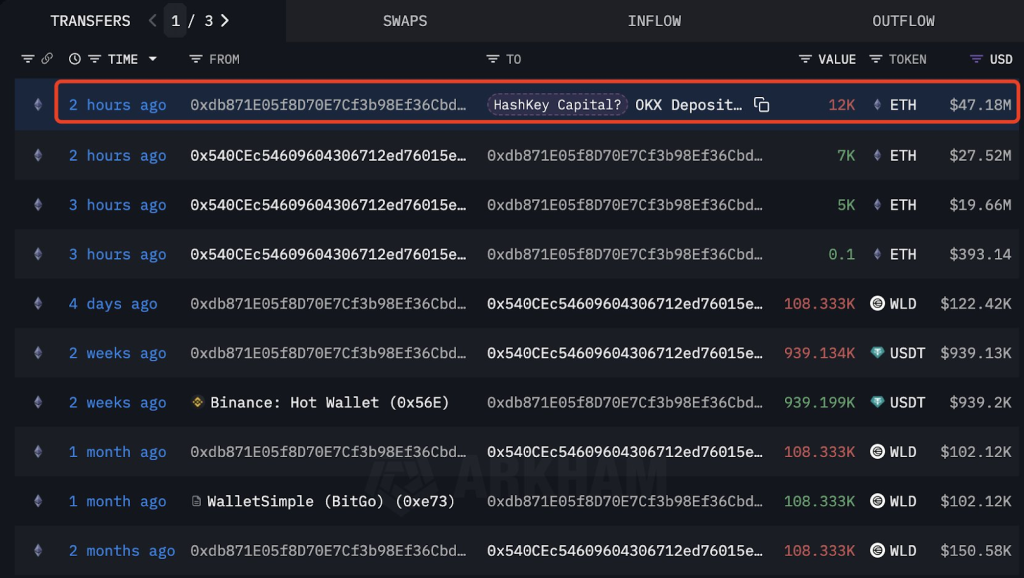

According to the ever-watchful eyes of Lookonchain (a platform that tracks blockchain activity like a hawk), a wallet likely tied to HashKey Capital—a titan in the crypto investment world—has transferred 12,000 ETH (worth roughly $47.18 million) to the OKX exchange. And when I say “just two hours ago,” I mean it happened faster than you can say “blockchain.” ⚡

Now, whenever someone moves such a colossal sum to an exchange, folks start whispering about sell-offs. It’s like seeing a bear lumber into a picnic—everyone assumes he’s there for the honey. So naturally, speculation is rife that HashKey might be cashing in their chips after Ethereum’s recent price surge. Or maybe they’re just redecorating their digital wallet. Who knows with these whales? 🤷♂️

Ethereum Rally: At a Crossroads or Just Taking a Breather? 🚦

This whale-sized maneuver comes at a rather inconvenient time—just days before the U.S. Federal Reserve’s interest rate decision. For those who don’t speak economist, this is a Big Deal™ that could send shockwaves through risk assets like crypto. Analysts are suggesting that some institutions might be de-risking or locking in profits before the market decides to throw a tantrum. Because, you know, markets love drama. 🎭

Ethereum had been strutting its stuff earlier this month, but whale activity like this often signals short-term corrections. Especially when everyone’s biting their nails ahead of macroeconomic catalysts. It’s like waiting for the other shoe to drop, except the shoe is worth billions and could land on your portfolio. Ouch. 👢

Ethereum Price Analysis: A Dash of Optimism, Sprinkled with Caution 📊

Top crypto analyst Michaël van de Poppe chimed in on Ethereum’s price action, noting that while ETH recently broke out, the move lacked the oomph one might expect. In his words:

“I wouldn’t be surprised to see a short correction or a liquidity sweep before the next leg up,” he said.

In plain English? Expect some turbulence before the rocket ship takes off again. Van de Poppe believes this volatility is a playground for short-term traders but might leave long-term holders clutching their pearls. 💎

Despite the doom-and-gloom chatter, Ethereum remains technically strong:

- Current Price: $3,887

- RSI: Neutral at 59.21 (not too hot, not too cold—just right!) 🥄

- MACD: Slight bearish crossover (cue ominous music) 🎶

- Support Zones: Fair Value Gaps around $3,865–$3,870

- Major Support: Holding above $3,800 critical level (don’t let it drop below this line!) 🚧

All this suggests that while a short-term dip is possible, ETH is still cruising uphill unless $3,800 decides to pack its bags and leave. But hey, stranger things have happened in crypto. 👻

Is This a Dip Worth Buying, or the Start of Something Sinister? 🕵️♀️

Ethereum’s fundamentals remain as solid as a rock (or at least as solid as anything in crypto can be). Backed by institutional interest, upcoming DeFi developments, and whispers of spot ETH ETFs, many analysts are still bullish on ETH testing $4,000 and beyond in the coming weeks. 🚀

But here’s the kicker: with big players like HashKey potentially dumping their holdings, short-term caution is as wise as bringing an umbrella to a rainstorm. All eyes are now glued to the Fed’s rate decision, which could either ignite a market rally or turn profit-taking into a full-blown fire sale. Buckle up, folks—it’s gonna be a bumpy ride. 🎢

Never Miss a Beat in the Crypto World! 📰

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Because in crypto, ignorance isn’t bliss—it’s bankruptcy. 💸

FAQs: The Cliff Notes Edition 📚

Why did 12,000 ETH get transferred to OKX?

A wallet tied to HashKey Capital moved 12,000 ETH to OKX, signaling a potential institutional sell-off. Or maybe they just wanted to consolidate their stash. Who can say? 🤔

How could the Fed rate decision impact Ethereum?

A hawkish Fed stance could trigger profit-taking, while dovish signals may boost Ethereum toward $4,000. It’s like a game of financial roulette, but with fewer spinning wheels and more spinning heads. 🌀

What does whale activity mean for Ethereum’s price?

Large ETH transfers to exchanges often signal selling, raising short-term correction risks for Ethereum. Think of it as a red flag waving in the wind—or in this case, a red candlestick on a chart. 🔴

Read More

- Best Controller Settings for ARC Raiders

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Ashes of Creation Rogue Guide for Beginners

- Can You Visit Casino Sites While Using a VPN?

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Holy Hammer Fist, Paramount+’s Updated UFC Archive Is Absolutely Perfect For A Lapsed Fan Like Me

- Nintendo Switch Just Got One of 2025’s Best Co-Op Games

- If you ditched Xbox for PC in 2025, this Hall Effect gamepad is the first accessory you should grab

- Tom Hardy’s Action Sci-Fi Thriller That Ended a Franchise Quietly Becomes a Streaming Sensation

- John Wick AAA Game to be Announced Soon Says Lionsgate Chairman

2025-07-28 16:00