Ah, dear reader! In the grand theatre of market speculation, we find ourselves at a most critical juncture, where the fate of our dear asset hangs delicately in the balance, like an opera singer poised for a high note.

Resistance Pressure Builds as Price Nears Trendline

Behold the 3-day chart of WLD/USDT, an excellent sketch by the illustrious analyst Baykuş (@BaykusCharts). It reveals a descending trendline that has, rather stubbornly, thwarted numerous valiant attempts at a rally since our protagonist’s all-time high. We witness a tragicomic pattern of lamentable lower highs, with Worldcoin now clinging to the edge at $1.179, once more grappling with the long-forgotten resistance of yore.

The proximity of our beleaguered WLD to this ominous yellow trendline casts it in a dramatic spotlight. Will it break free and soar to new heights, or will it succumb to the weight of its own despair?

Ah, but there lies a horizontal support zone, fortified between $0.95 and $1.00, a bastion that has withstood months of onslaught, offering refuge for weary traders. The exponential moving average ribbon, once a tyrant, now dons the garb of a benevolent protector.

Our trusty candlesticks, those fickle friends, press against this comforting ribbon, heightening the tension that hangs thicker than a Russian winter. A decisive breach, dear reader, could herald a medium-term bullish trend, if, and only if, the waters of volume swell during this fateful breakout.

24-Hour Pullback Triggers Temporary Stabilization

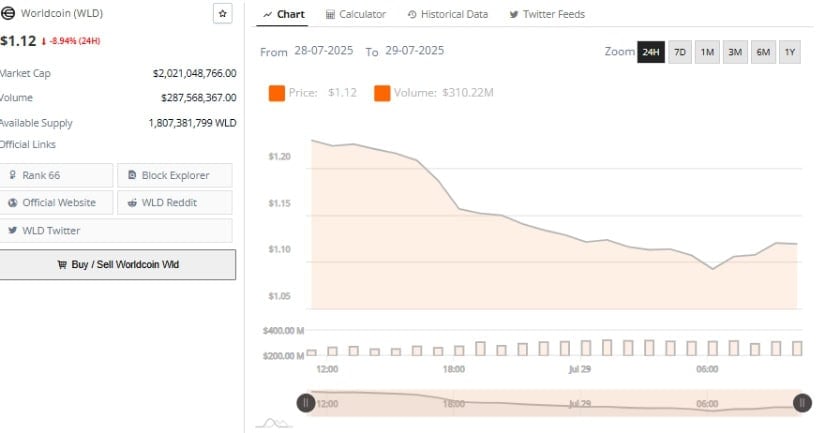

In the most recent pas de deux, from July 28 to July 29, our protagonist WLD danced in a troubling manner, beginning the evening at approximately $1.20 only to waltz steadily down to a tragic $1.10 by the witching hour—an intraday loss that served as a reminder of the whims of the market.

With daily trading volume exceeding a staggering $287 million, it appears many souls are keenly watching this particular dance, even as the price slipped from grace, pulling the market capjust above the $2 billion mark.

Following this dramatic sell-off, the price nestled itself in the comforting embrace of a sideways trading range between $1.08 and $1.10, a veritable safety zone for those brave enough to believe. The tepid recovery at the close barely nudged the price to $1.12, failing to dare challenge its earlier high.

Continued caution pervades the air, whispering that our buyers have not yet regained their confidence, and WLD may soon require a more potent bullish talisman to reclaim loftier heights.

At the Time of Writing, Indicators Reflect a Mixed Sentiment Shift

The daily chart of WLD/USDT on TradingView now reveals a feeble rebound from the depths near $1.08. As I pen these words, the price stands delicately at $1.128. Earlier in July, our dear token approached the lofty $1.50 mark, only to be met with the cruel hand of sellers near their resistance realms.

The current pullback, while contained, hints that incessant pressure beneath $1.20 may very well delay the anticipated breakout; thus, we find ourselves in quite the pickle.

Meanwhile, the Chaikin Money Flow (CMF) holds steadfast at +0.10, promising sustained inflows—an encouraging prospect, indeed! Yet, the Bull and Bear Power (BBP) sits ominously at -0.081, reflecting the short-term bearish sentiment lurking just below the surface.

This divergence between the steadfast CMF and the moody BBP suggests a potential shift in the winds of fortune. The bulls are valiantly defending their cherished support, while the short-term bears wield their influence, thwarting the triumphant clarion call of a breakout.

Read More

- Sony Removes Resident Evil Copy Ebola Village Trailer from YouTube

- Can You Visit Casino Sites While Using a VPN?

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- The Night Manager season 2 episode 3 first-look clip sees steamy tension between Jonathan Pine and a new love interest

- Holy Hammer Fist, Paramount+’s Updated UFC Archive Is Absolutely Perfect For A Lapsed Fan Like Me

- EastEnders confirms explosive return of Mitchell icon this Christmas – but why have they returned?

- All 3 New Avengers: Doomsday Characters Confirmed by The Trailers

- 6 Things We Hope to See in the Rumored September Nintendo Direct

- Jujutsu Kaisen Season 3 Explains Yuta Is More Terrifying Than Fans Remember

2025-07-29 20:12