Ah, Bitcoin. That ever-so-volatile beast of the digital realm. After another futile attempt at surpassing the $120,000 mark, it seems to be cooling off, like a cup of tea left out too long on a cold windowsill. Some analysts, ever the optimists, are now predicting that Bitcoin’s next top could touch the $150,000 ceiling. How quaint. 🙄

Bitcoin’s Current Overheating Phase: A Glimpse of Hope

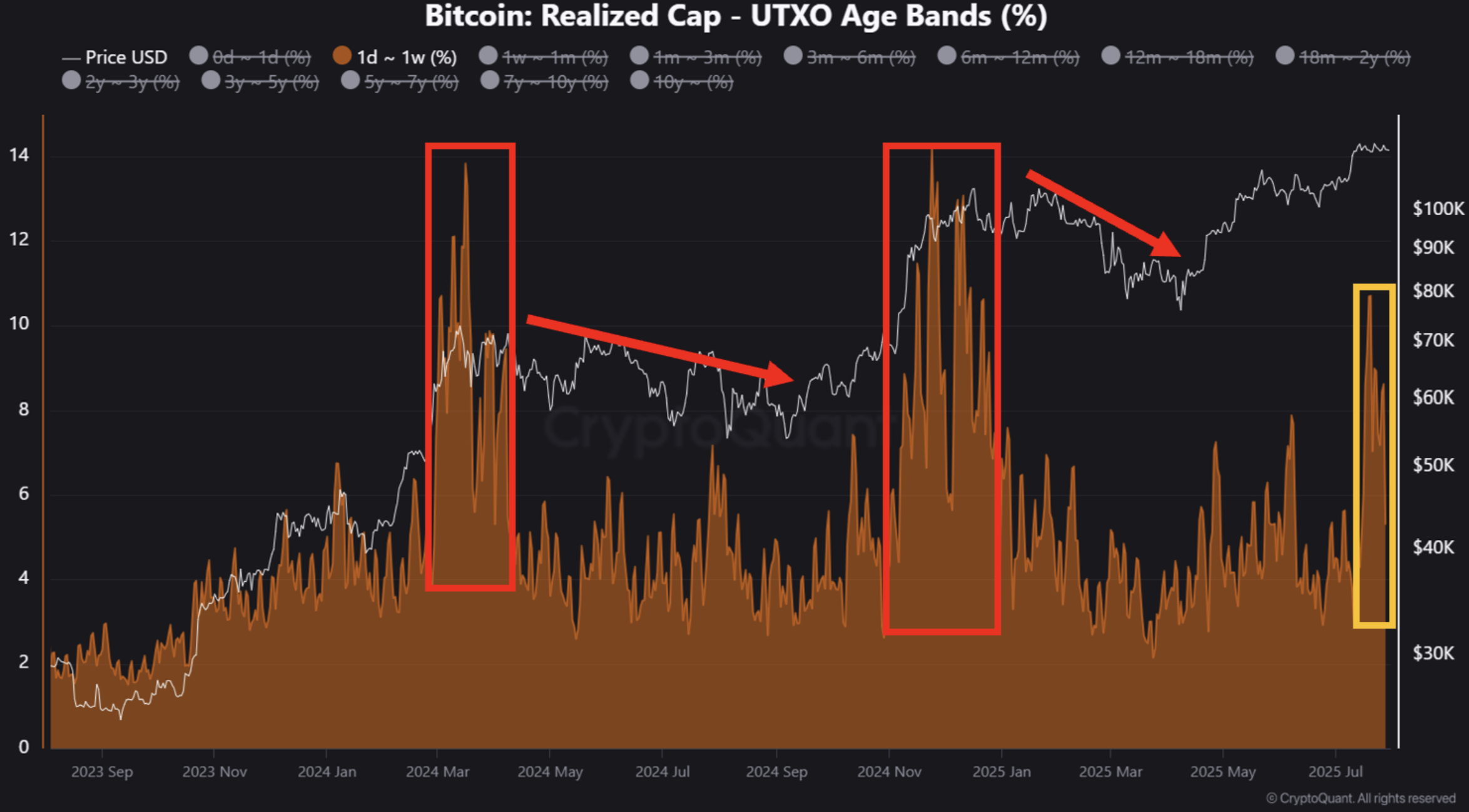

According to the ever-reliable CryptoQuant’s Crypto Dan, Bitcoin is in the midst of a cooling-off period following a brief yet passionate overheating episode. The clues are written in the charts, with the most telling sign coming from the cohort of BTC that’s been in hibernation for just one week. A period of rest after a heated affair – sounds familiar, right?

The following chart (not that you’ll find it all that fascinating) shows the decreasing peaks of this short-term holding cohort. It seems the market is catching its breath. A slight sigh of relief in the chaos. Phew! 😅

Crypto Dan, ever the philosopher, compares this to the earlier overheating phases in 2024 and 2025. Yes, both of those had much longer and much more intense episodes. You know, those were the real dramatic seasons of Bitcoin’s life – flashing red boxes, plenty of suspense. The current situation? A fleeting moment in comparison. A yellow box, if you will. It’s all rather anticlimactic. 😆

Here’s Dan’s profound takeaway:

Given that the recent price increase was, well, modest, expect a short correction. But fret not, for the uptrend of 2025 is just around the corner. Patience, my friends, patience. 🌱

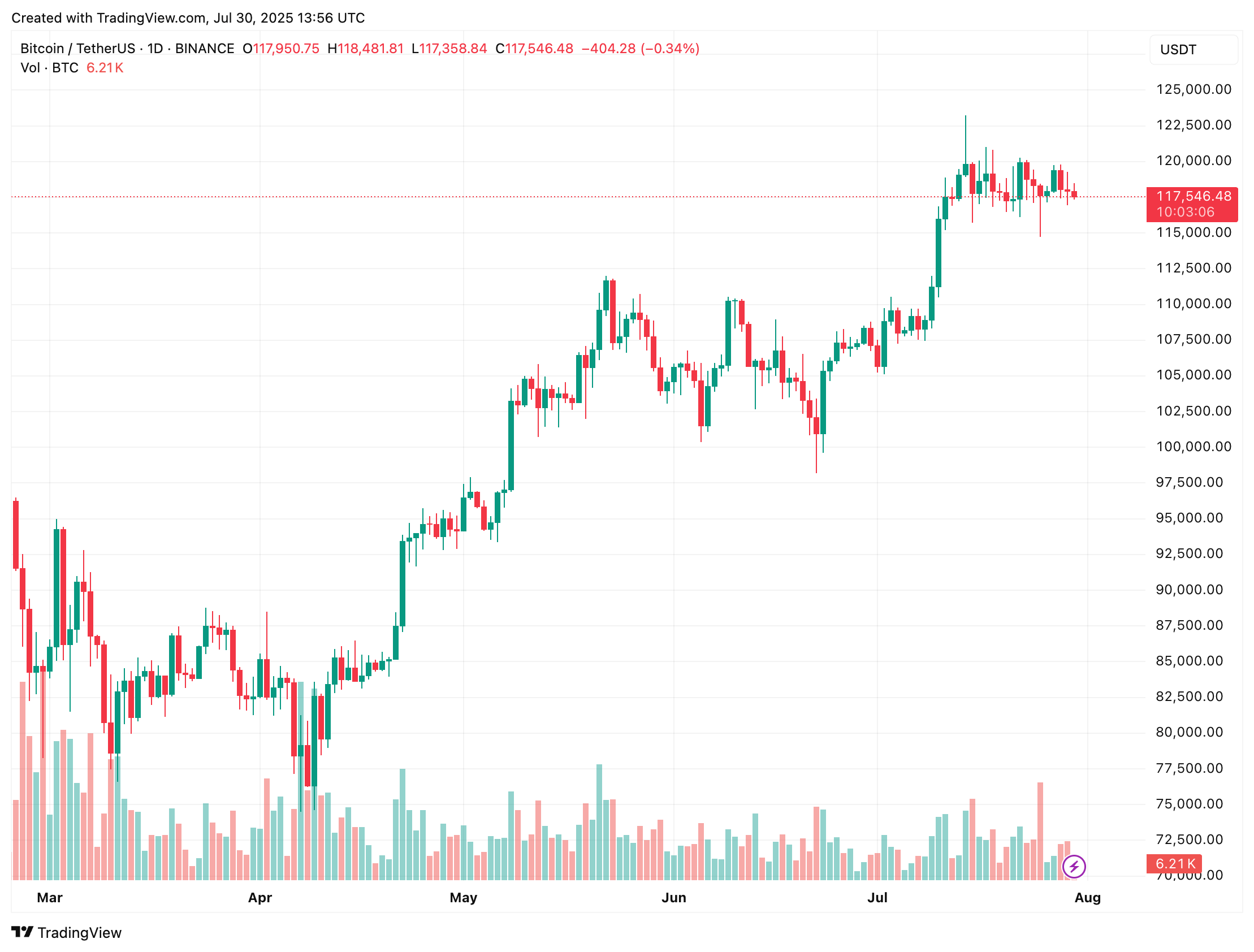

Bitcoin’s journey from a modest $108,000 on July 1 to a glorious new ATH (that’s “All-Time High” for the uninitiated) of $123,128 on July 13 was quite the spectacle. Now, it’s chilling around $117,500 – not exactly setting any hearts on fire, but hey, it’s still in the game.

Is Bitcoin About to Drop the Mic?

Now, let’s talk about what might be coming next. Bitcoin seems to be in a bit of a pressure cooker. And no, not the kind you use to make stew. Veteran analyst Titan of Crypto says that Bitcoin is “in a pressure cooker,” which, quite frankly, doesn’t sound all that appetizing. A tight squeeze, if you will. The Bollinger Bands are tightening like a new pair of jeans, volatility is shrinking, and the RSI (Relative Strength Index for those playing at home) is compressing. All signs pointing towards a breakout. Or, as I like to think of it, a dramatic exit stage left. 🎭

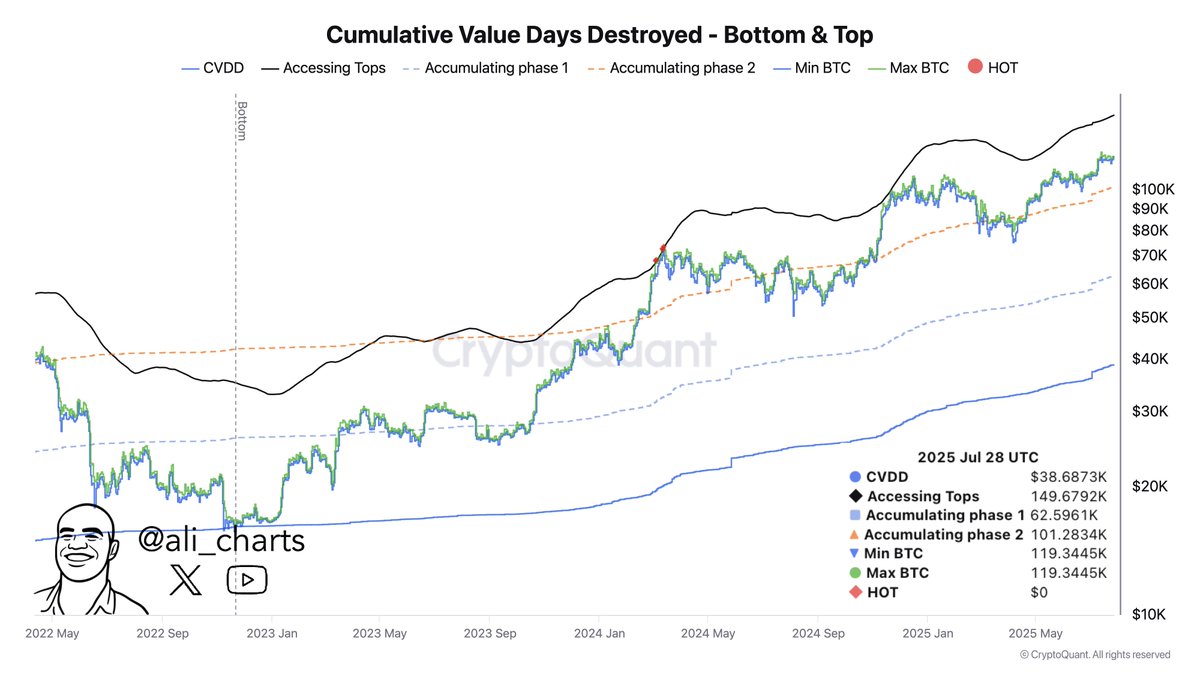

And then there’s Ali Martinez, who thinks that Bitcoin’s next top could climb all the way to $149,679. This is based on the Cumulative Value Days Destroyed (CVD) metric. Sounds technical, right? Basically, it measures who’s holding the cards – the buyers or the sellers. I won’t bore you with the details. But, let’s just say, the charts are very optimistic.

Still, all isn’t rosy in the land of Bitcoin. Recent data shows that exchange reserves are at a one-month high, which means some holders might be preparing to sell. And, let’s be honest, that could dampen the current bullish vibe. It’s like when you’re about to go on a date, and then your ex texts you. Awkward. 😬

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Resident Evil Requiem cast: Full list of voice actors

- Gold Rate Forecast

- Best Controller Settings for ARC Raiders

- Best Shazam Comics (Updated: September 2025)

- How to Build a Waterfall in Enshrouded

- Best Thanos Comics (September 2025)

- The 10 Best Episodes Of Star Trek: Enterprise

- 🎩 Pi Network Upgrades: Faster KYC Gets Your All-Red-Hot Delight! 🎩

2025-07-31 05:13