For the past several days, Bitcoin’s price has been fluctuating within a specific range, moving between approximately $117,261 and $120,000. Lately, certain market situations and external factors, including the FOMC meeting scheduled for Wednesday, have led to a brief drop in its value.

Currently, the price of Bitcoin stands at approximately $118,419. Following a dip to $115,700, there has been a slight rebound. However, the future direction of Bitcoin is unclear due to factors like increased selling pressure.

Bitcoin is Showing Signs of a Decline Ahead

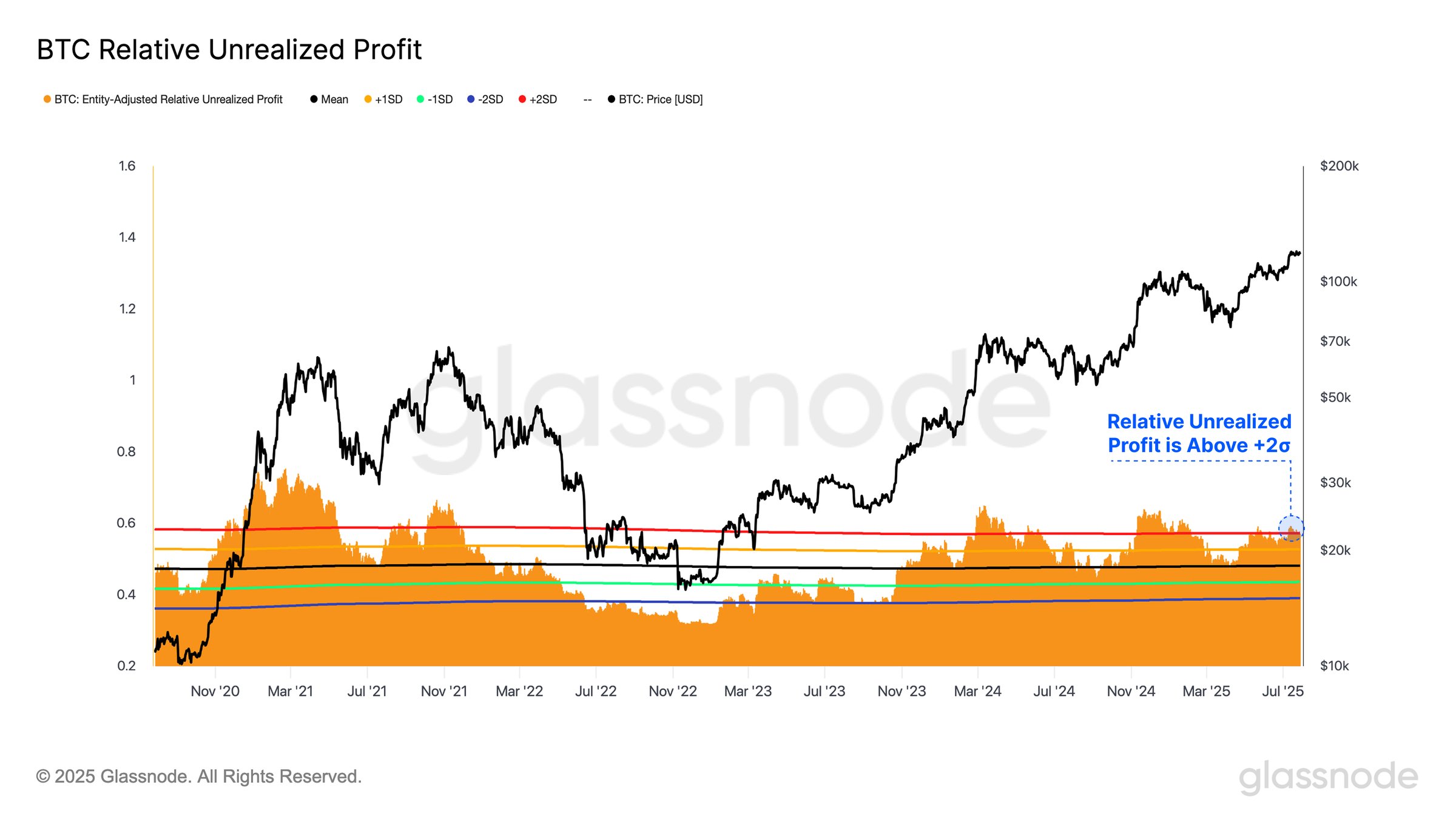

Lately, the Relative Unrealized Profit (RUP) surpassed the upper limit of the 2 standard deviation band, a point typically linked to exuberant market stages. In the past, this pattern has usually come before market peaks, suggesting an underlying urge to sell that might pull prices down in the future.

Based on the present situation of RUP, it seems there might be an impending retreat within the next few days, possibly causing Bitcoin’s value to move outside its current holding pattern. Historically speaking, such a trend could trigger more sell-offs, leading to additional bearish influence.

If you’re interested in receiving daily market updates and insights on the token TA, consider subscribing to Editor Harsh Notariya’s Crypto Newsletter by clicking here.

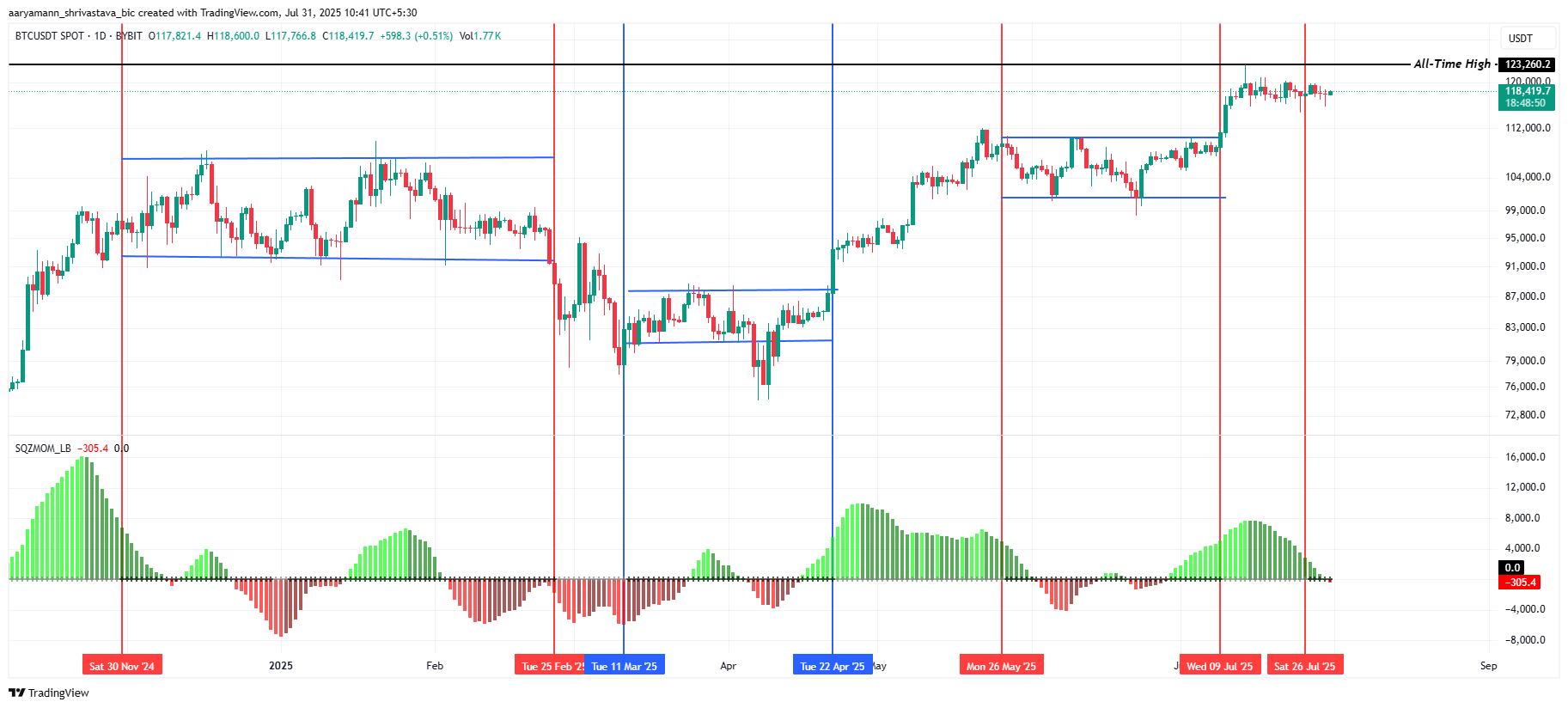

In simpler terms, the Squeeze Momentum Indicator indicates that Bitcoin might be heading towards a period of restricted price fluctuations, often referred to as a consolidation phase. Historically, such phases have been followed by substantial price changes after the consolidation ends.

Under increasing pressure, Bitcoin’s value seems ready for a significant swing. Should the overall market maintain its bearish stance, Bitcoin might experience a steep drop, especially if the SMI signals this downward trend in the near future.

BTC Price Needs To Jump

Presently, Bitcoin is being exchanged at approximately $118,410. On Wednesday, it dropped to $115,700 following the release of the FOMC report. The market’s reaction to the Federal Reserve’s decision not to adjust interest rates sparked a recovery for BTC, but the broader market climate continues to present potential risks.

If traders decide to sell their Bitcoins for a profit, it could cause further drops in the currency’s value. This might push Bitcoin’s price below its current support of around $117,261. A fall beyond this level could lead to prices as low as $115,000 or potentially even lower.

In simpler terms, for this bearish prediction about Bitcoin to change, it needs to stay above $120,000 and regain $122,000 as a support level. If Bitcoin surges beyond these levels, it could gather enough momentum to reach new heights. But until then, the price of Bitcoin remains susceptible to fluctuations and market influences.

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Controller Settings for ARC Raiders

- How to Build a Waterfall in Enshrouded

- Rod Stewart’s Albums Ranked: Every Release & Biggest Hits You Forgot About

- The Sci-Fi Thriller That Stephen King Called ‘Painful To Watch’ Just Joined Paramount+

- Guide: Marathon Server Slam Gets Underway Today – Here’s Everything You Need to Know

- Monster Hunter Stories 3’s character creator is officially revealed — and it features a cosmetic that’s normally paywalled in the mainline games

- New PS4 Game Announced for 2027 (When the PS6 Is Supposed to Release)

2025-07-31 12:12